Freight rail services provider CSX (NASDAQ:CSX) missed Wall Street’s revenue expectations in Q4 CY2024, with sales falling 3.8% year on year to $3.54 billion. Its non-GAAP profit of $0.42 per share was in line with analysts’ consensus estimates.

Is now the time to buy CSX? Find out by accessing our full research report, it’s free.

CSX (CSX) Q4 CY2024 Highlights:

- Revenue: $3.54 billion vs analyst estimates of $3.56 billion (3.8% year-on-year decline, 0.6% miss)

- Adjusted EPS: $0.42 vs analyst estimates of $0.42 (in line)

- Adjusted EBITDA: $1.53 billion vs analyst estimates of $1.67 billion (43.2% margin, 8.7% miss)

- Operating Margin: 31.3%, down from 35.7% in the same quarter last year

- Free Cash Flow Margin: 15.5%, down from 21.8% in the same quarter last year

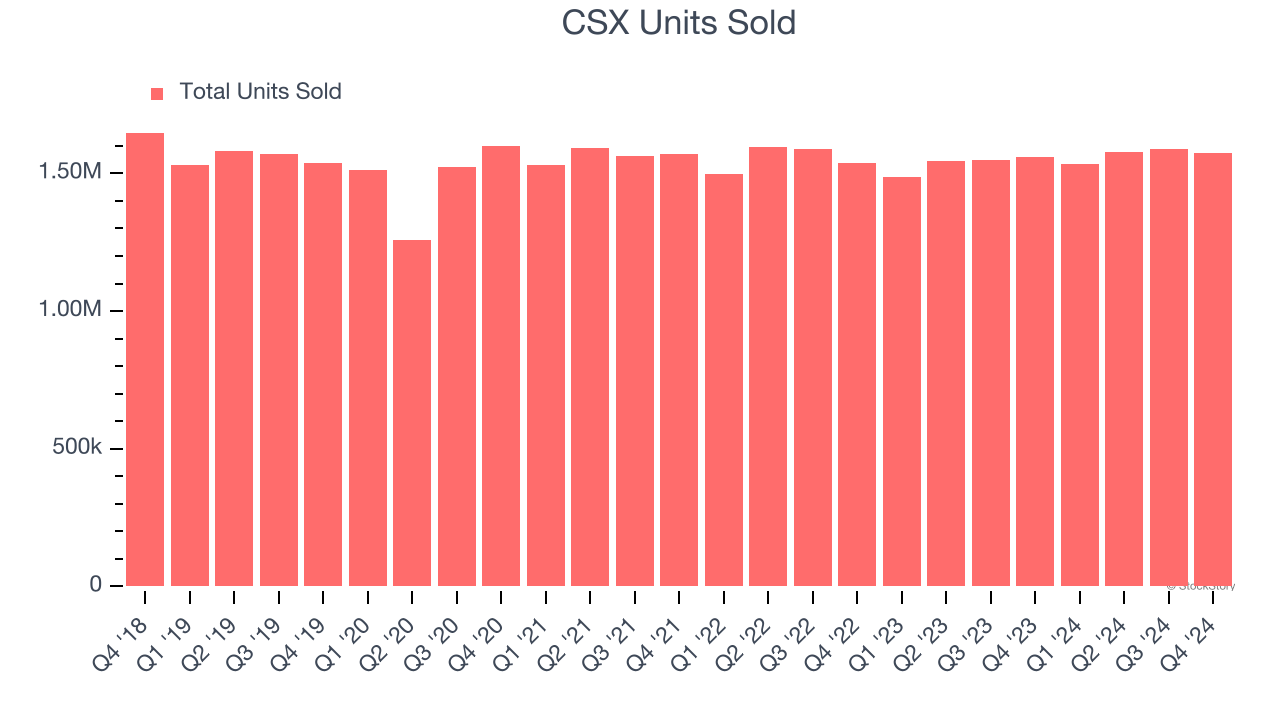

- Sales Volumes were flat year on year, in line with the same quarter last year

- Market Capitalization: $64.1 billion

Company Overview

Established as part of the Chessie System and Seaboard Coast Line Industries merger, CSX (NASDAQ:CSX) is a transportation company specializing in freight rail services.

Rail Transportation

The growth of e-commerce and global trade continues to drive demand for shipping services, presenting opportunities for rail transportation companies. While moving large volumes by rail can be highly cost-efficient for customers compared to air and ground transport, this mode of transportation results in slower delivery times, presenting a trade off. To improve transit times, the industry continues to invest in digitization to optimize fleets, loads, and even braking systems. However, rail transportation companies are still at the whim of economic cycles. Consumer spending, for example, can greatly impact the demand for these companies’ offerings while fuel costs can influence profit margins.

Sales Growth

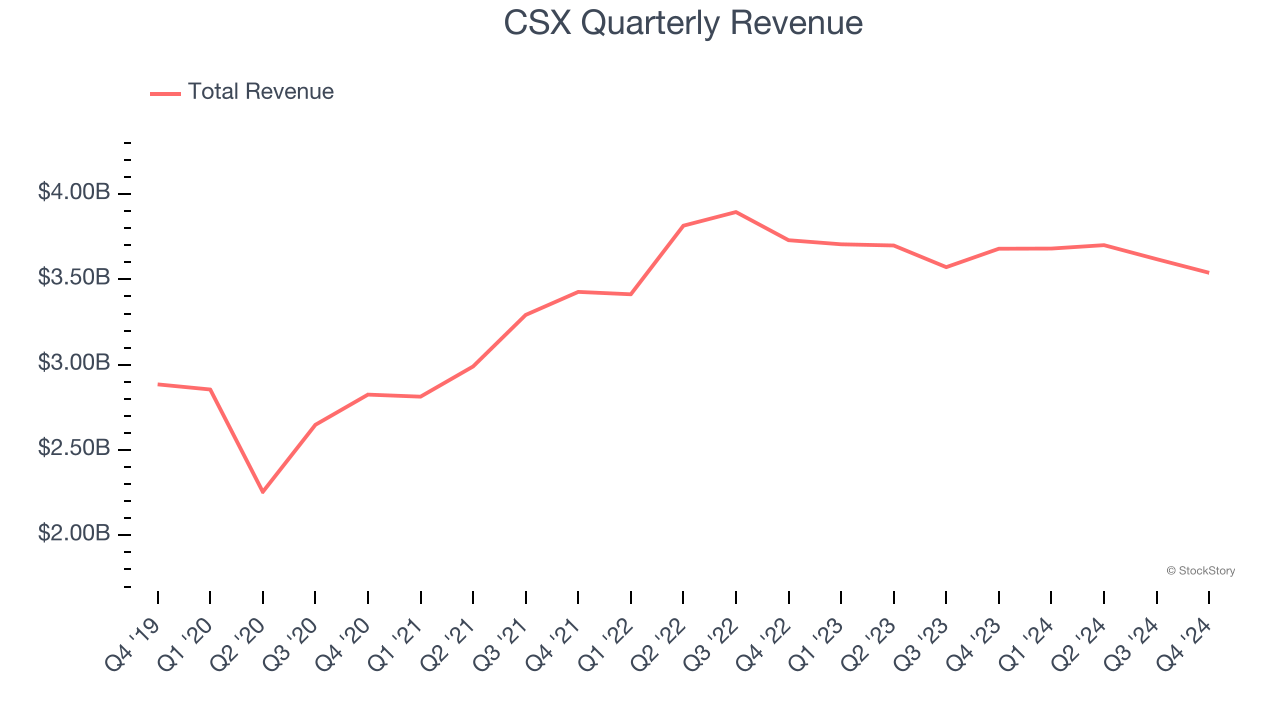

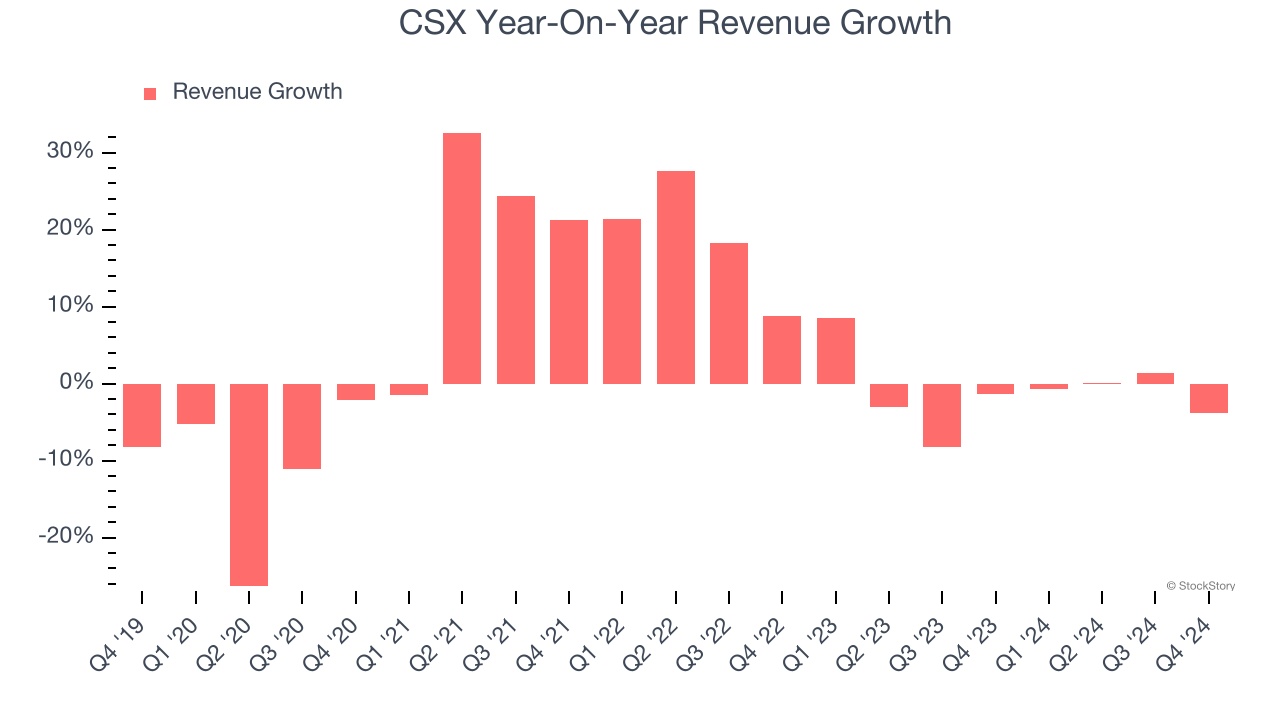

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, CSX grew its sales at a sluggish 4% compounded annual growth rate. This was below our standard for the industrials sector and is a poor baseline for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. CSX’s history shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 1.1% annually. CSX isn’t alone in its struggles as the Rail Transportation industry experienced a cyclical downturn, with many similar businesses observing lower sales at this time.

We can dig further into the company’s revenue dynamics by analyzing its units sold, which reached 1.58 million in the latest quarter. Over the last two years, CSX’s units sold were flat. Because this number is better than its revenue growth, we can see the company’s average selling price decreased.

This quarter, CSX missed Wall Street’s estimates and reported a rather uninspiring 3.8% year-on-year revenue decline, generating $3.54 billion of revenue.

Looking ahead, sell-side analysts expect revenue to grow 2.2% over the next 12 months. While this projection implies its newer products and services will catalyze better top-line performance, it is still below the sector average.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Operating Margin

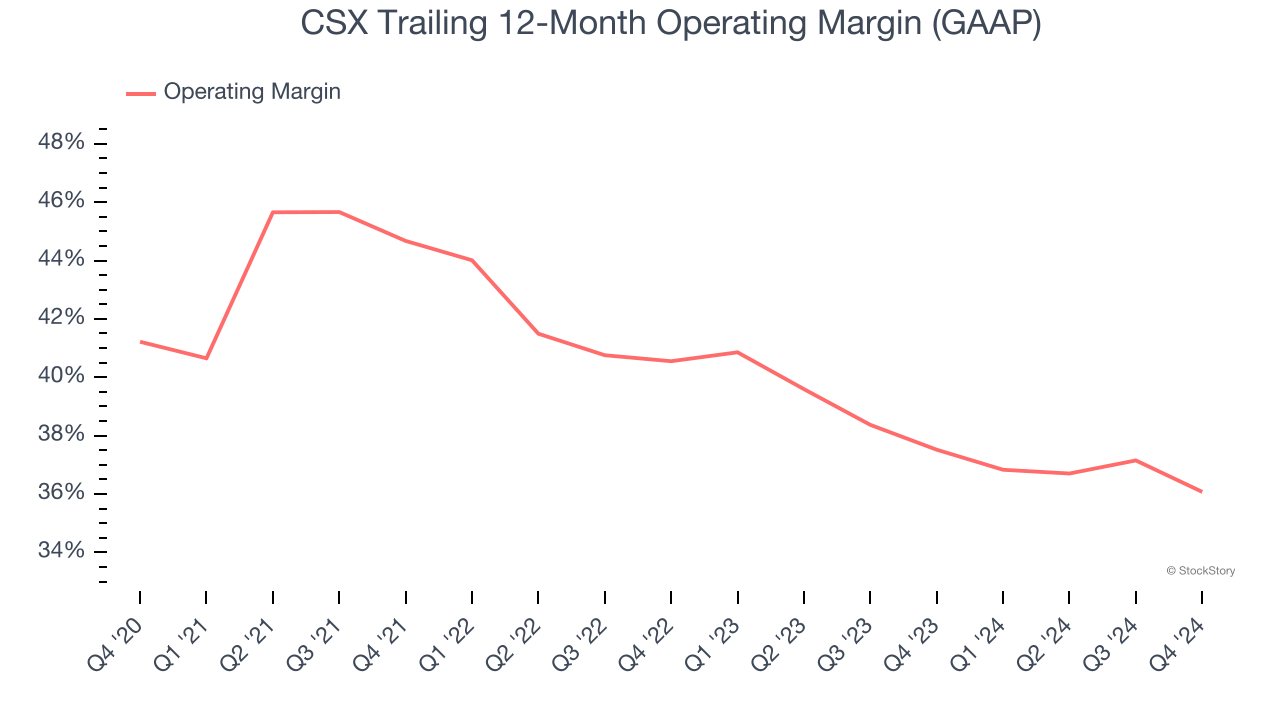

CSX has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 39.8%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, CSX’s operating margin decreased by 5.1 percentage points over the last five years. Even though its historical margin is high, shareholders will want to see CSX become more profitable in the future.

In Q4, CSX generated an operating profit margin of 31.3%, down 4.5 percentage points year on year. Since CSX’s operating margin decreased more than its gross margin, we can assume it was recently less efficient because expenses such as marketing, R&D, and administrative overhead increased.

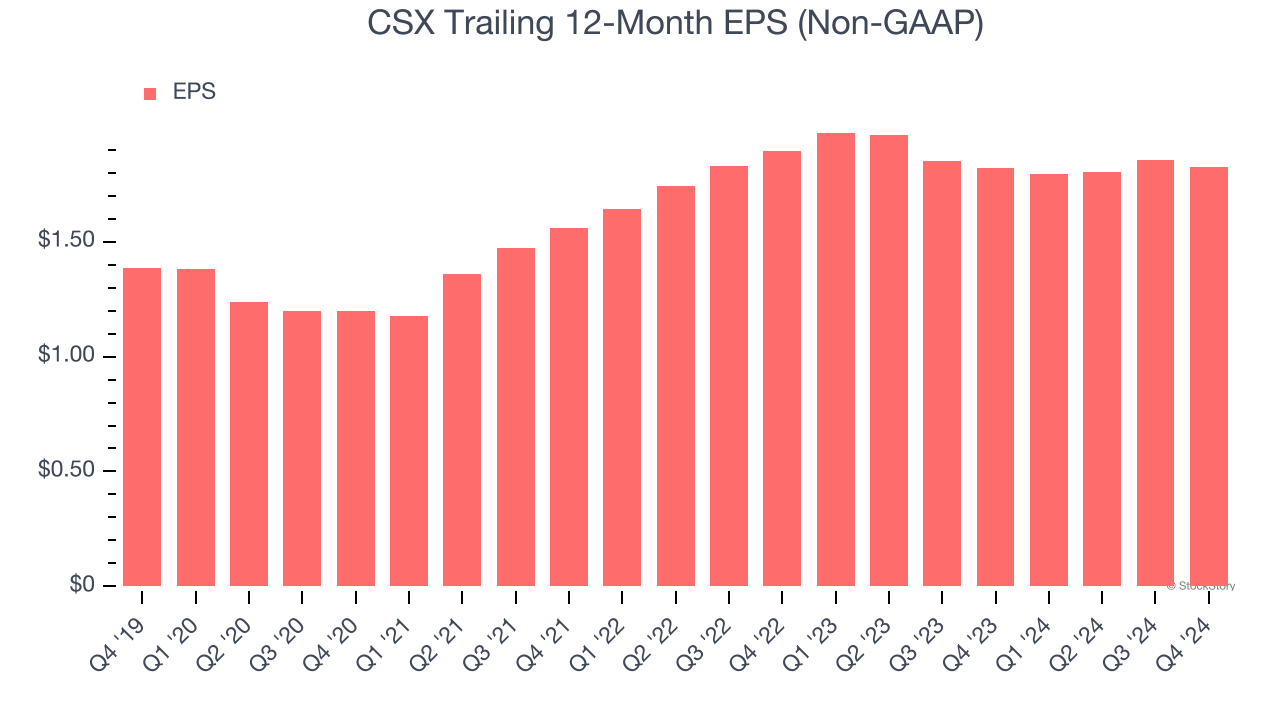

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

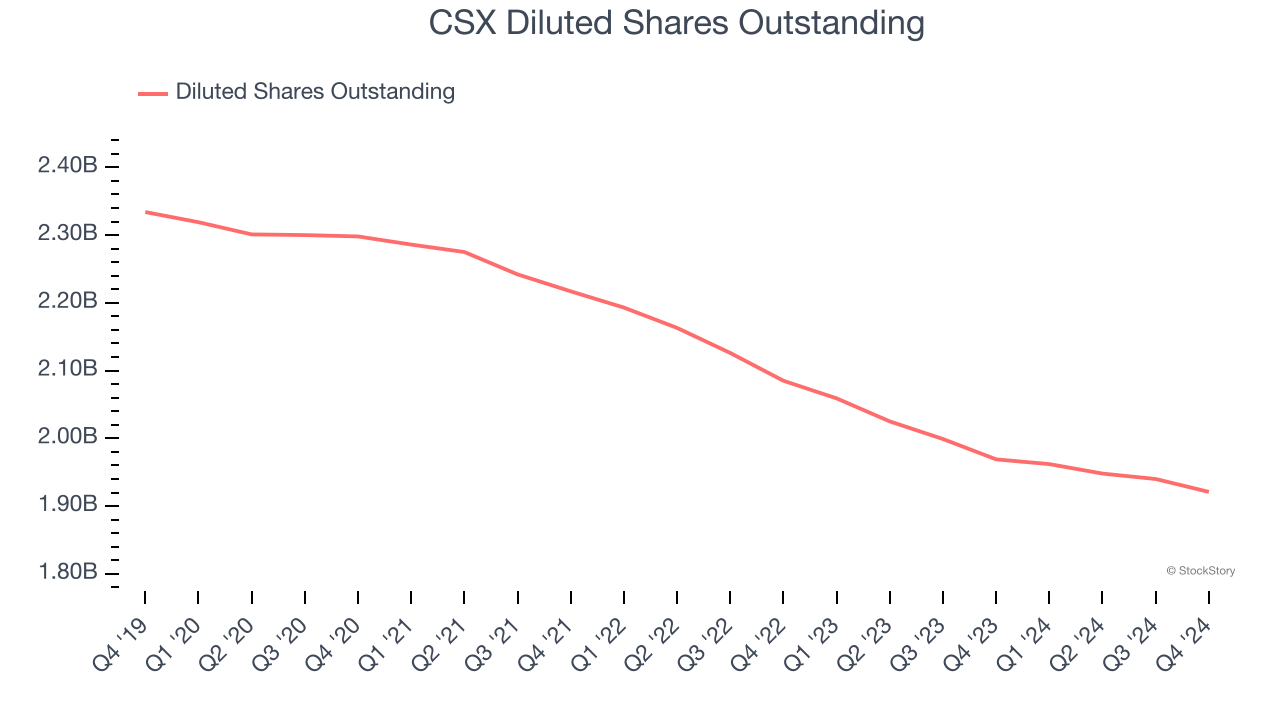

CSX’s EPS grew at an unimpressive 5.6% compounded annual growth rate over the last five years. This performance was better than its 4% annualized revenue growth but doesn’t tell us much about its business quality because its operating margin didn’t expand.

Diving into the nuances of CSX’s earnings can give us a better understanding of its performance. A five-year view shows that CSX has repurchased its stock, shrinking its share count by 17.7%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For CSX, its two-year annual EPS declines of 1.8% show it’s continued to underperform. These results were bad no matter how you slice the data.

In Q4, CSX reported EPS at $0.42, down from $0.45 in the same quarter last year. This print was close to analysts’ estimates. Over the next 12 months, Wall Street expects CSX’s full-year EPS of $1.82 to grow 5.8%.

Key Takeaways from CSX’s Q4 Results

We struggled to find many resounding positives in these results as its EBITDA missed significantly and its revenue fell slightly short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 2.8% to $32.70 immediately following the results.

The latest quarter from CSX’s wasn’t that good. One earnings report doesn’t define a company’s quality, though, so let’s explore whether the stock is a buy at the current price. What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.