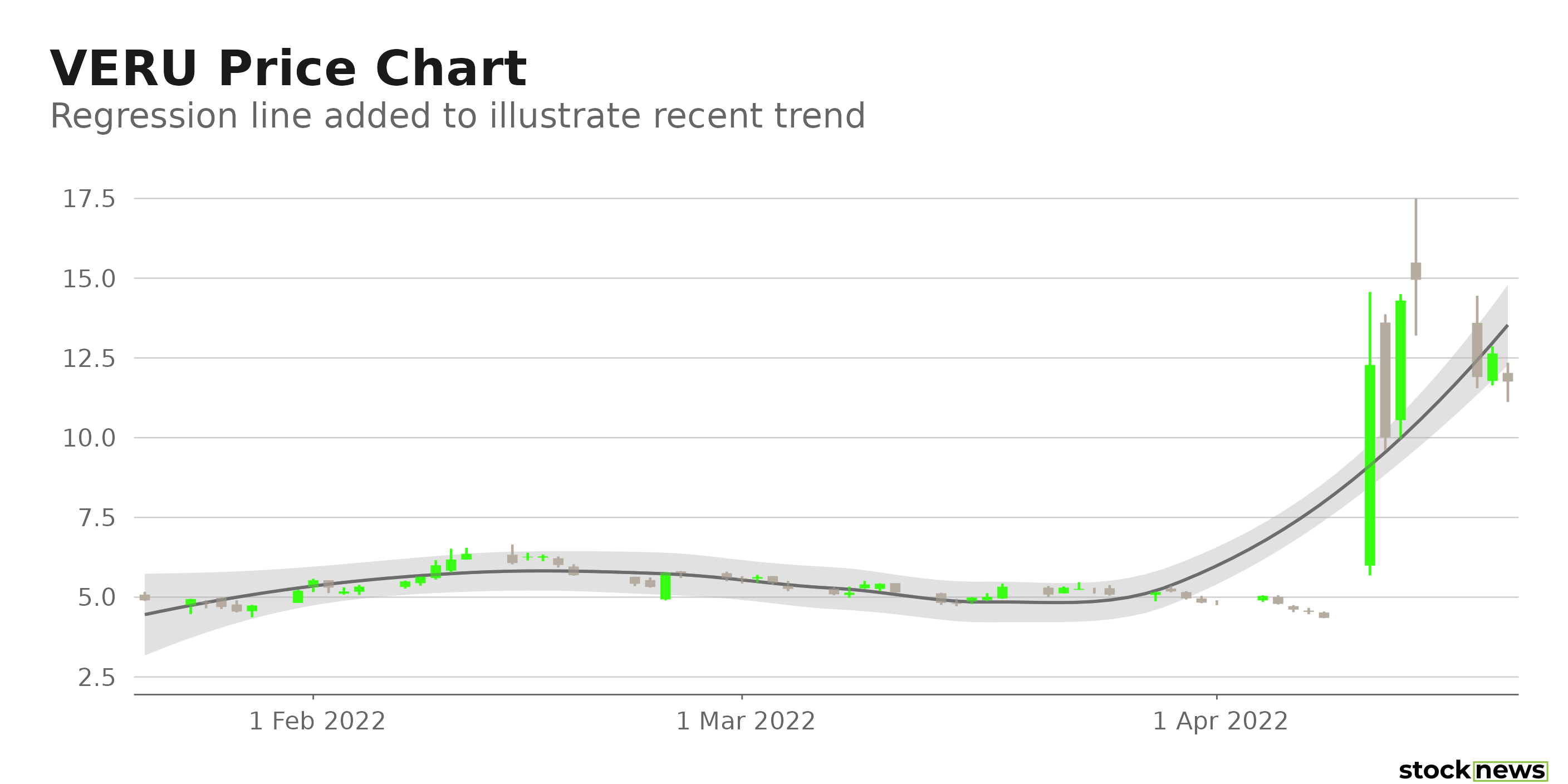

Miami-based Veru Inc. (VERU) is an oncology biopharmaceutical company that is focused on developing novel medications for the treatment of breast and prostate cancers. Its shares have gained 120.6% in price over the past month to close yesterday's trading session at $11.76.

According to the preliminary findings of the phase 3 clinical study released on April 11, VERU's oral medicine sabizabulin reduced fatalities by an astonishing 55% when delivered to hospitalized patients with severe COVID-19. With such promising data, the company’s shares surged by more than 190% last week and remained up by more than 200% for five consecutive days.

However, VERU’s sales have slowed this year, with its quarterly net revenue declining by 3% year on year in its first fiscal quarter of 2022. In addition, it is currently trading at an expensive valuation versus its peers, which could impact its price performance in the near term.

Here is what could shape VERU's performance in the near term:

Stretched Valuation

In terms of forward Price/Sales, the stock is currently trading at 15x, which is 1114.9% higher than the 1.23x industry average. Also, its 12.61x forward EV/Sales is 588.7% higher than the 1.83x industry average. Furthermore, VERU's 6.84x trailing-12-months Price/Book is 123.9% higher than the 3.05x industry average.

Inadequate Financials

VERU's net revenue declined 3.3% year-over-year to $14.14 million for its first quarter, ended Dec. 31, 2021. Its operating loss came in at $4.96 million, compared to a $19.19 million operating profit. And the company reported a $6.38 million net loss, compared to a net profit of $17.23 million in the prior-year quarter. Its loss per share amounted to $0.08 over this period.

Poor Profitability

VERU's 0.5% trailing-12-months asset turnover is 42.2% lower than the 0.86% industry average. Also, its trailing-12-months ROA, EBITDA margin, and ROC are negative at 9.4%, 18.1%, and 6.2%, respectively. In addition, its cash from operations stood at a negative $24.89 million compared to the $419 million industry average.

POWR Ratings Reflect Uncertainty

VERU has an overall D rating, which equates to Sell in our proprietary POWR Ratings system. The POWR ratings are calculated by considering 118 distinct factors, with each factor weighted to an optimal degree.

Our proprietary rating system also evaluates each stock based on eight distinct categories. VERU has an F grade for Growth and a D for Value. The company's poor fundamentals are consistent with the Growth grade. In addition, the company's higher-than-industry valuations are in sync with the Value grade.

Among the 170 stocks in the F-rated Medical – Pharmaceuticals industry, VERU is ranked #156.

Beyond what I have stated above, you can view VERU ratings for Quality, Momentum, Stability, and Sentiment here.

Click here to checkout our Healthcare Sector Report for 2022

Bottom Line

VERU's shares have surged in price over the past month on the back of the company’s recent preliminary results of its oral medicine sabizabulin, which reduces fatality by more than 50% in COVID-19 patients. However, its decline in revenue and poor bottom-line performance could raise investors' concerns in the near term. So, given its lofty valuations and weak profitability, we believe the stock is best avoided now.

How Does Veru Inc. (VERU) Stack Up Against its Peers?

While VERU has an overall D rating, one might want to consider its industry peers, Novartis AG (NVS), Merck & Co. Inc. (MRK), and Bristol – Myers Squibb Co. (BMY), which have an overall A (Strong Buy) rating.

VERU shares fell $0.31 (-2.64%) in premarket trading Thursday. Year-to-date, VERU has gained 99.66%, versus a -6.08% rise in the benchmark S&P 500 index during the same period.

About the Author: Pragya Pandey

Pragya is an equity research analyst and financial journalist with a passion for investing. In college she majored in finance and is currently pursuing the CFA program and is a Level II candidate.

The post Up 200% in Just the Past Month, is Veru Stock Still a Buy? appeared first on StockNews.com