(Please enjoy this updated version of my weekly commentary published October 25, 2021 from the POWR Growth newsletter).

Market Commentary

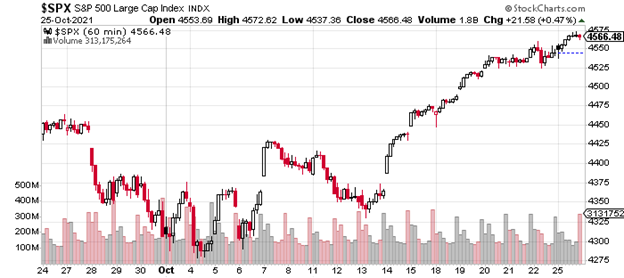

First, let’s examine the impressive advance of this past week:

Over the past week, the S&P 500 climbed higher by more than 90 points. We basically had two days of buying, 3 days of consolidation, and then today’s gain. As noted above, this is a textbook “melt-up”.

It also is consistent with our expectation that the market would be quite strong going into year-end due to fund managers being underinvested and underperforming.

This type of market has to be torturous for such a fund manager who is likely bearish on the economic or earnings outlook but has to watch stocks go higher. Even if they have resolved to buy, there is no satisfactory dip or correction to put billions of dollars to work.

For us, the decisions are much simpler as we are already basically fully invested. Instead, we have to focus on optimizing our portfolio while hewing to some sort of risk-management protocol and healthy diversification.

De-Bottlenecking

Part of this process involves identifying fundamental shifts in the economy and markets and the companies that are going to benefit.

Examples of this in our portfolio are identifying inflation as a potent threat and buying 3 companies that would see increased revenue and earnings as a result. Or anticipating that the supply/demand dynamics in energy would likely lead to prices advancing this year and getting long with 3 of our positions.

Both of these groups fall in the reflation category which has benefitted from strength in commodities, industrial activity, and inflationary pressures. We also have growth stocks that have struggled as rates have risen. In contrast, this development has been positive for many value stocks such as banks and insurance companies.

As noted in the intro, I will be adding a fourth category – debottlenecking. I anticipate that as coronavirus cases decline and ports and countries fully reopen, we will start to see these bottlenecks and supply chain challenges improve. Already, I believe that we have peaked, and there are signs that the backlog is improving.

I believe this trend will have implications for many industries. It will lead to strength in sectors that will benefit from increased production like autos and auto supplier stocks. Retailers’ margins will expand, while inventories will become fully stocked.

The losers will be shipping stocks and container companies. It could even be a headwind for some of the inflation winners as resolving these issues could lead to a decline in inflation expectations.

This will likely be our focus in the next couple of trade alerts.

What To Do Next?

The POWR Growth portfolio was launched in early April and is off to a fantastic start.

What is the secret to success?

The portfolio gets most of its fresh picks from the Top 10 Growth Stocks strategy which has stellar +46.42% annual returns.

If you would like to see the current portfolio of growth stocks, and be alerted to our next timely trades, then consider starting a 30 day trial by clicking the link below.

About POWR Growth newsletter & 30 Day Trial

All the Best!

Jaimini Desai

Chief Growth Strategist, StockNews

Editor, POWR Growth Newsletter

SPY shares were trading at $458.10 per share on Tuesday morning, up $2.55 (+0.56%). Year-to-date, SPY has gained 23.72%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Jaimini Desai

Jaimini Desai has been a financial writer and reporter for nearly a decade. His goal is to help readers identify risks and opportunities in the markets. He is the Chief Growth Strategist for StockNews.com and the editor of the POWR Growth and POWR Stocks Under $10 newsletters. Learn more about Jaimini’s background, along with links to his most recent articles.

The post How De-bottlenecking Will Provide a Further Boost to the Stock Market appeared first on StockNews.com