Last year has been challenging for Rivian Automotive, Inc. (RIVN) as it grappled with supply chain disruptions, escalating costs, production delays, and mounting losses.

Nevertheless, RIVN garnered investors’ attention this year with its robust production figures for the second quarter. Moreover, it started delivering to Europe the electric vans it makes for Amazon.com, Inc. (AMZN) and reiterated its plan to build 50,000 electric cars within the calendar year. This fuelled a strong rally in the stock, with an increase of 61.2% observed over the past month.

However, the sustainability of its gains remains uncertain as Rivian finds itself up against tenacious competition and continues to operate at a loss. The electric vehicle industry’s pricing war intensified recently, with Ford Motor Company (F) slashing its F-150 Lightning trucks’ prices. Simultaneously, Tesla, Inc. (TSLA) is gearing up to produce Cybertrucks this year.

Despite RIVN’s production acceleration, it may not be the optimal time for investors to buy the stock. Carefully examining RIVN’s key financial metrics will provide more insight into the prevailing situation.

Analyzing RIVN’s Financial Trends: Rising Revenues Amid Escalating Losses

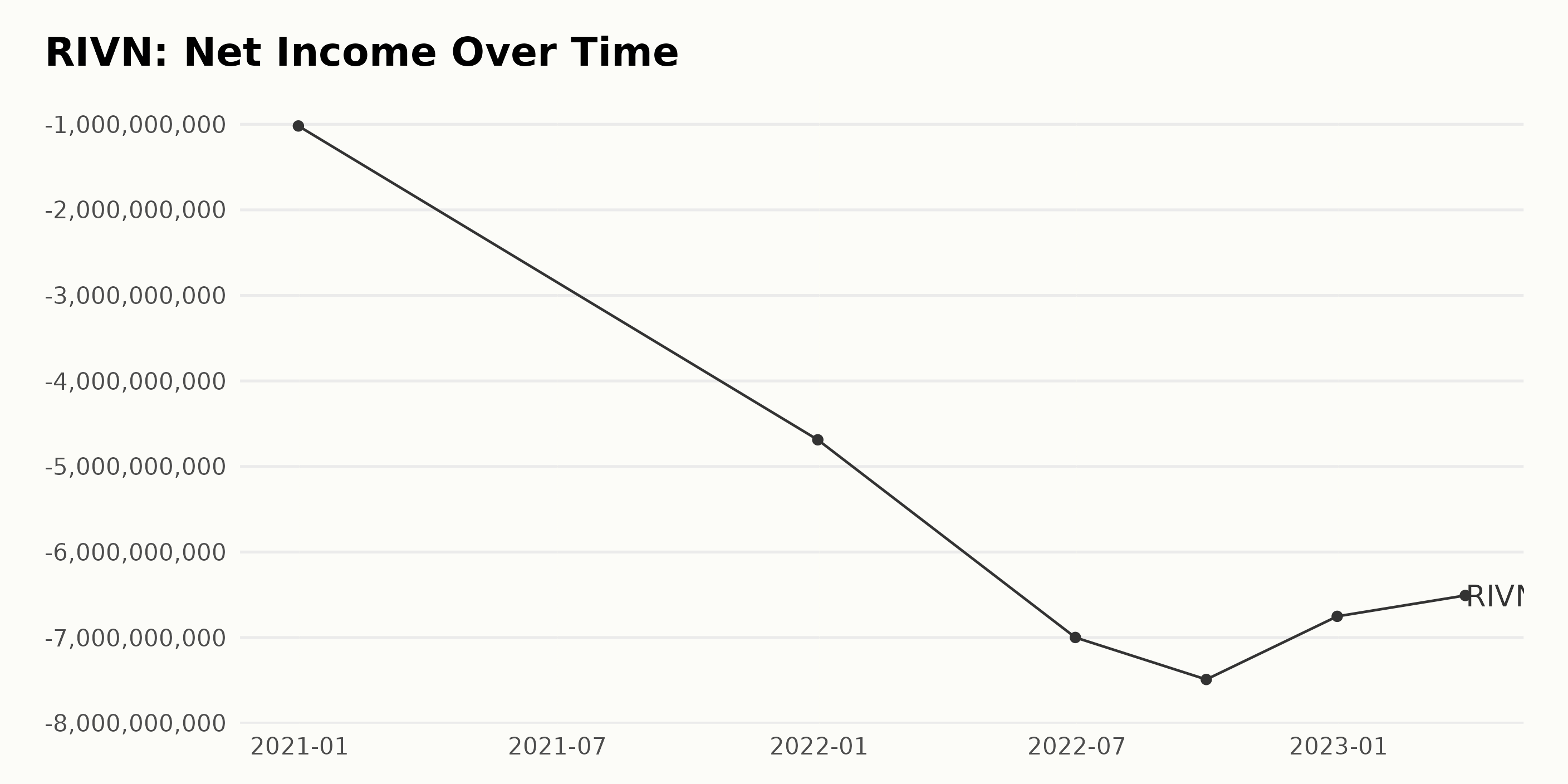

The trailing-12-month net income of RIVN has been experiencing consistent negative growth over the reported period. Here are the key observations (all values indicated as losses):

- As of December 2020, RIVN was at a loss of $1.02 billion.

- The loss increased sharply over the next year to $4.69 billion in December 2021, indicating a significant downturn.

- By mid-2022, the losses worsened further to $7 billion by the end of June 2022.

- The highest loss came at the end of the third quarter in September 2022, with a net loss of $7.49 billion.

- The losses decreased slightly to $6.75 billion by December 2022.

- In what seems to be an improving trend, the most recent data of the first quarter of 2023 shows a continued decrease in losses, with net income at -$6.51 billion.

When we measure the growth rate from the first value to the last, the net income experienced a growth rate of -538.69%. The losses increased by approximately 5.38 times over the reported period. The general trend indicates an increase in loss with some relief in recent quarters. The overall picture remains one of substantial net losses for RIVN over the reported period.

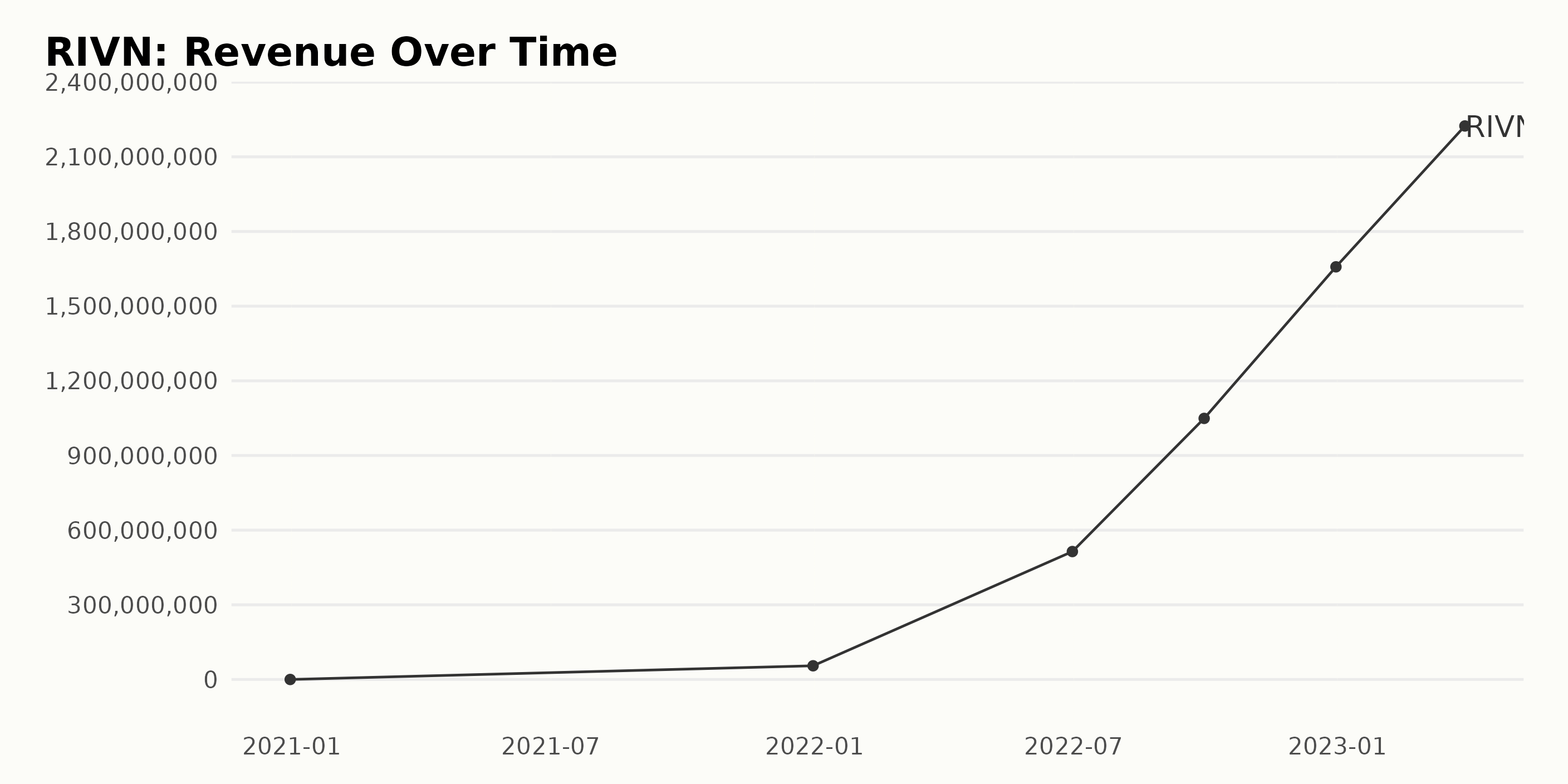

Based on the provided data, the trailing-12-month revenue of RIVN shows an overall upward trend from December 31, 2020, to March 31, 2023. Here is the summary story:

- On December 31, 2020, RIVN reported zero revenue.

- The first significant entry comes up a year later, with RIVN reporting a revenue of $55 million on December 31, 2021.

- By June 30, 2022, the company’s revenue increased dramatically to $514 million.

- The upward trend continues, and by September 30, 2022, RIVN’s revenue soared to roughly $1.05 billion.

- Ending the calendar year 2022, its revenue rose significantly again to approximately $1.66 billion, as reported on December 31, 2022.

- In the most recent data point — as of March 31, 2023 — RIVN recorded a further increase in its revenue to about $2.22 billion.

This time-series data showcases a robust, increasing trend in RIVN’s revenue, rising from zero at the end of 2020 to $2.22 billion by the end of March 2023.

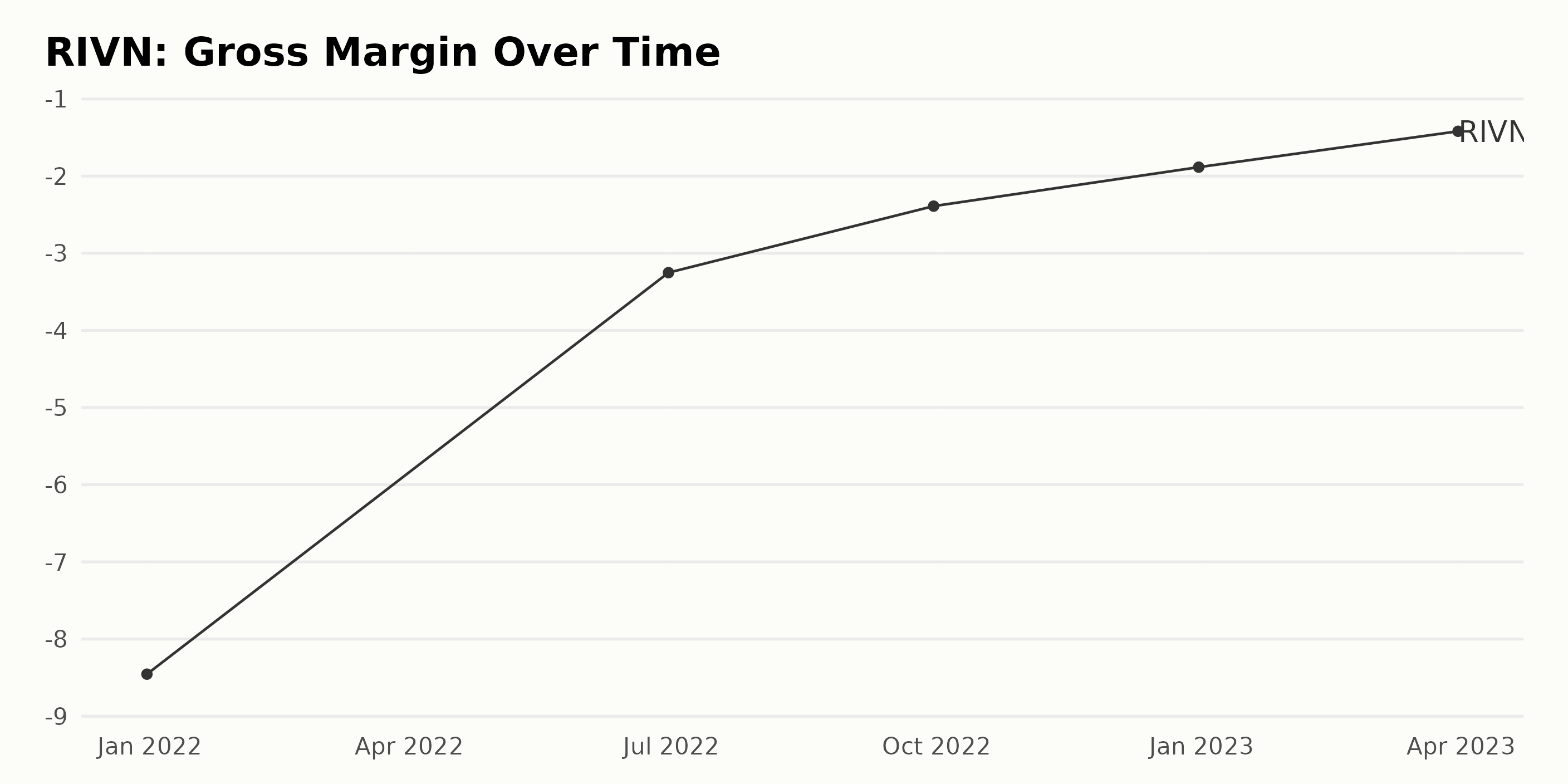

The gross margin of RIVN varied significantly over the observed period from December 31, 2021, to March 31, 2023. Here are the essential trend and fluctuations summarized:

- On December 31, 2021, RIVN’s gross margin was -845.5%.

- By June 30, 2022, there was a notable increase in the gross margin, reducing the negative value to -325.1%.

- Following this positive trend, the gross margin improved to -238.9% by September 30, 2022.

- By the end of 2022, December 31, the gross margin continued to rise, reaching -188.4%.

- In the most recent data point, on March 31, 2023, the gross margin is reported to be -141.9%.

In conclusion, while there has been a consistent improvement in RIVN’s gross margin from December 2021 to March 2023, it is still negative.

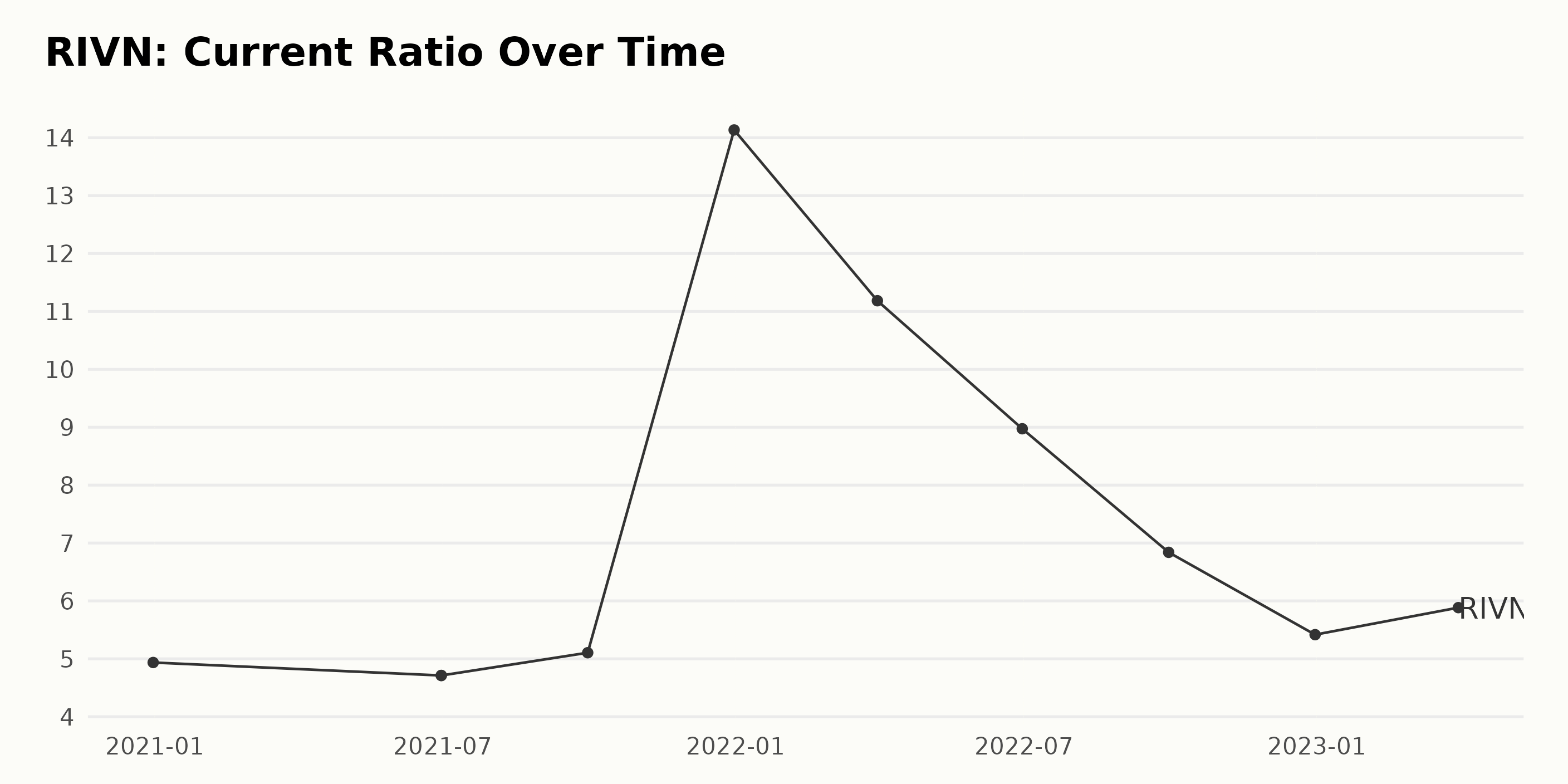

Here is a summary of the trend and fluctuations in the current ratio of RIVN: -

- The data starts on December 31, 2020, with a current ratio of 4.94 for RIVN.

- There was a slight decrease to 4.71 by June 30, 2021. This level was maintained for the same period.

- A sudden jump occurred by September 30, 2021, leading to a current ratio of 5.11.

- A significant increase was noticed on December 31, 2021, reaching its highest recorded level at 14.14.

- However, from 2022 onwards, there has been a steady decline in the current ratio value. It dropped to 11.19 by March 31, 8.97 by June 30, and 6.84 by September 30.

- A significant drop was noted at the end of 2022, with the current ratio landing at 5.42 on December 31.

- An increase was observed on March 31, 2023, lifting the current ratio to 5.88.

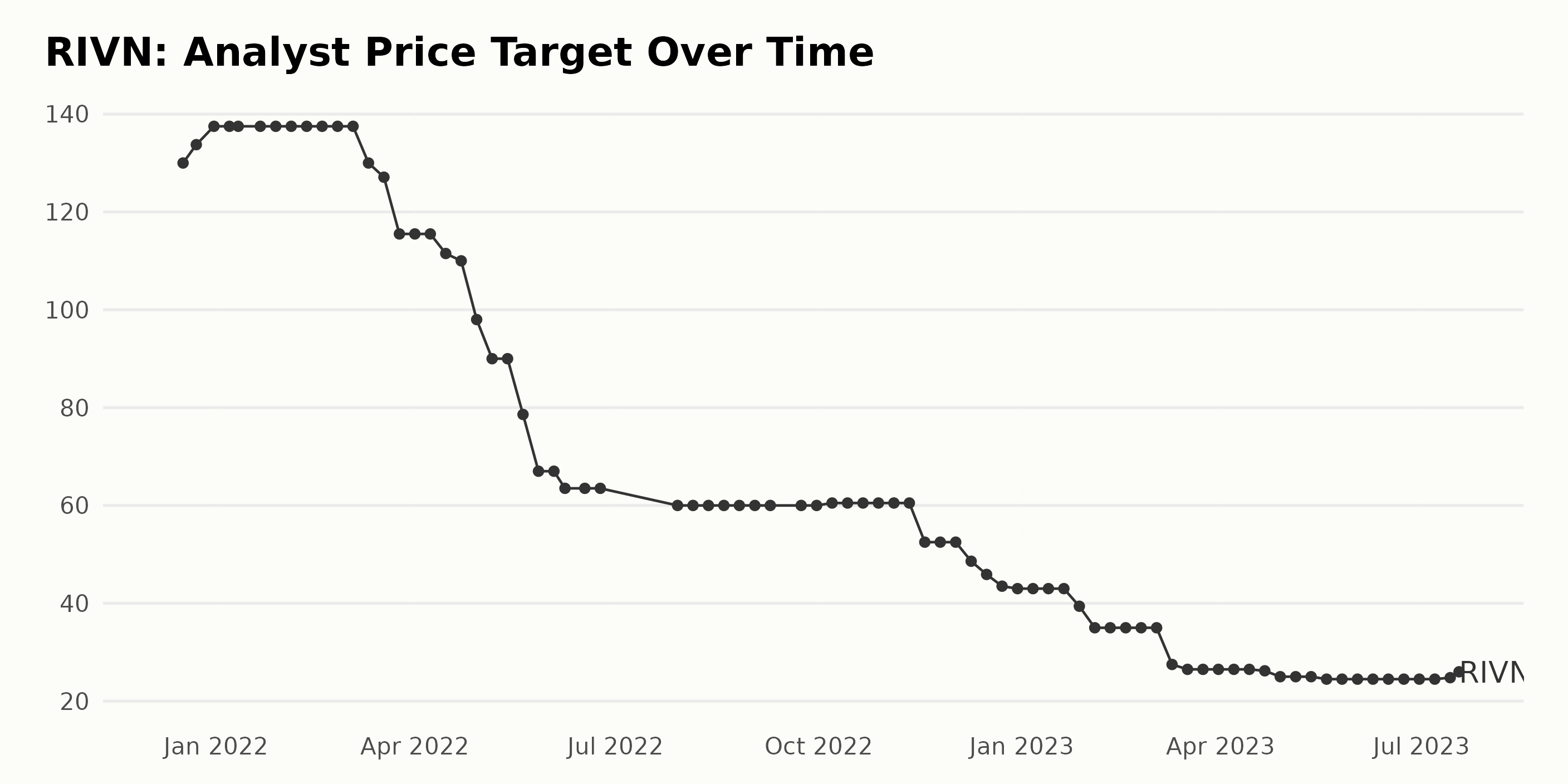

The Analyst Price Target data for RIVN shows a downward trend throughout the duration of the series, from December 2021 to July 2023. While the target price initially showed an upward movement, reaching a peak at $137.5 by January 7, 2022, it subsequently experienced a gradual decline over the period.

The first significant dip occurred between March and May 2022 when the value decreased sharply from $130 on March 11, 2022, to $67 on May 27, 2022, marking more than a 48% reduction in its value.

This is followed by a period of relative stability with minor fluctuations until October 2022, when a slight increase to $60.5 was observed. However, overall, the trend continues to decline from the latter part of 2022 and well into 2023, eventually dropping to a low of $24.5 by June 2, 2023.

Interestingly, towards the end of the series, in July 2023, a slight uptick was recorded, with the last value recorded on July 18, 2023, being $26, suggesting a minor recovery.

In terms of growth rate, the change from the initial recorded price target value of $130 to the final value of $26 represents an approximate decrease of around 80% across the total period. Summarising, RIVN’s declining Analyst Price Target trend possibly indicates a diminishing sentiment toward the stock’s future performance amongst investment analysts over this time series.

Examining RIVN’s Share Price Volatility and Growth Trends in 2023

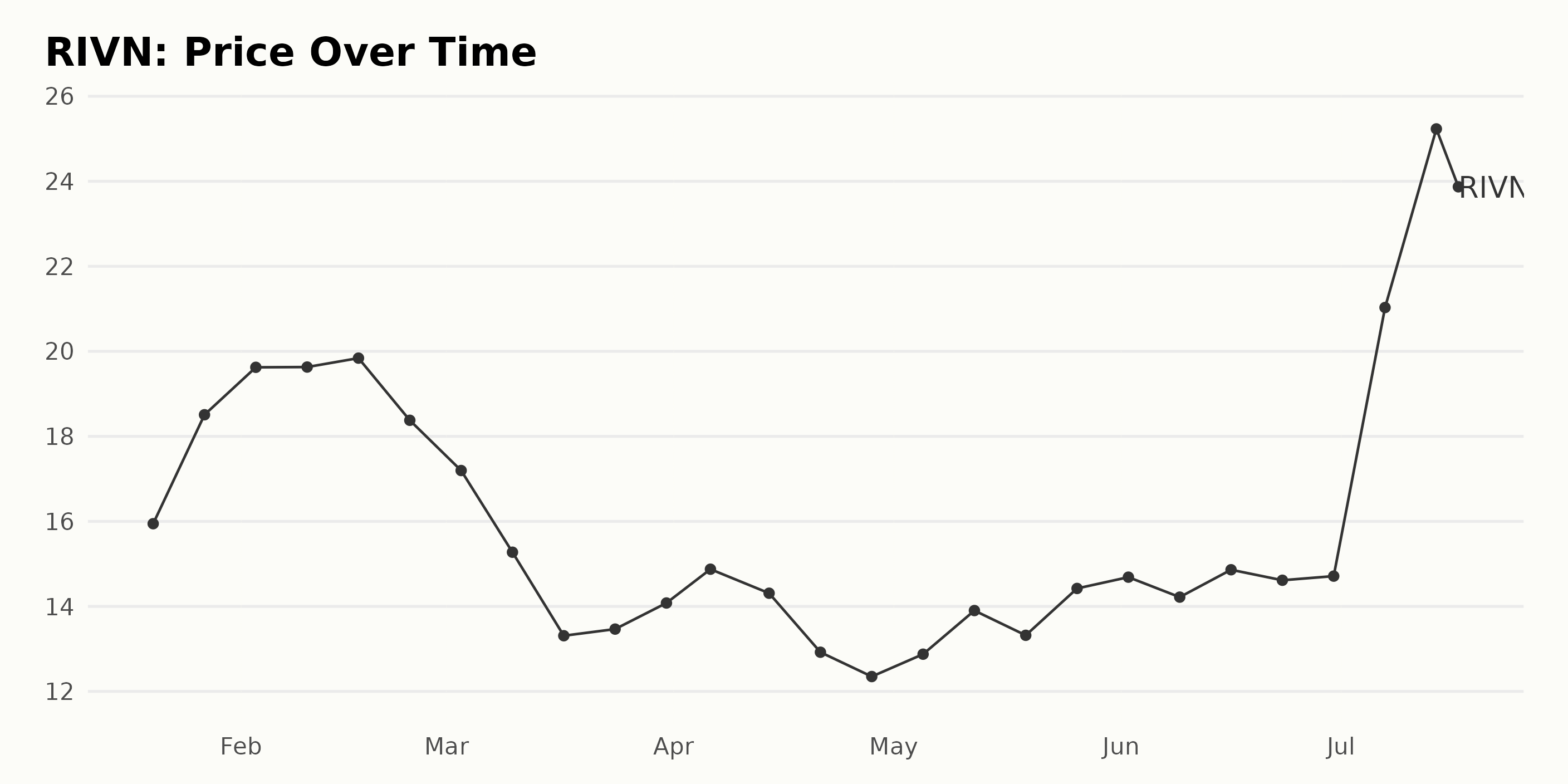

Analyzing the share price of RIVN over the provided timeframe:

- On January 20, 2023, the share value was $15.95.

- The price then increased over the following weeks, reaching a high of $19.84 on February 17, 2023.

- Post February 17, there was a decline to a low of $13.31 on March 17, 2023.

- From the end of March to the end of June, the prices showed a gradual recovery with minor fluctuations, reaching $14.71 by June 30, 2023.

- There was a significant increase in share price in July, jumping from $14.71 on June 30, 2023, to $21.03 on July 7, 2023, and further accelerating to a peak of $25.23 on July 14, 2023.

- The data ends on July 17, 2023, when the price had dropped slightly to $23.99, although still maintaining a high value.

Overall, the price of RIVN shares exhibited a fluctuating growth rate throughout this series. It encountered an initial phase of growth, followed by a decline and a smaller period of recovery. The latter half of the series depicts a significant acceleration in share prices before concluding with a slight deceleration. It’s crucial to monitor if the sharp rise in July continues or if it represents a brief surge in the ongoing trend of variable growth. Here is a chart of RIVN’s price over the past 180 days.

Assessing RIVN’s POWR Ratings Performance

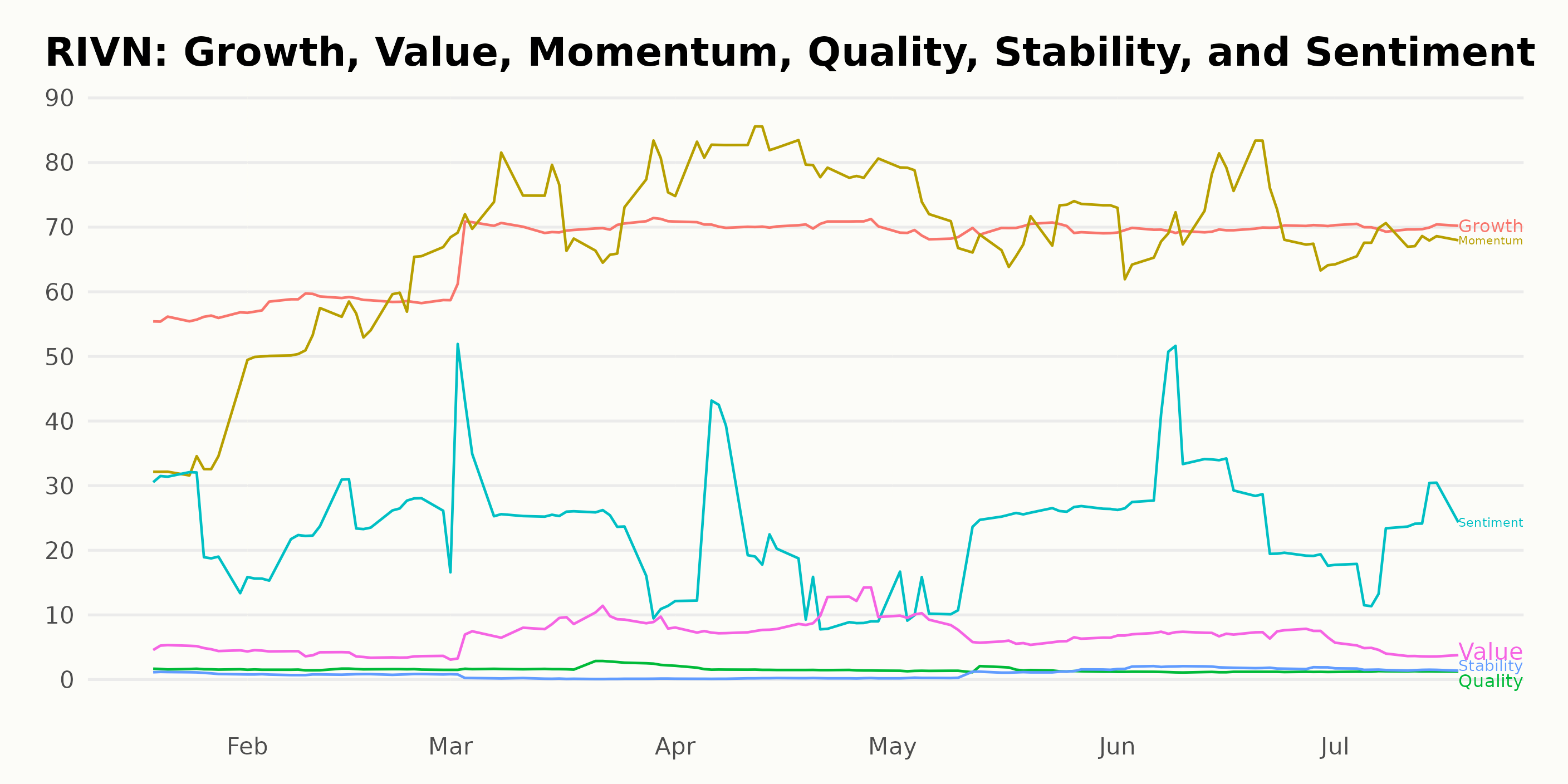

RIVN has an overall F rating, translating to a Strong Sell in our POWR Ratings system. It is currently ranked #51 out of the 55 stocks in the Auto & Vehicle Manufacturers category. It also has an F grade in Value, Stability, and Quality and a D in Sentiment.

For a detailed look at RIVN’s POWR grade and category ranking evolution over time, data from previous weeks is provided below:

- The week of January 21, 2023: POWR grade F, rank 52 in its category.

- The week of February 25, 2023: POWR grade F, rank 52 in its category.

- The week of March 25, 2023: POWR grade F, rank 46 in its category.

- The week of April 29, 2023: POWR grade F, rank 49 in its category.

- The week of May 27, 2023: POWR grade F, rank 50 in its category.

- The week of June 24, 2023: POWR grade F, rank 48 in its category.

Please note that lower rank values indicate a superior position within the respective category. Despite some fluctuations, the POWR grade for RIVN has remained consistent, signifying a turbulent performance of the stock during this period.

Stocks to Consider Instead of Rivian Automotive, Inc. (RIVN)

Other stocks in the Auto & Vehicle Manufacturers sector that may be worth considering are Bayerische Motoren Werke Aktiengesellschaft (BMWYY), Subaru Corp. (FUJHY), and Honda Motor Company Ltd. (HMC) -- they have better POWR Ratings.

What To Do Next?

Discover 10 widely held stocks that our proprietary model shows have tremendous downside potential. Please make sure none of these “death trap” stocks are lurking in your portfolio:

RIVN shares were trading at $25.01 per share on Tuesday afternoon, up $1.02 (+4.25%). Year-to-date, RIVN has gained 35.70%, versus a 19.39% rise in the benchmark S&P 500 index during the same period.

About the Author: Subhasree Kar

Subhasree’s keen interest in financial instruments led her to pursue a career as an investment analyst. After earning a Master’s degree in Economics, she gained knowledge of equity research and portfolio management at Finlatics.

The post Is the Worst Over for Rivian Automotive (RIVN)? appeared first on StockNews.com