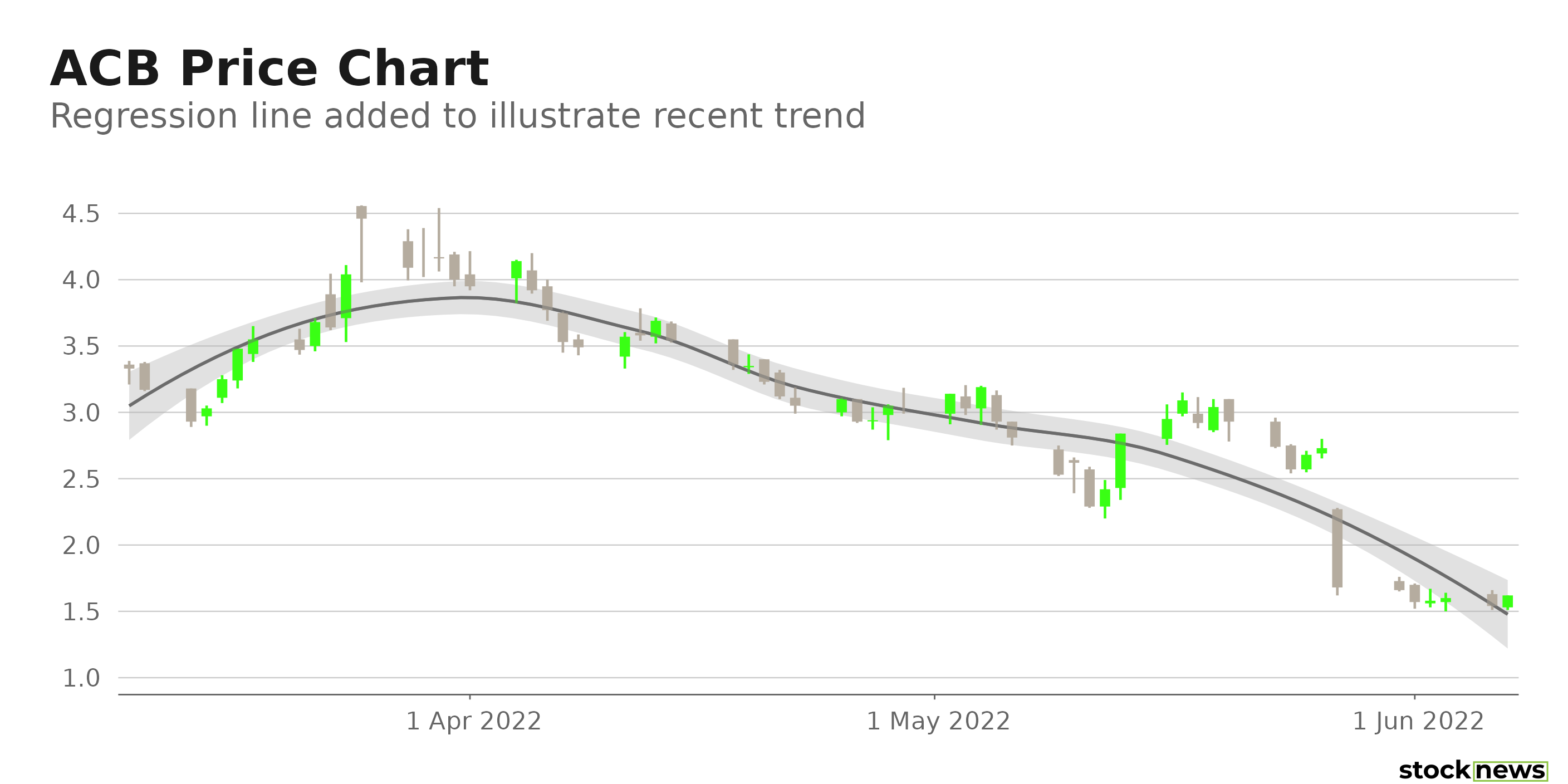

Aurora Cannabis Inc. (ACB) in Calgary, Canada, is a global cannabis industry leader that services the medicinal and consumer sectors. However, its stock is down 83.7% in price over the past year and 70.1% year-to-date to close yesterday’s trading session at $1.62. In addition, its shares are currently trading 84.8% below their 52-week high of $10.64, which they hit on June 09, 2021.

Although the cannabis company has made noteworthy progress in broadening its portfolio by introducing new unique cultivars and increasing its foothold in the rapidly growing medical cannabis sector, it has struggled to achieve consistent revenue growth. The company’s consumer cannabis net revenue came in at $10.3 million in the third quarter, ended March 31, 2021, down from $14.4 million in the prior quarter, owing primarily to industry-wide price pressures across the company's portfolio and exacerbated by retail outlet closures for its premium products in key provinces.

In addition, in a report last month, CIBC analyst John Zamparo downgraded ACB from Neutral to Underperformer, implying that he expects the stock will trail behind its Canadian cannabis peers over the next 12-18 months.

Here is what could shape ACB's performance in the near term:

Bought Deal Financing

This month, ACB announced the completion of an offering of the company's units to raise approximately $172.5 million in gross proceeds. The company sold approximately 70.4 million units at $2.45 per unit, including approximately 9.2 million units issued due to the underwriters' exercise of its over-allotment option. According to the ACB, the offering's net proceeds will be used for general company purposes.

Negative Profit Margins

ACB's 0.10% trailing-12-month asset turnover ratio is 71.2% lower than the 0.36% industry average. Its 13.1% trailing-12-month gross profit margin is 76.5% lower than the 55.5% industry average. Also, its trailing-12-month ROA, ROC, and levered FCF margin are negative 78.6%, 6.7%, and 25.7%, respectively.

Weak Growth Prospects

The Street expects ACB's revenues and EPS to decline 7.6% and 29.2%, respectively, year-over-year to $178.01 million and $4.16 in fiscal 2022. Furthermore, analysts expect its EPS to decline 29.2% next quarter (ending Sept. 30, 2022)

POWR Ratings Reflect Bleak Outlook

ACB has an overall D rating, which equates to Sell in our proprietary POWR Ratings system. The POWR ratings are calculated by considering 118 distinct factors, with each factor weighted to an optimal degree.

Our proprietary rating system also evaluates each stock based on eight distinct categories. ACB has a D for Stability and Quality. The stock’s 3.13 beta is in sync with its Stability grade. In addition, the company's poor profitability is consistent with the Quality grade.

Of the 164 stocks in the F-rated Medical – Pharmaceuticals industry, ACB is ranked #153.

Beyond what I have stated above, one can view ACB ratings for Growth, Value, Momentum, and Sentiment here.

Click here to checkout our Healthcare Sector Report for 2022

Bottom Line

ACB's shares have plummeted 42.4% over the past month. While the company has made tremendous headway in the worldwide medical market, investors remain concerned about its negative profit margin and poor revenue-generating prospects. In addition, the stock is currently trading below its 50-day and 200-day moving averages of $2.99 and $5.08, respectively, indicating a downtrend. So, we think the stock is best avoided now.

How Does Aurora Cannabis Inc. (ACB) Stack Up Against its Peers?

While ACB has an overall D rating, one might want to consider its industry peers, Merck & Co. Inc. (MRK), Novartis AG (NVS), and Novo Nordisk A/S (NVO), which have an overall A (Strong Buy) rating.

What To Do Next?

If you would like to see more top stocks under $10, then you should check out our free special report:

What gives these stocks the right stuff to become big winners?

First, because they are all low-priced companies with explosive growth potential, that excel in key areas of growth, sentiment and momentum.

But even more important is that they are all top Buy rated stocks according to our coveted POWR Ratings system, Yes, that same system where top-rated stocks have averaged a +31.10% annual return.

Click below now to see these 3 exciting stocks which could double (or more!) in the year ahead:

ACB shares fell $0.00 (-0.07%) in premarket trading Wednesday. Year-to-date, ACB has declined -70.06%, versus a -12.20% rise in the benchmark S&P 500 index during the same period.

About the Author: Pragya Pandey

Pragya is an equity research analyst and financial journalist with a passion for investing. In college she majored in finance and is currently pursuing the CFA program and is a Level II candidate.

The post Is Aurora Cannabis a Buy Under $2? appeared first on StockNews.com