We FINALLY saw the stock market take a step back after a seeming non-stop 5 month rally. Many investment commentators point to the Fitch ratings downgraded of US debt as the primary cause. However, if we are being honest with ourselves....this self off was long overdue. The Fitch announcement was just a convenient excuse to hit the sell button for a while.

Friday was an interesting session worthy of note. The Government Employment Report seemed like a Goldilocks announcement. Not too hot...not too cold...just right helping the S&P 500 rise nearly 1% early in the session.

Yet as the day progressed those gains melted off the board leading to a -0.53% session. Even more interesting was the S&P 500 (SPY) closing below 4,500 and now probably on our way towards 4,400 (more on that in the Price Action section below.)

Even though we don’t like seeing red on the screen...this is healthy. That investors took the opportunity of an intraday rally to take more gains off the table.

On Monday we got a solid bounce back as investors have gotten into the habit of buying every dip the past several months as that strategy has paid off handsomely. What they didn’t know was a surprise announcement on Monday that Moody’s was downgrading their ratings on a slew of small to midsized banks. This reawakened the Risk Off sentiment from last week with more investors hitting the sell button in earnest on Tuesday.

This is the classic swinging of the fear/greed pendulum. The greed of the rally up to 4,600 was overextended. Simply conditions were not that pristine to keep rising. This left investors vulnerable to any bad news for which Fitch and Moody’s were reminders that the overall market may be ahead of itself.

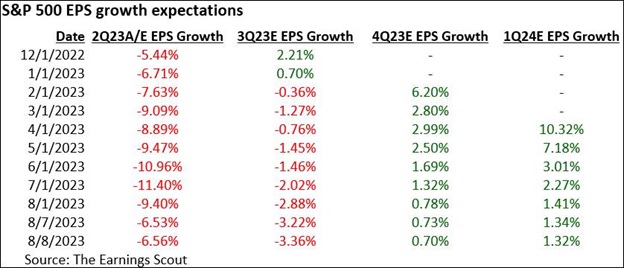

Another reminder of this is on the earnings front. As we come down the homestretch of Q2 earnings season we find that earnings estimates for the future have been trimmed for the next few quarters. Adding those 3 quarters together points to virtually no year over year growth.

The weak earnings outlook is NOT GOOD FUEL FOR A BULL RALLY

Especially true when the S&P 500 is already at a PE of 20. That is not necessarily overpriced...but it is rather fully priced. Thus, to reasonably expect more upside you need better earnings growth prospects for the future to compel higher prices without overly inflating PE.

This is a long way of saying that now is a logical time for the runaway rally to end and for us to enter a healthy consolidation period to digest recent gains. And thus be more selective about the stocks that should advance from here.

So Why Still Believe in a Long Term Bull Rally?

Because the Fed is providing more hints of a “dovish tilt”. That gained steam with the speech from Harken of the Philly Fed where he stated that likely no further rate hikes are needed. At this stage they just need to give the current high rates time to sink in and bring down inflation further. Then start thinking about lower rates.

Plain and simple, the future lowering of rates is a tail wind for the economy that increases the odds of better growth prospects (what is needed to push prices higher). Knowing that is on the horizon is a reason to be more bullish now.

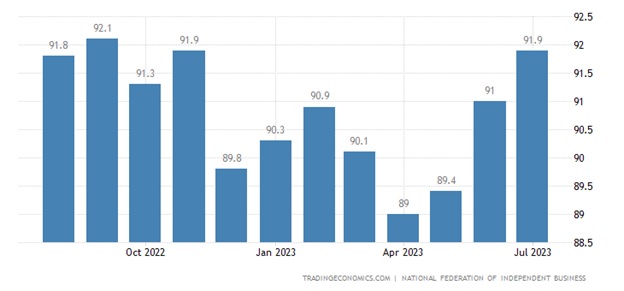

On top of that you have more business people feeling optimistic about the future. Here is the chart for the NFIB Small Business Optimism reading on Tuesday morning at 91.9.

As you can see this is the 3rd straight month of improvement and the highest reading in quite a while. This increased optimism is a precursor to improving growth trends.

Think about this. First you feel good about something...then you act on that positive impulse. This is why sentiment surveys are considered leading indicators of future economic activity.

Putting it altogether there is stronger reasons to believe that recession will be avoided during this rate hike cycle. If so, then the economy should pick up from here...which lifts earnings prospects...which is necessary fuel for share price appreciation.

Price Action & Trading Plan

Here is the updated S&P 500 chart:

Moving Averages: 50 Day (yellow), 100 Day (orange), 200 Day (red)

Right now 4,600 is setting up as a spot of stiff resistance and now trying to find support on the underside for likely a trading range to form. My guess is that the 50 day moving average around 4,420 is about as low as stocks need to go.

This sets up for a trading range where we likely swim around for a few months before the typical holiday rallies of November/December kick in giving us a real shot at the previous all time high of 4,818.

This sets us up nicely for a stock pickers market which is my favorite. Meaning where the overall market is kind of lukewarm...but those with a stock picking advantage find way to carve out profits.

In our case, the POWR Ratings is a big advantage in our corner to find stock picking profits in any market environment...especially an environment where the leaders are overripe and investors will rotate to more attractive, underpriced plays.

What To Do Next?

Discover my current portfolio of 5 stocks packed to the brim with the outperforming benefits found in our POWR Ratings model.

Plus I have added 4 ETFs that are all in sectors well positioned to outpace the market in the weeks and months ahead.

This is all based on my 43 years of investing experience seeing bull markets...bear markets...and everything between.

If you are curious to learn more, and want to see these 9 hand selected trades, then please click the link below to get started now.

Steve Reitmeister’s Trading Plan & Top Picks >

Wishing you a world of investment success!

Steve Reitmeister…but everyone calls me Reity (pronounced “Righty”)

CEO, StockNews.com and Editor, Reitmeister Total Return

SPY shares fell $0.10 (-0.02%) in after-hours trading Tuesday. Year-to-date, SPY has gained 18.23%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Steve Reitmeister

Steve is better known to the StockNews audience as “Reity”. Not only is he the CEO of the firm, but he also shares his 40 years of investment experience in the Reitmeister Total Return portfolio. Learn more about Reity’s background, along with links to his most recent articles and stock picks.

The post Home on the Trading Range appeared first on StockNews.com