With a steadfast focus on capitalizing on the immense potential of artificial intelligence (AI), Advanced Micro Devices, Inc. (AMD) has been strengthening its capabilities in developing AI chips. Acknowledging the U.S. sanctions preventing the export of an array of chips to China, the company is planning to develop AI chips specifically for the Chinese market that will comply with U.S. export controls, thereby positioning the company in a favorable spot for expansion.

Concurrently, AMD intends to elevate the production of its MI300 chip, which challenges NVIDIA Corporation (NVDA), a leader in the market.

However, the broader landscape of the global chip industry faces obstacles posed by geopolitics and apprehensions related to national security, disrupting the industry’s globalization and overall growth dynamics.

The chairman and acting CEO of memory chipmaker Yangtze Memory Technologies (YMTC) expressed that the global industry could be embarking on a “period of turmoil.”

Moreover, analytics firm Gartner projects a worrisome 11.2% decline in worldwide semiconductor revenue in 2023. Macroeconomic uncertainties may also pose imminent challenges to AMD’s performance.

Adding to the concerns, on August 15, 2023, AMD’s Chair, President, and CEO, Lisa Su, sold 75,000 company shares. This action aligns with an ongoing trend of insider selling at AMD, thereby signaling a potential lack of confidence in the company’s future performance by its executive members.

Considering these circumstances, it might be advisable to exercise caution regarding AMD stock at present. However, further analysis of AMD’s key financial metrics can offer a better understanding of the given scenario.

Advanced Micro Devices Inc.: A Fluctuating Financial Performance from 2020 to 2023

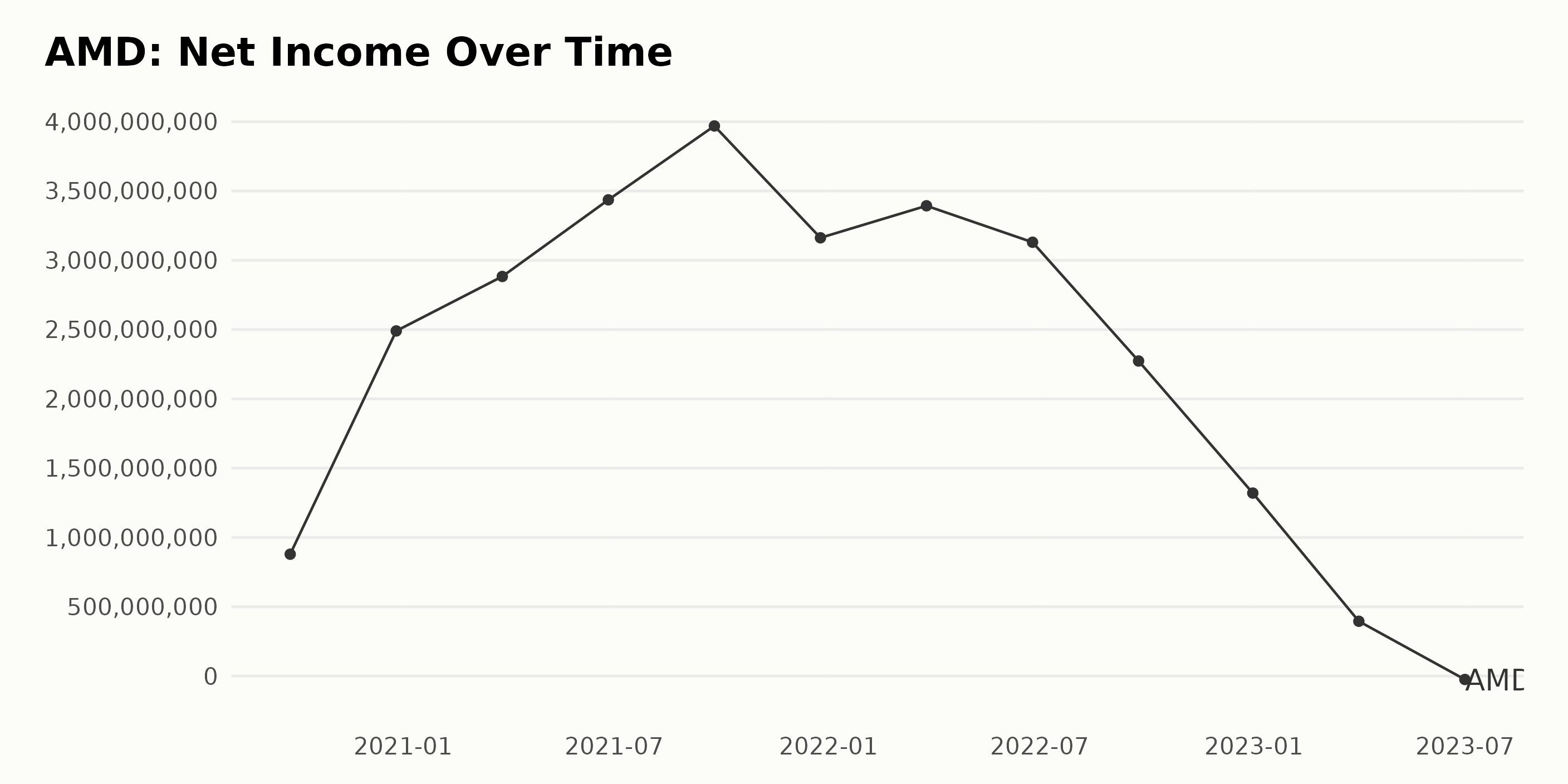

The trailing-12-month net income of AMD shows significant fluctuations and trends over the period from September 2020 to July 2023.

- Net Income experienced growth from $879 million in September 2020 to $2.49 billion by December 2020, a significant rise.

- In the first two quarters of 2021, AMD witnessed further growth in net income from $2.88 billion in March to $3.43 billion in June. However, in the latter half of 2021 (September & December), there was a drop from $3.96 billion to $3.16 billion.

- 2022 started strong, with the net income reaching $3.39 billion in March, but it varied in the subsequent quarters falling to $3.13 billion in June and dropping drastically to $1.32 billion in December.

- The first half of 2023 saw an underwhelming performance, with the net income falling drastically to $395 million in April and reaching the negative territory with -$25 million in July.

From the first value of $879 million in September 2020 to the last reported value of -$25 million in July 2023, the net income saw a substantial decrease in its performance.

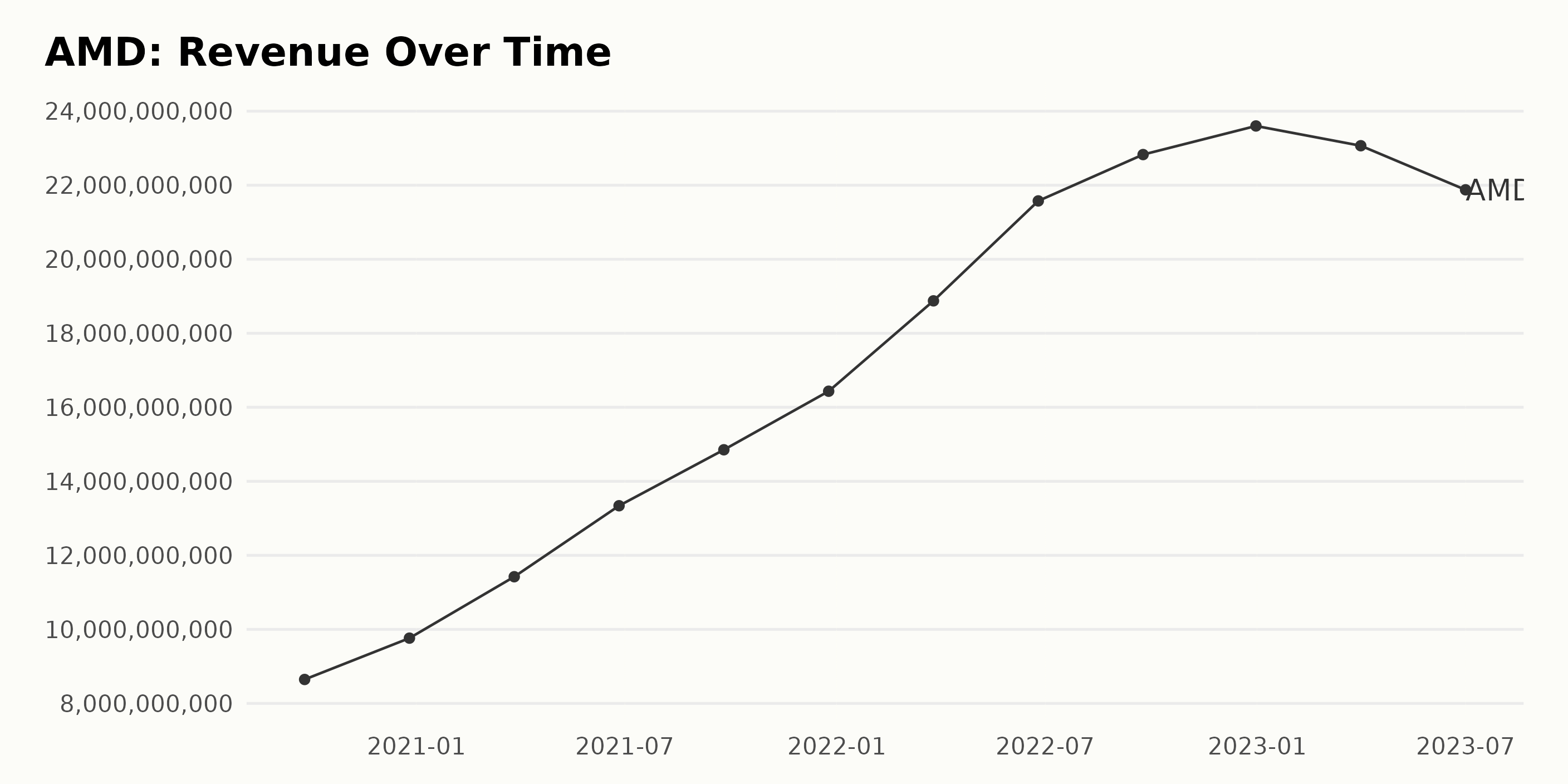

The trailing-12-month revenue of AMD has shown a pattern of steady growth with some fluctuations. The company’s revenue has nearly tripled from September 2020 to July 2023, highlighting a significant rise.

Key Highlights:

- The revenue in September 2020 was around $8.65 billion, which grew significantly to reach $16.43 billion by December 2021, indicating an upward trend within a year.

- A surge could be seen in 2022, when the revenue reached its height at $23.60 billion in December 2022, demonstrating a high growth rate throughout the year.

- However, the first quarter of 2023 marked a turning point, revealing a minor dip to $23.07 billion. The decreasing trend continued through the second quarter of 2023, where the revenue was $21.88 billion.

In terms of growth rates, measured from the first value of $8.65 billion in September 2020 to the last value of $21.88 billion in July 2023, the company’s revenue increased by near to 153%. Hence, despite the recent downturn, AMD has shown substantial growth over the analyzed period. More attention should be paid to this regression in upcoming quarters to determine if it’s part of a larger declining trend or just a temporary fall.

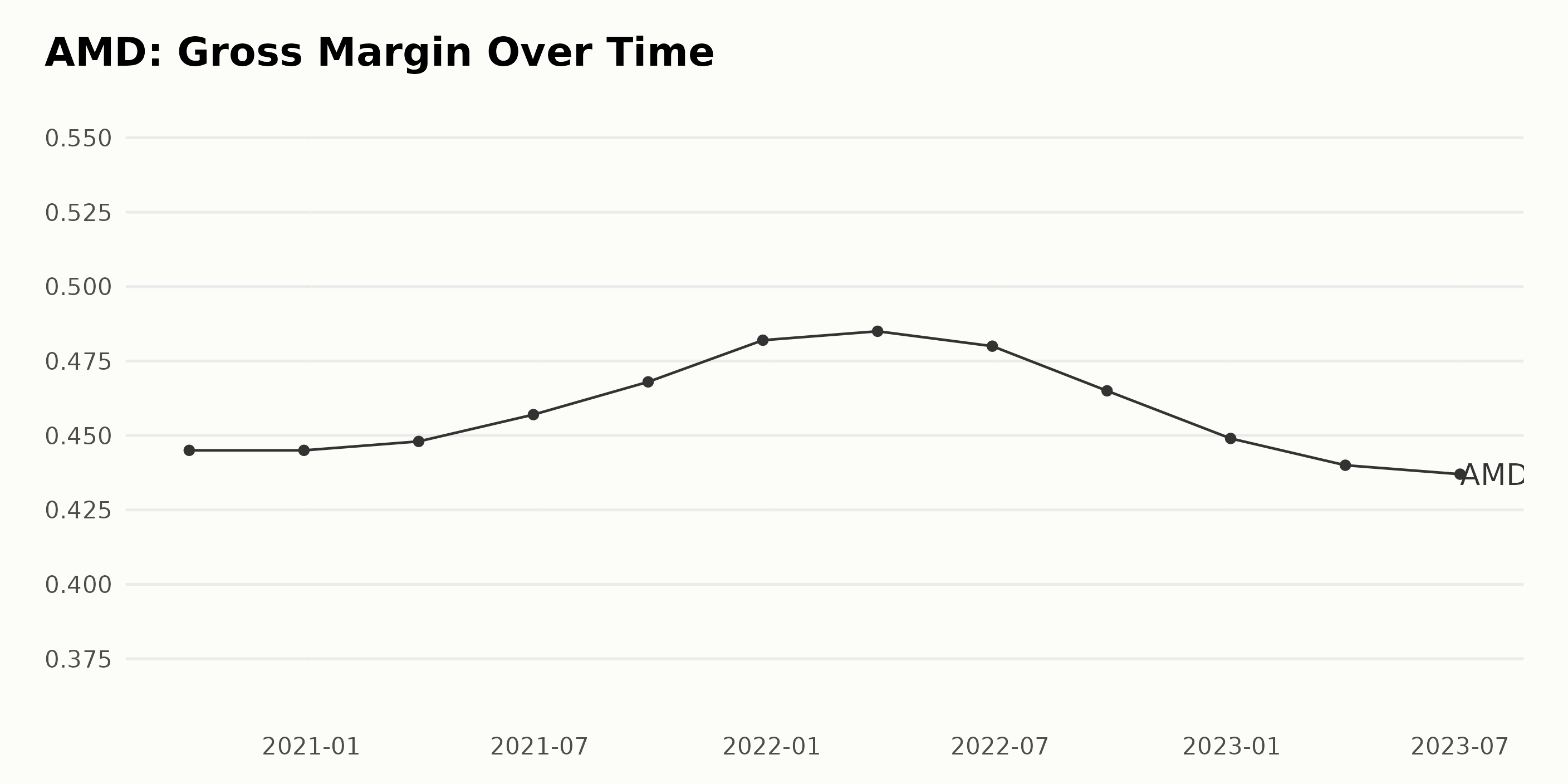

The gross margin of AMD has exhibited an interesting trend over the last few years, experiencing fluctuations and showing an overall downward trajectory in the most recent periods:

- On September 26, 2020, the gross margin stood at 44.5%.

- There was no significant change on December 26, 2020, remaining at 44.5%.

- A minor uptick was observed on March 27, 2021, to 44.8%.

- By June 26, 2021, the gross margin had risen to 45.7% gradually.

- There was another rise on September 25, 2021, reaching 46.8%.

- The margin peaked on December 25, 2021, at 48.2%.

- The gross margin kept ascending slightly to 48.5% on March 26, 2022.

- An abrupt drop was noted by June 25, 2022, lowering to 48%.

- By September 24, 2022, a more considerable fall was observed, reaching 46.5%.

- Further decline was reported, hitting 44.9% by the end of 2022.

- As of April 1, 2023, a decrease to 44% was measured.

- To conclude, the value decreased slightly, marking the gross margin at 43.7% on July 1, 2023.

From the start of the series in September 2020 to the most recent data in July 2023, there has been a net decrease in gross margin from 44.5% to 43.7%. While numerous fluctuations occurred during this period, a notable downward trend is apparent in recent times, indicating possible challenges for AMD. Remember, emphasizing slightly recent data, the gross margin declined from its highest point of 48.2% in December 2021 to 43.7% in July 2023, marking a significant drop that might be of concern. The trend suggests a need for strategic assessment to enhance profit margins moving forward.

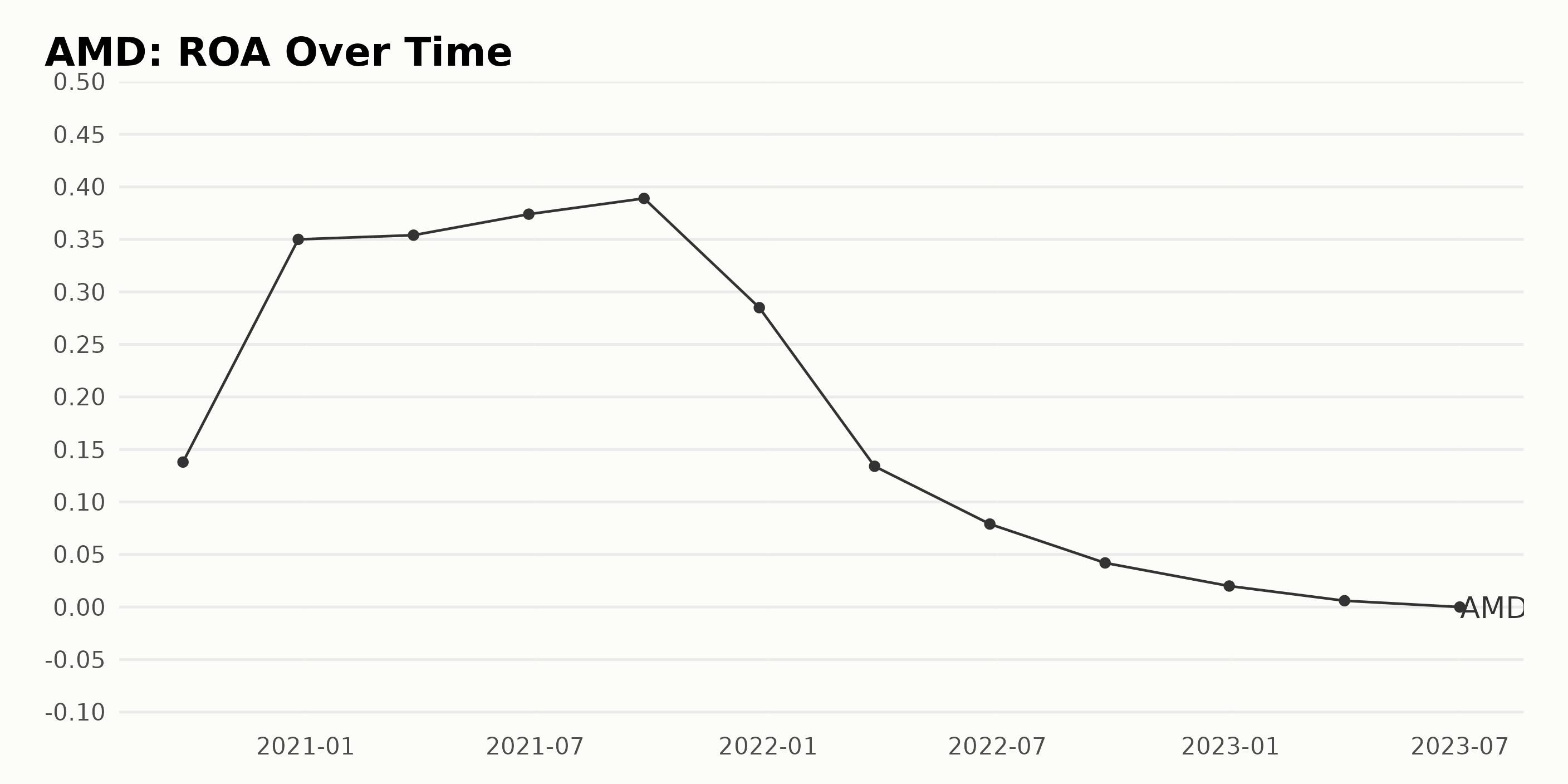

According to the data presented, AMD has shown a mixed trend in its Return on Assets (ROA) from September 2020 to July 2023. Notable fluctuations are visible throughout the period, emphasizing the volatility of the company’s financial performance.

- On September 26, 2020, the ROA stood at 13.8%.

- A significant increase was observed by December 26, 2020, when the ROA rose to 35%.

- This upward momentum carried into the first half of 2021, culminating in a ROA of 38.9% on September 25, 2021. This represented the peak value during this period.

- This was followed by a general decline, with the ROA decreasing to 28.5% by December 25, 2021, and continuing to drop sharply in 2022, reaching a low of 2% on December 31, 2022.

- Further decreases were recorded in 2023, finding a null-value ROA of 0% by July 1, 2023.

The overall growth rate between September 26, 2020, and July 1, 2023, is negative, indicating a decrease in ROA from the initial 13.8% to 0%. Special focus should be placed on the more recent and significant downturn in AMD’s ROA during the latter half of the tracked period. Despite periods of strong performance, recent trends as of July 2023 suggest caution may be required for investors and stakeholders moving forward.

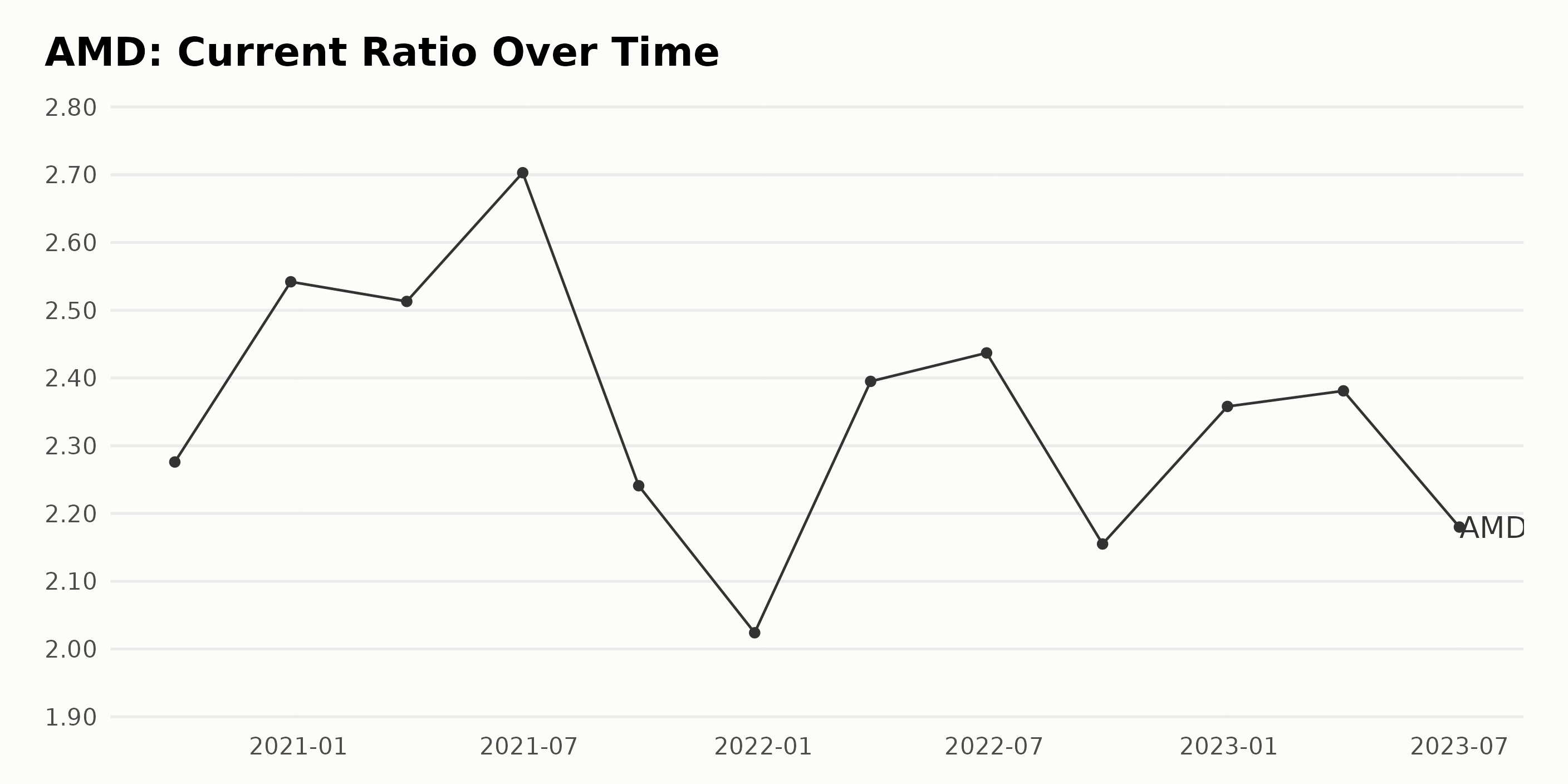

The trend and fluctuation in the Current Ratio of AMD show a somewhat volatile pattern over the observed period, with peaks also occurring at irregular intervals. Below are key observations on the trend and fluctuations:

- Starting from a current ratio of 2.28 in September 2020, AMD showed a slight increase to 2.54 by December 2020, an approximate increase of 11.6%.

- This upward trend continued at a slightly slower pace, reaching a peak of 2.70 in June 2021. This marked the highest point for the company’s current ratio within the data series.

- However, subsequent periods saw a downward trend, registering a significant drop to 2.02 in December 2021. This was the lowest point in the time series and represented a decrease of about 25.2% from the previous high in June 2021.

- After that, an inconsistent but general upward trend was noted, culminating in a current ratio of 2.38 in April 2023, before dropping again to 2.18 in July 2023.

- The current ratio of AMD in the final observed period (July 2023) registered a decrease of about 8.4% compared to the previous peak in April 2023.

In terms of growth rate, considering the first value (September 2020) and the last value of the series (July 2023), there is a decrease of nearly 4.19% over the analyzed period.

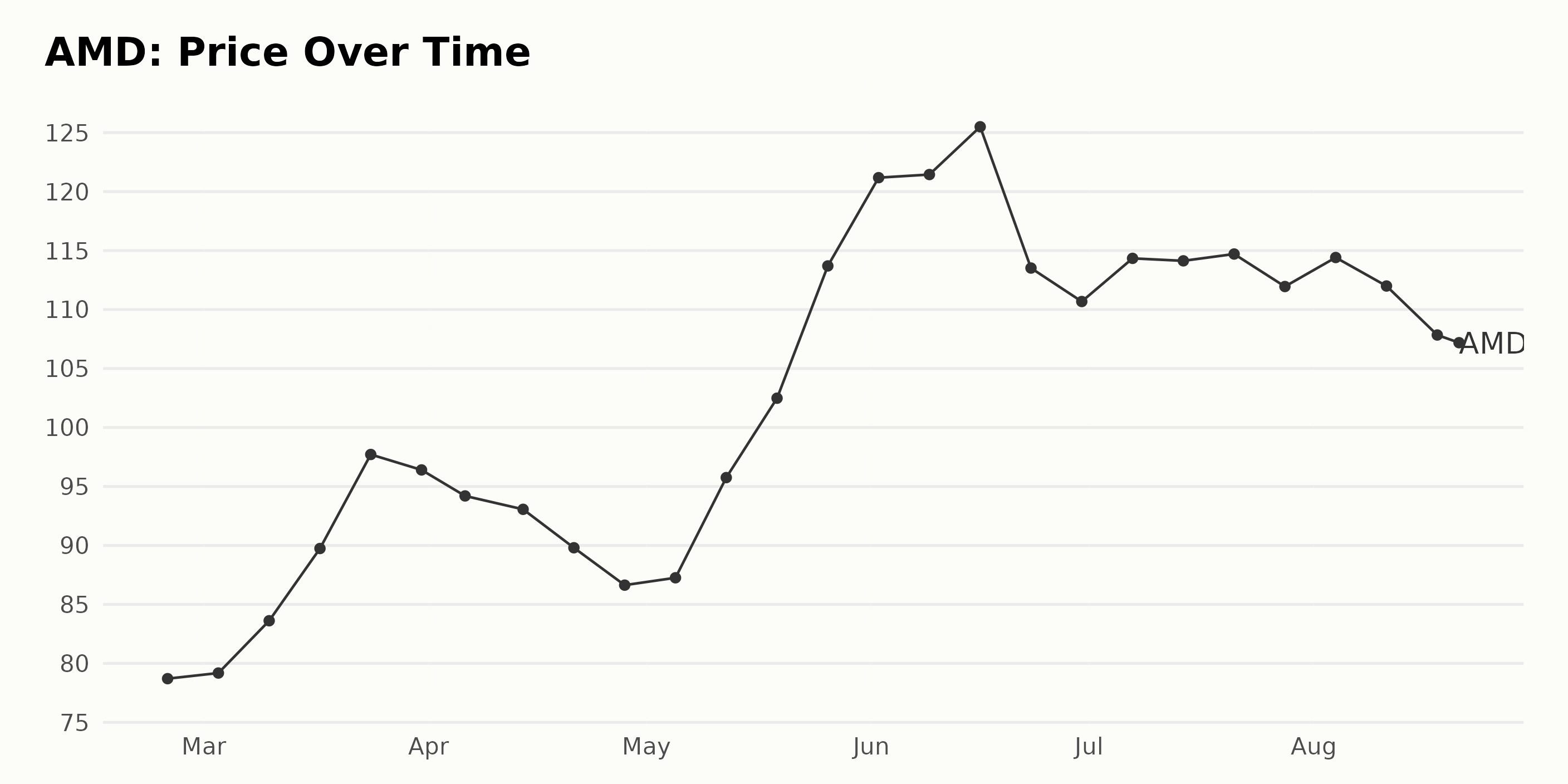

Analyzing Advanced Micro Devices’ Share Price Fluctuations: February-August 2023

The data for AMD presents the following trend:

- On February 24, 2023, the share price was $78.09.

- In March 2023, there is a clear uptrend with growth in share prices, beginning at $79.18 on March 3 and peaking at $97.71 on the 24 before a slight dip to $96.40 at the end of the month.

- The beginning of April 2023 continues the downward pattern, with the share price decreasing to $93.06 by the 14. Following this, the prices show a further decline, reducing to $86.63 by the end of the month.

- In May 2023, the trend reversed significantly. Starting at a low of $87.26 on May 5, the share price escalated to a high of $113.70 on May 26, marking a considerable increase in the growth rate.

- The upward momentum continued into early June 2023, with the share price reaching an apex of $125.50 on June 16. Afterward, the prices saw a downturn, dropping to $110.68 by June 30.

- A pattern of stagnation is visible in July 2023, where the prices fluctuated around $114.

- In August 2023, the share price faced continuous depreciation, falling from $114.41 on August 4 to $108.22 on August 21.

In summation, the share prices of AMD displayed a moderate oscillation from February to August 2023. However, there are periods of noticeable acceleration in growth during March and May 2023, whereas a significant deceleration can be seen towards the end of June and in August 2023. Here is a chart of AMD’s price over the past 180 days.

Examining AMD’s POWR Ratings

AMD has an overall D rating, translating to a Sell in our POWR Ratings system. It is ranked #83 out of the 92 stocks in the Semiconductor & Wireless Chip category.

Here are the broad strokes regarding the POWR grade of AMD:

- The POWR grade for AMD remained consistent at D throughout the reviewed period.

- The rank in the Semiconductor & Wireless Chip category varied slightly, with lower numbers indicating better performance.

In more detail:

- On February 25, 2023, AMD had a POWR grade of D, ranking 86 in its category.

- Over March and April 2023, the company’s ranking fluctuated between 83 and 86.

- In May 2023, despite maintaining the D POWR Grade, AMD climbed slightly in its ranking, consistently placing 82.

- However, by June 10, 2023, it slipped slightly to the 85 position but improved again to 83 by the end of June.

- As of the most recent data point, AMD’s POWR grade was D, with a rank of 83.

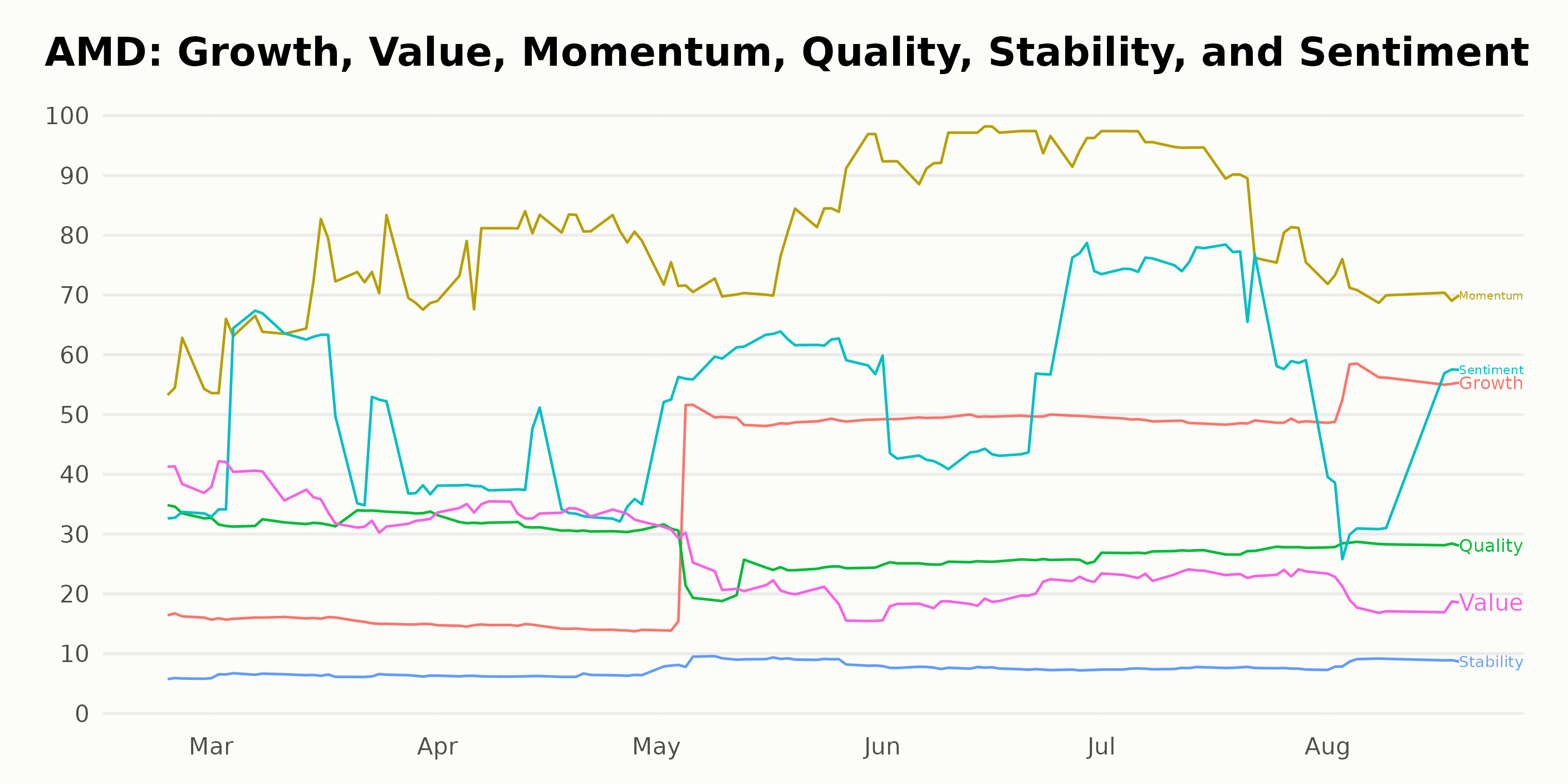

Looking at the POWR Ratings for AMD, the three most noteworthy dimensions are Growth, Momentum, and Sentiment, as these dimensions consistently have the highest ratings throughout the given period.

- The Growth dimension saw a significant increase over this period. Starting from a relatively low value of 16 in February 2023, it experienced a substantial jump to 44 by May 2023, eventually reaching its peak at 54 in August 2023.

- The Momentum dimension revealed a clear upward trend, demonstrating AMD’s increasing market performance. Starting at 56 in February 2023, Momentum escalated steadily each month, hitting 95 in June 2023. Although there was a slight dip to 71 by August 2023, this dimension maintained its strong performance overall.

- The Sentiment dimension experienced some fluctuation over the period. However, from March to July 2023, there was a consistent rise, peaking at 71 in July 2023, indicating an increasingly positive market sentiment towards AMD. Despite dropping slightly to 40 in August 2023, Sentiment still displayed one of the higher ratings among the six dimensions.

It’s worth noting that while I am only reporting on the three highest-rated dimensions, other dimensions such as Quality, Stability, and Value also contribute to AMD’s overall rating and may have their own respective trends and characteristics.

Stocks to Consider Instead of Advanced Micro Devices Inc. (AMD)

Other stocks in the Semiconductor & Wireless Chip sector that may be worth considering are Renesas Electronics Corporation (RNECF), Photronics Inc. (PLAB), and Infineon Technologies AG (IFNNY) -- they have better POWR Ratings.

What To Do Next?

Get your hands on this special report with 3 low priced companies with tremendous upside potential even in today’s volatile markets:

3 Stocks to DOUBLE This Year >

AMD shares were unchanged in premarket trading Tuesday. Year-to-date, AMD has gained 67.08%, versus a 15.75% rise in the benchmark S&P 500 index during the same period.

About the Author: Subhasree Kar

Subhasree’s keen interest in financial instruments led her to pursue a career as an investment analyst. After earning a Master’s degree in Economics, she gained knowledge of equity research and portfolio management at Finlatics.

The post Is the Popular Advanced Micro Devices (AMD) a Buy or Sell This Week? appeared first on StockNews.com