Over the last six months, Titan International’s shares have sunk to $7.50, producing a disappointing 10.7% loss - a stark contrast to the S&P 500’s 9.3% gain. This was partly due to its softer quarterly results and might have investors contemplating their next move.

Is there a buying opportunity in Titan International, or does it present a risk to your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

Even with the cheaper entry price, we're swiping left on Titan International for now. Here are three reasons why we avoid TWI and a stock we'd rather own.

Why Is Titan International Not Exciting?

Acquiring Goodyear’s farm tire business in 2005, Titan (NSYE:TWI) is a manufacturer and supplier of wheels, tires, and undercarriages used in off-highway vehicles such as construction vehicles.

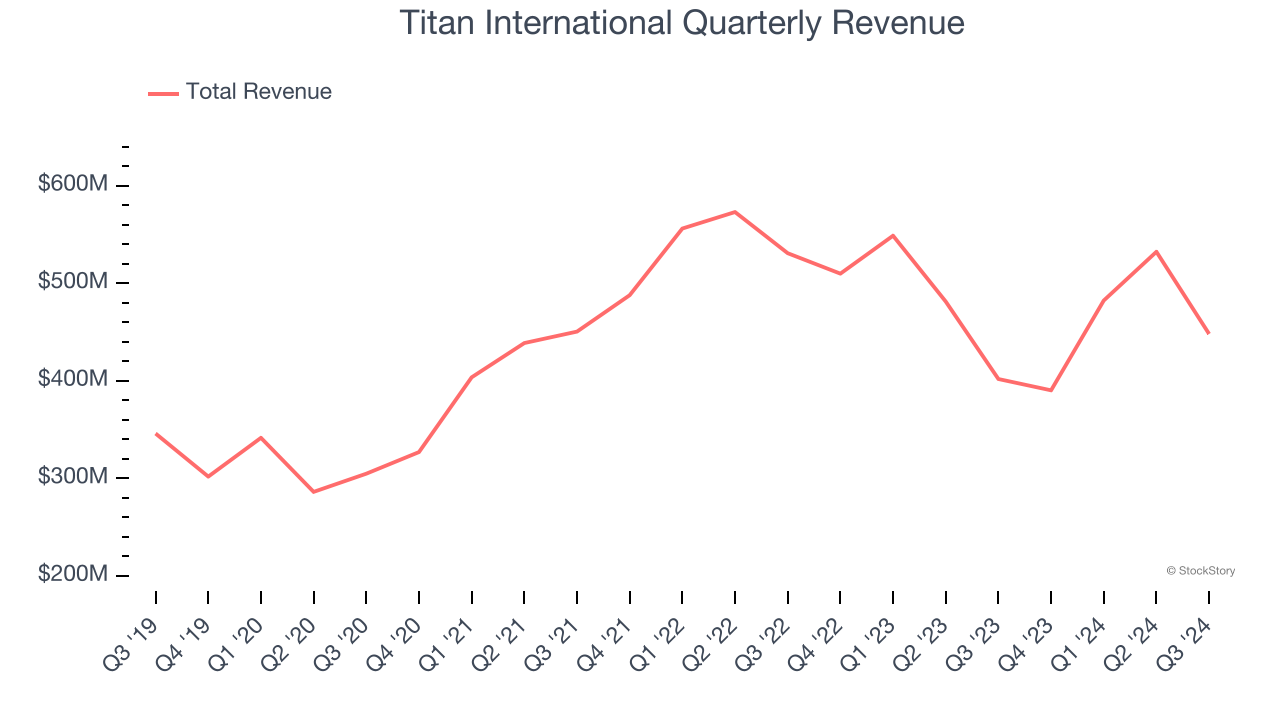

1. Long-Term Revenue Growth Disappoints

A company’s long-term sales performance signals its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Unfortunately, Titan International’s 4.2% annualized revenue growth over the last five years was sluggish. This was below our standard for the industrials sector.

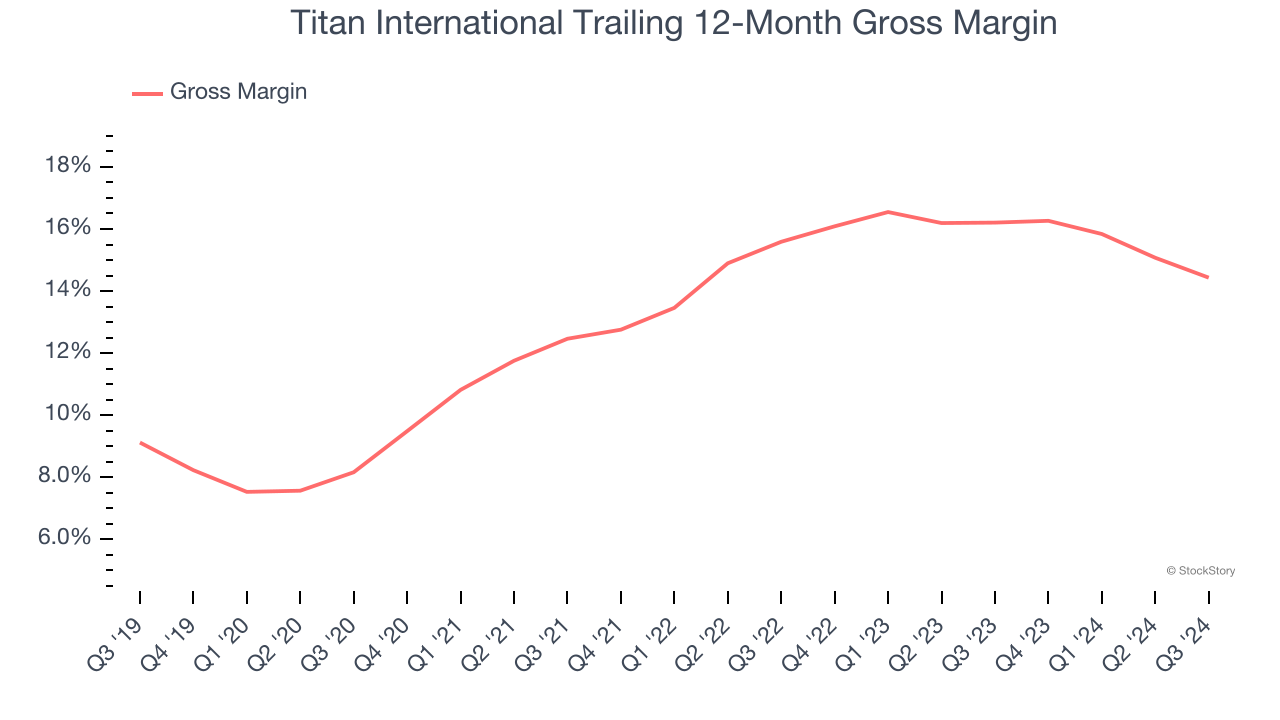

2. Low Gross Margin Reveals Weak Structural Profitability

Cost of sales for an industrials business is usually comprised of the direct labor, raw materials, and supplies needed to offer a product or service. These costs can be impacted by inflation and supply chain dynamics.

Titan International has bad unit economics for an industrials business, signaling it operates in a competitive market. As you can see below, it averaged a 13.9% gross margin over the last five years. That means Titan International paid its suppliers a lot of money ($86.14 for every $100 in revenue) to run its business.

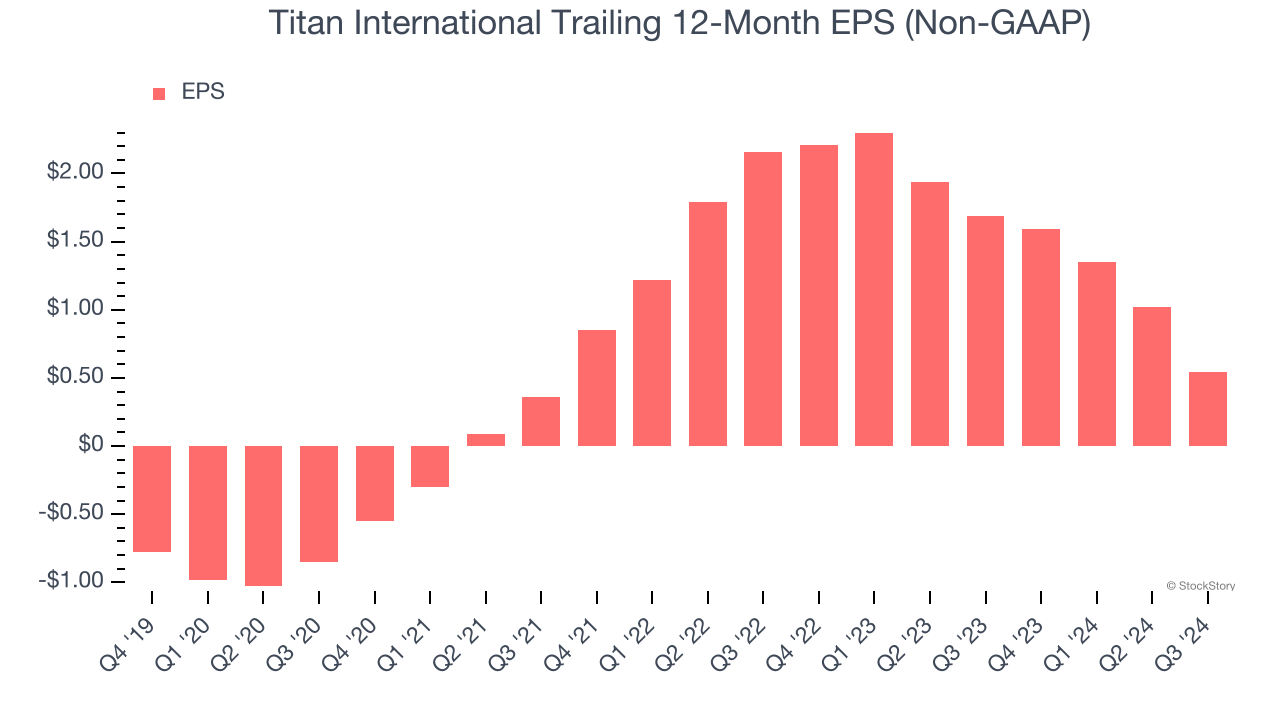

3. EPS Took a Dip Over the Last Two Years

Although long-term earnings trends give us the big picture, we like to analyze EPS over a shorter period to see if we are missing a change in the business.

Sadly for Titan International, its EPS declined by more than its revenue over the last two years, dropping 50%. This tells us the company struggled to adjust to shrinking demand.

Final Judgment

Titan International isn’t a terrible business, but it isn’t one of our picks. Following the recent decline, the stock trades at 20× forward price-to-earnings (or $7.50 per share). This valuation is reasonable, but the company’s shakier fundamentals present too much downside risk. We're fairly confident there are better investments elsewhere. We’d recommend looking at the most dominant software business in the world.

Stocks We Would Buy Instead of Titan International

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.