The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how automotive and marine retail stocks fared in Q3, starting with OneWater (NASDAQ:ONEW).

At their essence, cars and boats get you from point A to point B, but the former is usually a necessity in everyday life while the latter is a luxury or leisure product. The retailers that sell these vehicles therefore cater to different needs and populations. There are also retailers that may not sell cars and boats themselves but the parts and accessories needed to keep these complex machines in tip top shape.

The 11 automotive and marine retail stocks we track reported a slower Q3. As a group, revenues missed analysts’ consensus estimates by 0.7%.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 5.3% since the latest earnings results.

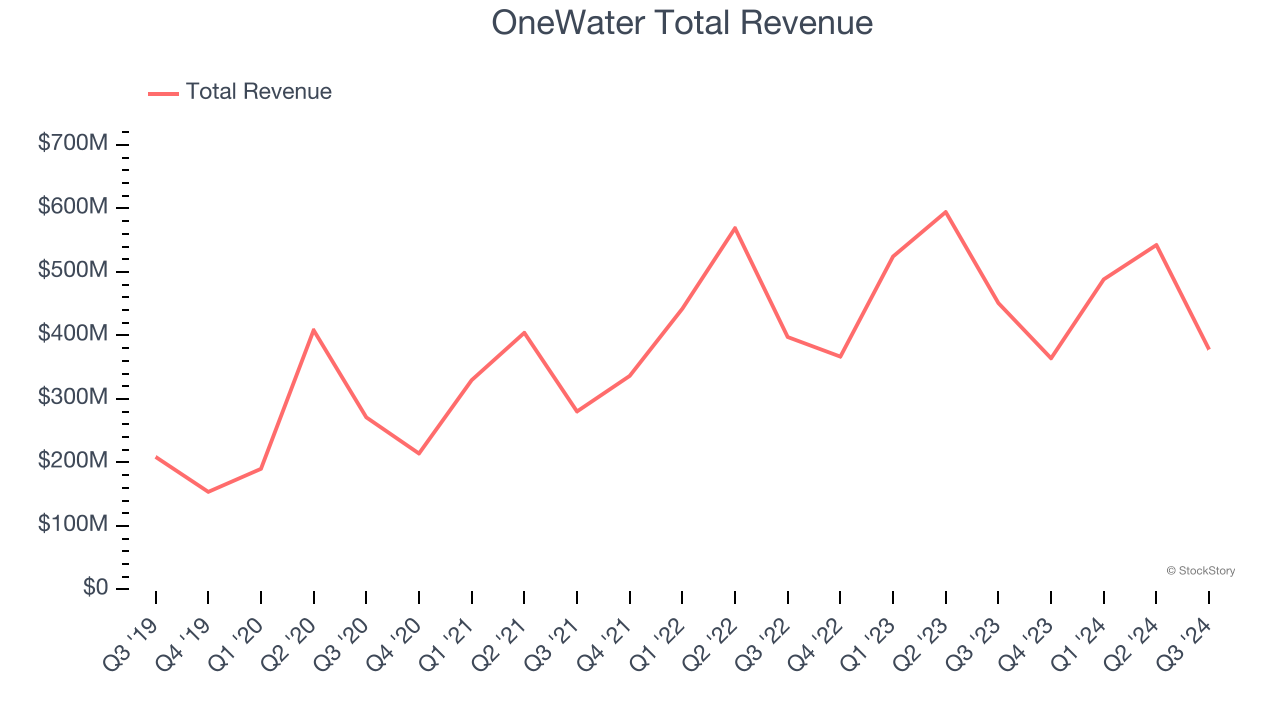

Weakest Q3: OneWater (NASDAQ:ONEW)

A public company since early 2020, OneWater Marine (NASDAQ:ONEW) sells boats, yachts, and other marine products.

OneWater reported revenues of $377.9 million, down 16.2% year on year. This print fell short of analysts’ expectations by 10%. Overall, it was a disappointing quarter for the company with full-year revenue guidance missing analysts’ expectations.

“Our team demonstrated remarkable resilience and execution amidst a challenging retail environment as consumer behavior and industry inventory reset in fiscal 2024. Our revenue and brand diversification, coupled with our geographic reach, helped mitigate the impact of macroeconomic uncertainty and severe weather, underscoring the strength of our business model,” commented Austin Singleton, Chief Executive Officer at OneWater.

OneWater delivered the weakest performance against analyst estimates and slowest revenue growth of the whole group. Unsurprisingly, the stock is down 34.9% since reporting and currently trades at $15.48.

Is now the time to buy OneWater? Access our full analysis of the earnings results here, it’s free.

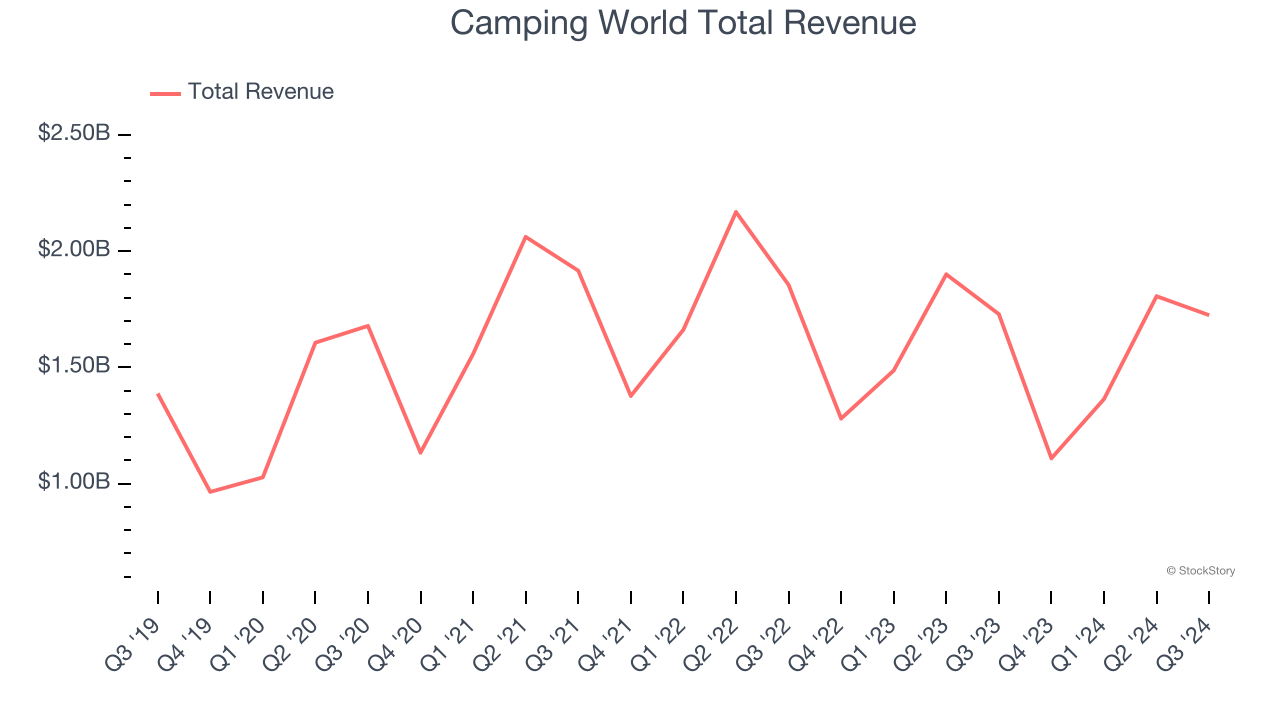

Best Q3: Camping World (NYSE:CWH)

Founded in 1966 as a single recreational vehicle (RV) dealership, Camping World (NYSE:CWH) still sells RVs along with boats and general merchandise for outdoor activities.

Camping World reported revenues of $1.72 billion, flat year on year, outperforming analysts’ expectations by 5.4%. The business had a stunning quarter with an impressive beat of analysts’ EPS and EBITDA estimates.

Camping World delivered the biggest analyst estimates beat among its peers. The market seems content with the results as the stock is up 3.7% since reporting. It currently trades at $22.19.

Is now the time to buy Camping World? Access our full analysis of the earnings results here, it’s free.

Advance Auto Parts (NYSE:AAP)

Founded in Virginia in 1932, Advance Auto Parts (NYSE:AAP) is an auto parts and accessories retailer that sells everything from carburetors to motor oil to car floor mats.

Advance Auto Parts reported revenues of $2.15 billion, down 3.2% year on year, falling short of analysts’ expectations by 1.1%. It was a disappointing quarter as it posted full-year revenue guidance missing analysts’ expectation.

Advance Auto Parts delivered the weakest full-year guidance update in the group. Interestingly, the stock is up 11.7% since the results and currently trades at $45.69.

Read our full analysis of Advance Auto Parts’s results here.

America's Car-Mart (NASDAQ:CRMT)

With a strong presence in the Southern and Central US, America’s Car-Mart (NASDAQ:CRMT) sells used cars to budget-conscious consumers.

America's Car-Mart reported revenues of $347.3 million, down 3.6% year on year. This print topped analysts’ expectations by 0.8%. More broadly, it was a satisfactory quarter as it also produced a solid beat of analysts’ gross margin estimates but a significant miss of analysts’ EPS estimates.

The stock is up 1.2% since reporting and currently trades at $46.24.

Read our full, actionable report on America's Car-Mart here, it’s free.

Lithia (NYSE:LAD)

With a strong presence in the Western US, Lithia Motors (NYSE:LAD) sells a wide range of vehicles, including new and used cars, trucks, SUVs, and luxury vehicles from various manufacturers.

Lithia reported revenues of $9.22 billion, up 11.4% year on year. This print lagged analysts' expectations by 2.5%. In spite of that, it was a strong quarter as it recorded a solid beat of analysts’ EBITDA estimates and a decent beat of analysts’ EPS estimates.

Lithia delivered the fastest revenue growth among its peers. The stock is up 8.3% since reporting and currently trades at $330.01.

Read our full, actionable report on Lithia here, it’s free.

Market Update

Thanks to the Fed's series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market has thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% each in November and December), and a notable surge followed Donald Trump's presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by the pace and magnitude of future rate cuts as well as potential changes in trade policy and corporate taxes once the Trump administration takes over. The path forward is marked by uncertainty.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.