Synopsys, Inc. (SNPS) in Mountain View, Calif., is the Silicon to Software partner for innovative companies that develop electronic products and software applications. It has a long history of being a global leader in electronic design automation (EDA) and semiconductor IP, and it boasts the industry's most comprehensive portfolio of application security testing tools and services.

The company's revenue and EBITDA have grown at a CAGR of 13.8% and 32.6%, respectively, over the past three years. Furthermore, its total assets have increased at an annualized rate of 14.1% over the same period. SNPS' net income and EPS have declined at CAGRs of 18.5% and 175%, respectively, over the past three years.

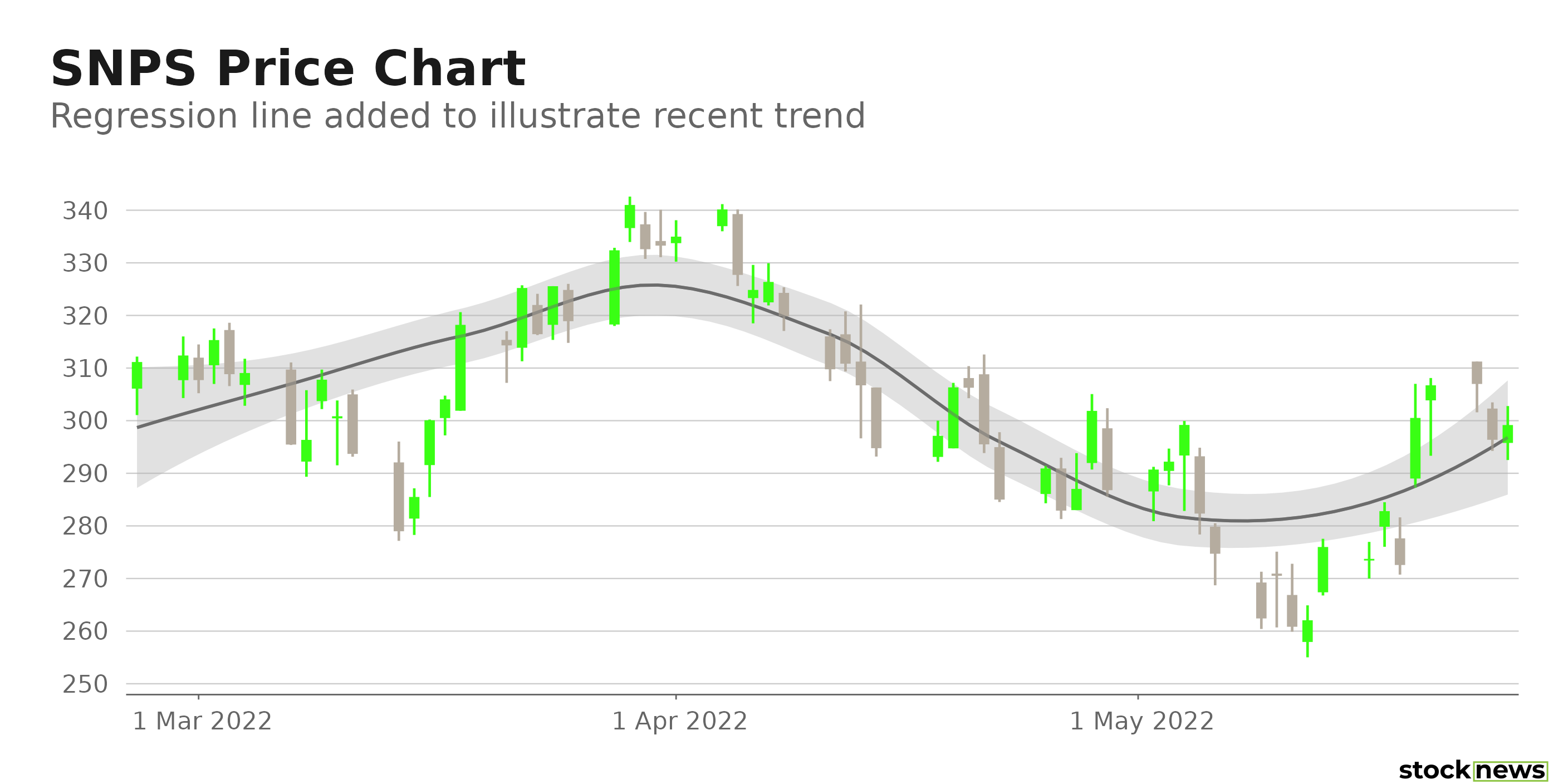

The stock has gained 16.9% in price over the past year and 2.8% over the past month to close yesterday's trading session at $299.17. Also, the company had an outstanding fiscal second quarter, exceeding guidance expectations with strength across all product groups and geographies.

Here is what could shape SNPS' performance in the near term:

Strategic Collaboration

This month, SNPS entered a distribution partnership with Arrow Electronics (ARW), a Fortune 102 value-added distributor, to deliver Synopsys Software Integrity Group's award-winning application security testing solutions to security resellers across North America. The Synopsys Software Integrity Group assists clients in building trust in their software by collaborating with major solution suppliers worldwide. These partners resell and supply joint Synopsys technologies and services, integrate them into DevSecOps workflows, and ensure an excellent client experience.

Also, this month, SNPS and Analog Devices, Inc. (ADI) partnered to deliver model libraries for DC/DC ICs and Module regulators using Synopsys' industry-leading simulation tool, Saber, as part of Synopsys' virtual prototyping service. Powertrain designers for products such as electric vehicles, avionic machines, instrumentation equipment, and supercomputers can now perform accurate multi-domain simulations with precision and speed using this new library in the Saber system-level simulation system, accelerating the design process and time-to-market.

Acquisition to Boost Growth

Last month, SNPS signed a definitive agreement to acquire WhiteHat Security, a renowned application security Software-as-a-Service (SaaS) provider. The inclusion of WhiteHat Security will give Synopsys considerable SaaS capabilities as well as market-leading dynamic application security testing (DAST) technologies, further strengthening what is considered the industry's most comprehensive application security testing portfolio. SNPS and WhiteHat Security, which was bought by NTT Security Corporation in 2019, share a goal for offering SaaS-based security testing solutions and integrating security into the software development lifecycle.

Robust Financials

During the second quarter, ended April 30, 2022, SNPS' total revenue increased 24.9% year-over-year to $1.28 billion. Its operating income increased 87.3% year-over-year to $363.70 million. The company's net income grew 51.1% from the year-ago value to $294.78 million, while its EPS grew 52.4% from the prior-year quarter to $1.89.

Strong Profitability

SNPS' 21.2% trailing-12-months net income margin is 281.2% higher than the 5.6% industry average. Also, its ROC, gross profit margin, and ROA are 147.6%, 61.4%, and 214.5% higher than the respective industry averages. Furthermore, its $1.70 billion in cash from operations is 1849.1% higher than the $87.12 million industry average.

Impressive Growth Prospects

The Street expects SNPS' revenues and EPS to rise 19.3% and 26%, respectively, year-over-year to $5.02 billion and $8.62 in fiscal 2022. In addition, SNPS' EPS is expected to rise at a 19.6% CAGR over the next five years. Furthermore, the company has an impressive earnings surprise history; it topped the Street’s EPS estimates in each of the trailing four quarters.

Consensus Rating and Price Target Indicate Potential Upside

Each of the six Wall Street analysts that rated SNPS rated it Buy. The 12-month median price target of $375.67 indicates a 25.6% potential upside. The price targets range from a low of $360.00 to a high of $409.00.

POWR Ratings Reflect Solid Prospects

SNPS has an overall B grade, which equates to a Buy rating in our proprietary POWR Ratings system. The POWR Ratings are calculated by considering 118 distinct factors, with each factor weighted to an optimal degree.

Our proprietary rating system also evaluates each stock based on eight distinct categories. SNPS has an A grade for Quality and a B for Growth. SNPS' solid earnings and revenue growth potential are consistent with the Quality and Growth grade.

Among the 156 stocks in the F-rated Software – Application industry, SNPS is ranked #12.

Beyond what I stated above, we have graded SNPS for Sentiment, Value, Stability, and Momentum. Get all SNPS ratings here.

Click here to check out our Software Industry Report for 2022

Bottom Line

SNPS has witnessed significant revenue growth across its segments, driven by strategic collaborations and acquisitions. Therefore, we think the stock could be a great pick now, given its robust growth attributes and favorable analysts' price targets.

How Does Synopsys Inc. (SNPS) Stack Up Against its Peers?

SNPS has an overall POWR B Rating, which equates to a Buy rating. Check out these other stocks within the same industry with A (Strong Buy) ratings: Commvault Systems Inc. (CVLT), Rimini Street Inc. (RMNI), and Progress Software Corporation (PRGS).

What To Do Next?

If you would like to see more top growth stocks, then you should check out our free special report:

What makes them "MUST OWN"?

All 9 picks have strong fundamentals and are experiencing tremendous momentum. They also contain a winning blend of growth and value attributes that generates a catalyst for serious outperformance.

Even more important, each recently earned a Buy rating from our coveted POWR Ratings system where the A rated stocks have gained +48.22% a year.

Click below now to see these top performing stocks with exciting growth prospects:

SNPS shares were unchanged in premarket trading Thursday. Year-to-date, SNPS has declined -18.81%, versus a -16.08% rise in the benchmark S&P 500 index during the same period.

About the Author: Pragya Pandey

Pragya is an equity research analyst and financial journalist with a passion for investing. In college she majored in finance and is currently pursuing the CFA program and is a Level II candidate.

The post Synopsys: A High-Quality Growth Stock to Buy Now appeared first on StockNews.com