Since June 2024, Airbnb has been in a holding pattern, posting a small loss of 4.5% while floating around $139.19. The stock also fell short of the S&P 500’s 13.7% gain during that period.

Is now the time to buy ABNB? Or does the price properly account for its business quality and fundamentals? Find out in our full research report, it’s free.

Why Are We Positive On Airbnb?

Founded by Brian Chesky and Joe Gebbia in their San Francisco apartment, Airbnb (NASDAQ:ABNB) is the world’s largest online marketplace for lodging, primarily homestays.

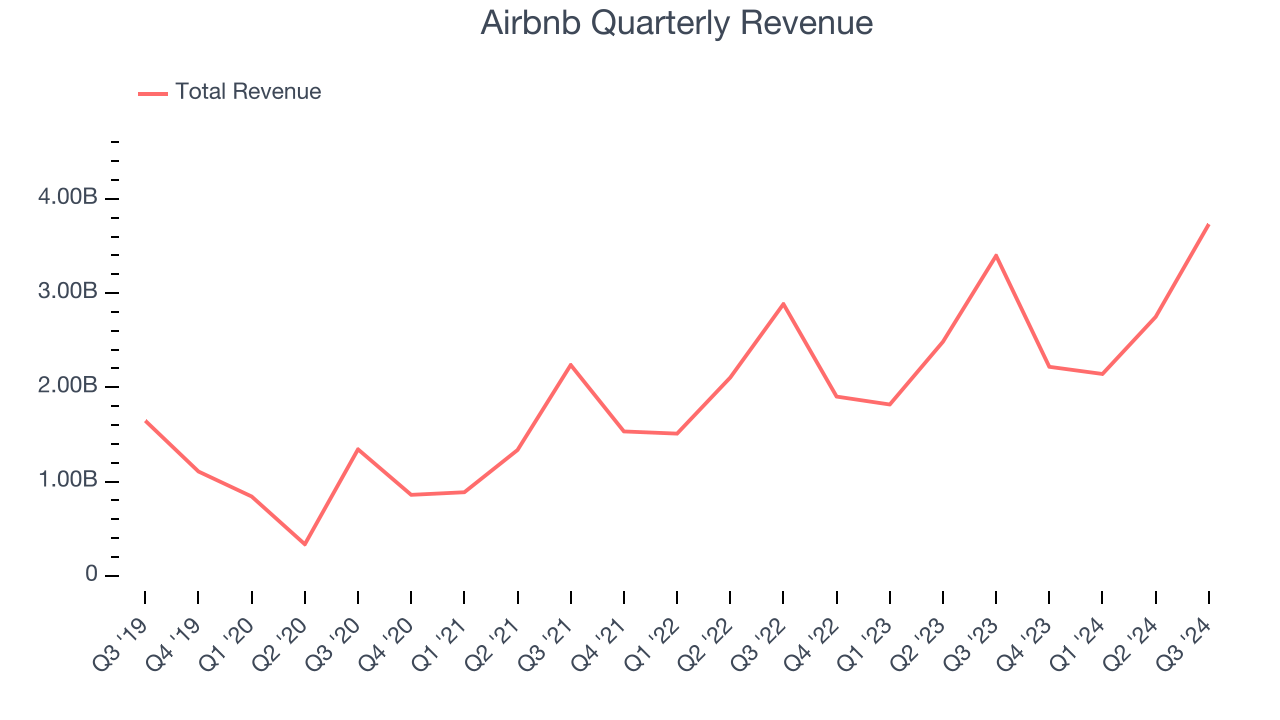

1. Skyrocketing Revenue Shows Strong Momentum

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years. Thankfully, Airbnb’s 26.8% annualized revenue growth over the last three years was exceptional. Its growth surpassed the average consumer internet company and shows its offerings resonate with customers.

2. Nights and Experiences Booked Skyrocket, Fueling Growth Opportunities

As an online travel company, Airbnb generates revenue growth by increasing both the number of stays (or experiences) booked and the commission charged on those bookings.

Over the last two years, Airbnb’s nights and experiences booked, a key performance metric for the company, increased by 12.7% annually to 122.8 million in the latest quarter. This growth rate is strong for a consumer internet business and indicates people love using its offerings.

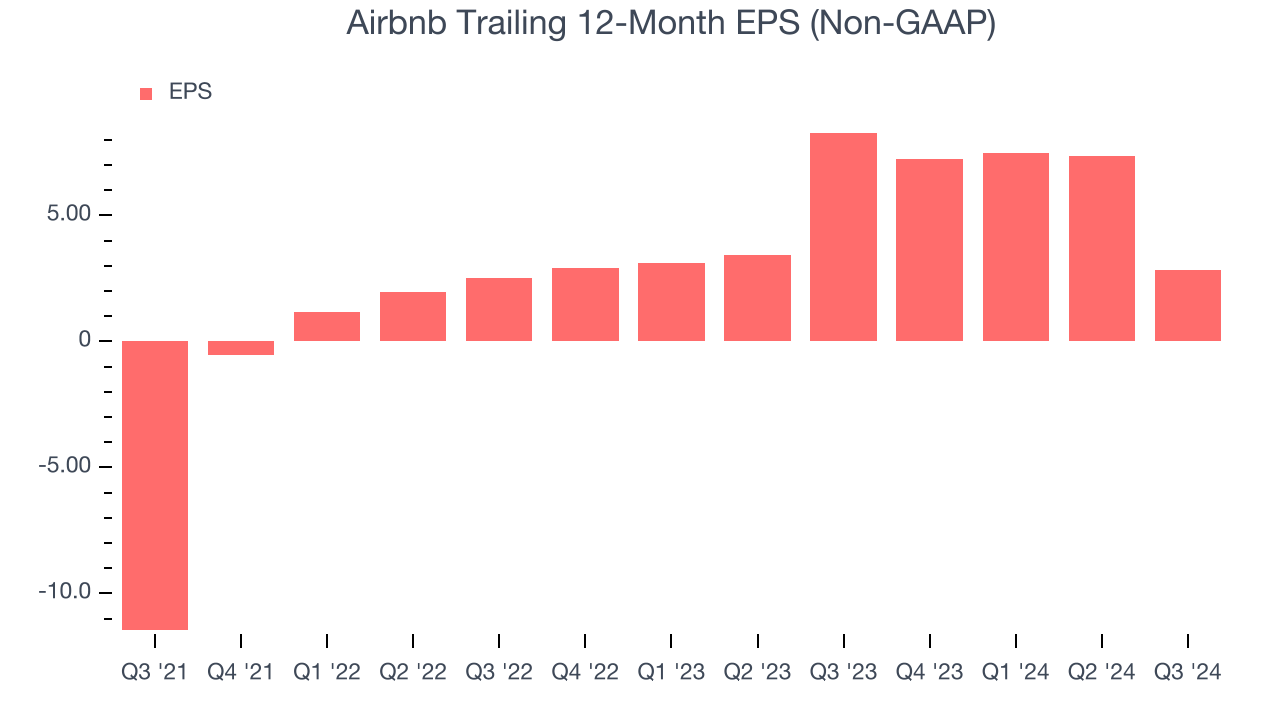

3. Outstanding Long-Term EPS Growth

Analyzing the change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Airbnb’s full-year EPS flipped from negative to positive over the last three years. This is a good sign and shows it’s at an inflection point.

Final Judgment

These are just a few reasons why Airbnb ranks near the top of our list. With its shares trailing the market in recent months, the stock trades at 21.1× forward EV-to-EBITDA (or $139.19 per share). Is now the right time to buy? See for yourself in our full research report, it’s free.

Stocks We Like Even More Than Airbnb

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.