Mobile e-commerce company ContextLogic Inc. (WISH) faces a challenging operating environment with macroeconomic pressures. In the last reported quarter (ended June 30), its revenues were $78 million, registering a decrease of 42% year-over-year.

Institutional holders also seem to be fleeing the stock. As of June 30, 86 institutions decreased their position in the stock, corresponding to about 1.87 million shares. In addition, insiders are selling the stock. In three months, insiders did not buy any shares while selling about 35.59 thousand shares.

Against this canvas, it is prudent to delve into WISH's critical financial indicators to comprehend the rationale for potentially avoiding investing in the stock at present.

Examining WISH's Financial Trends: Fluctuating Net Income and Steady Revenue Decline

The trend in WISH's trailing-12-month net income shows a significant fluctuation over the reported period. After a period of seeming recovery where losses were reduced, there appears to be another downturn, as observed in the last part of the data. Here are the key points:

- On December 31, 2020, WISH reported a net loss of $745 million.

- There was an increase in net loss to $872 million on September 30, 2021.

- By December 31, 2021, WISH reported a reduced net loss of $361 million, showing improved performance.

- This trend of reduction continued up to June 30, 2022, when it reported a net loss of $272 million.

- However, the figures started increasing again, with a net loss of $332 million on September 30, 2022.

- As of the most recent data, on June 30, 2023, WISH reported a net loss of $403 million.

From comparing the first and the most recent values, it can be seen that there is a decrease of $342 million in WISH's net income, indicating a negative growth rate. Note that the emphasis is on the fact that although there was a positive trend for some time, the more recent data shows an increase in losses, suggesting that issues persist for the company.

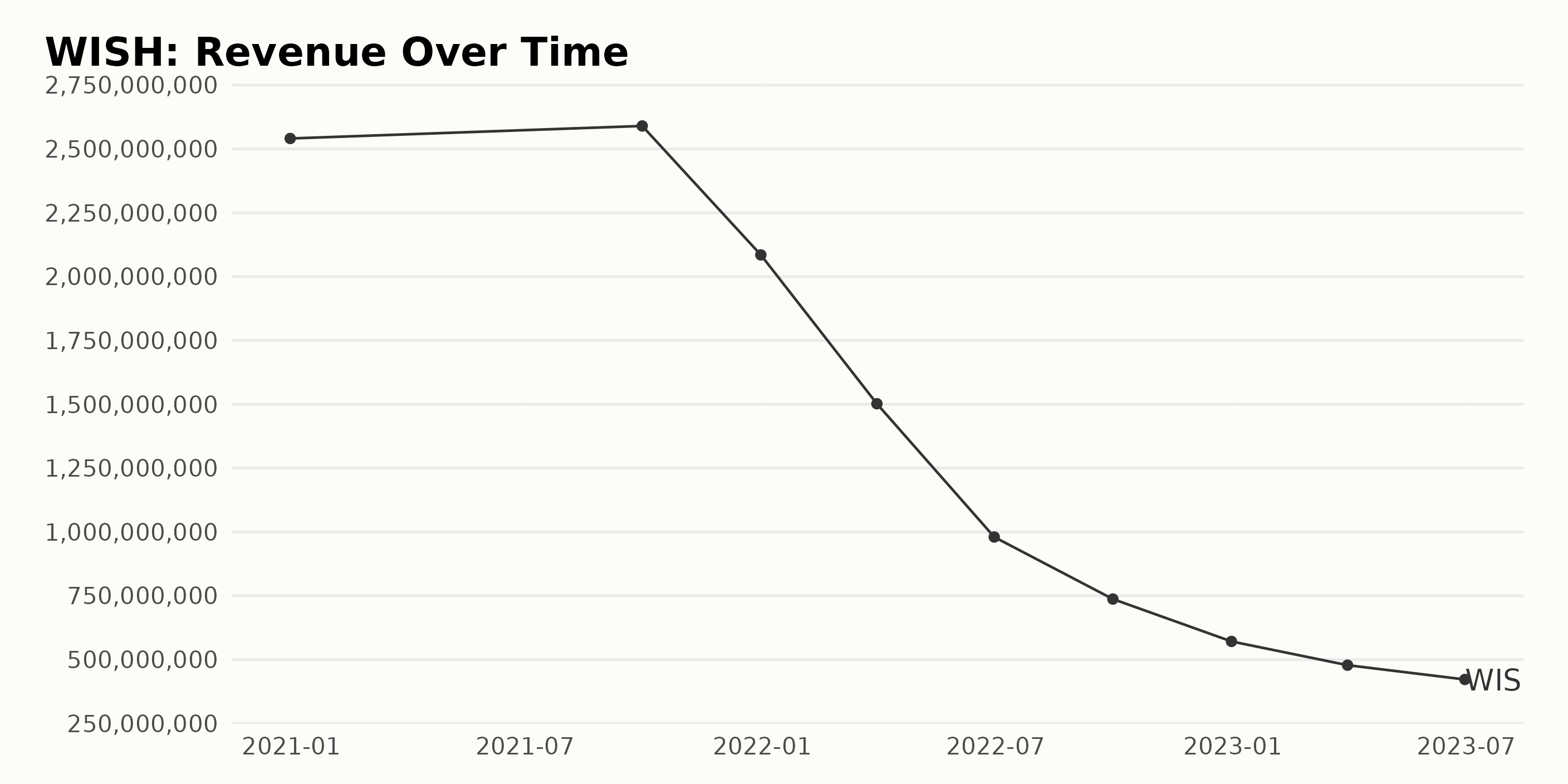

The trailing-12-month revenue of WISH has generally shown a declining trend over the past few years, with noticeable fluctuations. Here's a summary:

- On December 31, 2020, WISH reported a revenue of $2.54 billion.

- The revenue moderately increased to $2.59 billion by September 30, 2021.

- However, on December 31, 2021, there was a slight drop in revenue to $2.08 billion.

- A more significant decrease was observed by March 31, 2022, when the revenue stood at $1.50 billion.

- By June 30, 2022, the revenue sharply dropped to $980 million.

- This downward trajectory continued, and by September 30, 2022, the revenue fell to $737 million.

- On December 31, 2022, WISH reported a Revenue of $571 million, continuing the decreasing trend.

- The revenue kept falling in the first half of 2023, standing at $478 million and $422 million on March 31 and June 30, respectively.

When comparing the last data point from the first, we can see that there has been an overall decrease in WISH's revenue, from $2.54 billion on December 31, 2020, to $422 million by June 30, 2023. This translates to a stark decline over this period. More recent data indicates a concerning continuous downward trend in WISH's revenue.

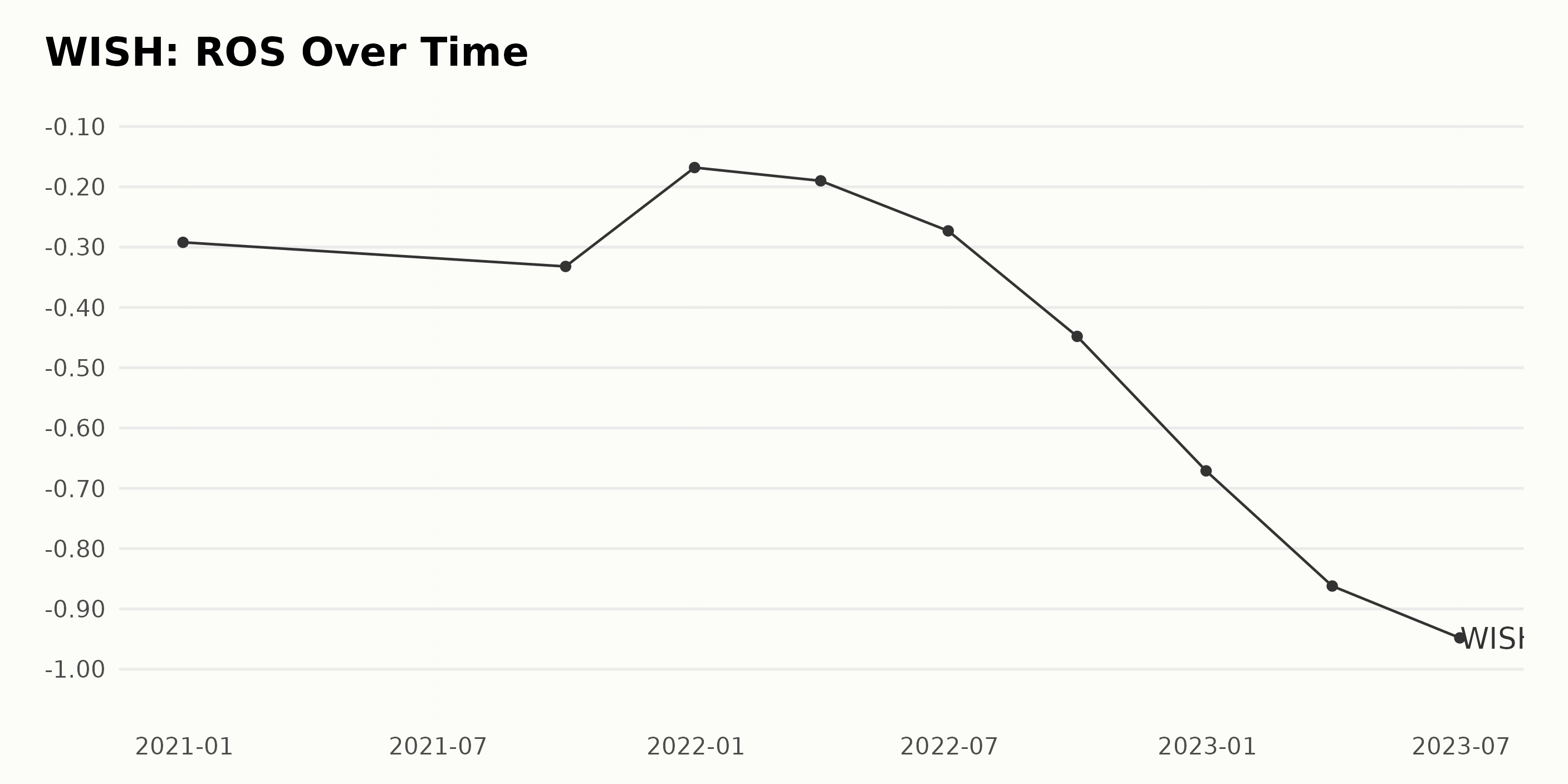

The reported Return On Sales (ROS) for WISH displays a consistently negative trend over the presented period. The introduction of these observations indicates an overall decline in WISH's profitability, culminating in its most recent and lowest recorded ROS value.

- On December 31, 2020, the ROS was observed at -0.29.

- As of September 30, 2021, a slight degradation was noticed, with ROS falling to -0.33.

- Toward the end of 2021, on December 31, there was an improvement, with ROS climbing to -0.17.

- The first quarter of 2022 marked another downturn, closing on March 31, with ROS recorded at -0.19.

- By mid-2022, on June 30, the ROS had dipped significantly to -0.27.

- September 30, 2022, marked an unfortunate record drop in ROS to -0.45.

- The year's end on December 31, 2022, witnessed a substantial decline, landing the ROS at -0.67.

- Into 2023, the downward progression continued, positioning the ROS at -0.86 as of March 31.

- Finally, the ROS hit its most negative value to date on June 30, 2023, at a staggering -0.95.

On review, these data suggest that WISH's ROS has steadily deteriorated over the monitored period. Given the progression from -0.29 in December 2020 to -0.95 in June 2023, we can discern a significant negative growth rate of approximately 228%.

However, please note that these results require careful interpretation due to the negative nature of ROS and the associated implications for business profitability.

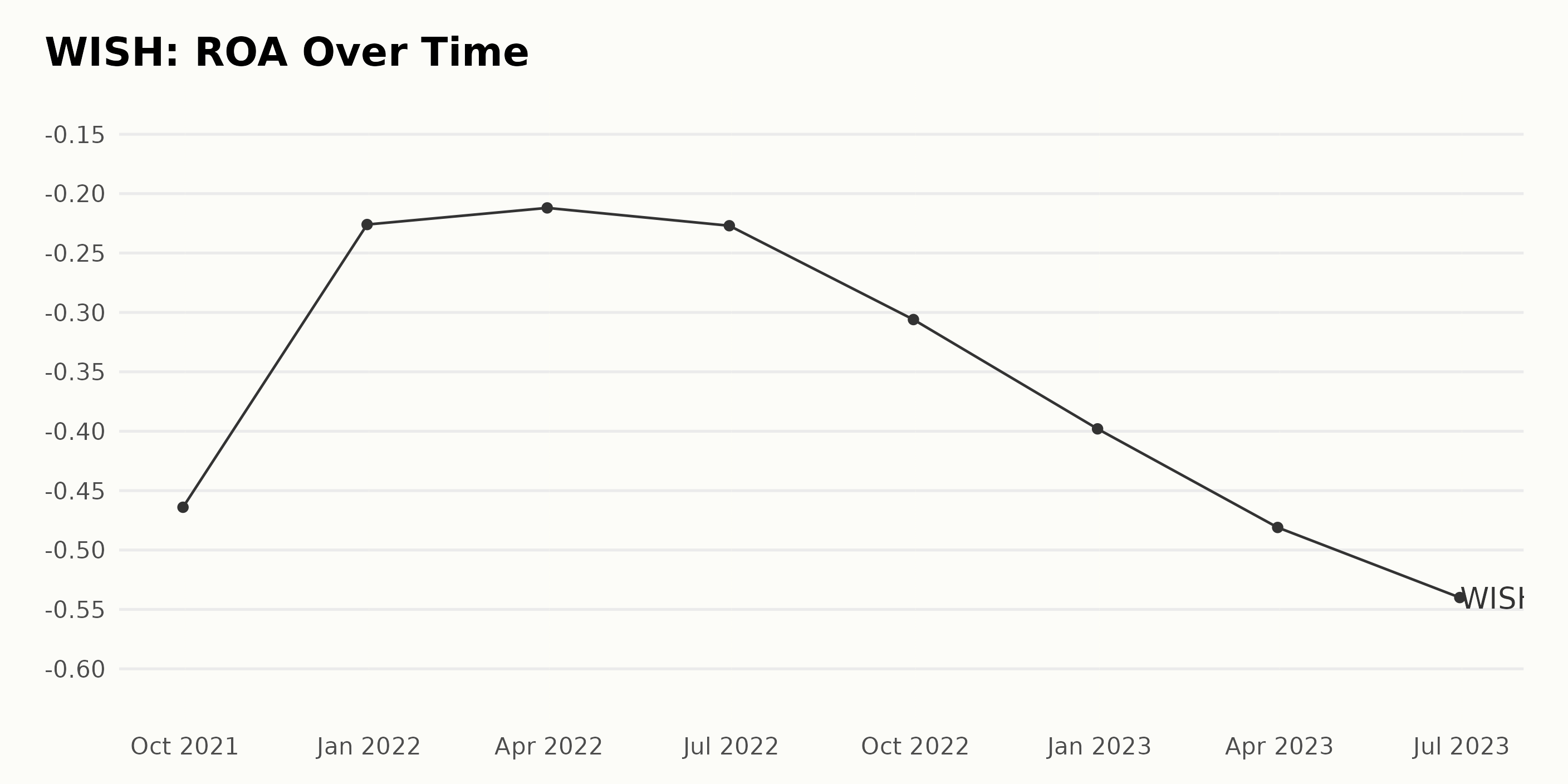

The trend and fluctuations in the Return On Assets (ROA) of WISH, as reported over the series of data, are summarized as follows:

- The ROA of WISH, which was -46.4% on September 30, 2021, began to improve slightly by year-end, reaching -22.6% on December 31, 2021.

- In the first quarter of 2022, the ROA slightly dropped to -21.2% by March 31. However, there was a minor fluctuation, with the ROA worsening to -22.7% as of June 30, 2022.

- From this point onwards, a negative trend emerged, with ROA continually deteriorating over subsequent quarters. On September 30, 2022, the ROA was -30.6%, which worsened to -39.8% on December 31, 2022.

- By the first half of 2023, this trend had further intensified, with ROA dropping to -48.1% as of March 31 and then further to -54.0% on June 30.

Comparing the last value with the first, there was an apparent decrease in the ROA of WISH over the series, from -46.4% at the beginning to -54.0% at the end. This indicates a downward growth rate of about 16.38% over the reported periods.

Analyzing WISH Stock's Volatility: A Downward Trend Amid Intermittent Growth Periods

Looking at the given data for the share price of WISH from March to September 2023, there appears to be an overall downward trend with some intermittent growth periods. Here are notable movements:

- On March 17, 2023, the share price was $12.22 and gradually decreased to $11.86 by March 31, 2023.

- In April 2023, the share price initially rose slightly to $12.17 on April 6, but there was a significant decrease throughout the month, reaching a low of $7.58 by April 28.

- Over May 2023, there was fluctuation, with the lowest point being $6.96 on May 5 and the highest reaching $8.09 on May 19, closing the month at $7.75.

- In June 2023, the price sees a similar pattern as in May, with the low point being $6.91 on June 30; the peak was $7.85 on June 16.

- In July 2023, the price increased significantly again, starting at $6.67 at the beginning of the month and growing to $8.86 by July 21. The month ended at $8.45.

- In August 2023, the trend steeply decelerated, starting at $8.18 at the beginning and declining to $5.02 at the end of the month.

- Start of September 2023 shows a slight increase at $5.33 as of September 6.

Overall, the share price of WISH has shown a general downward trend over this period, with short-term periods of growth in April, May, June, and July. However, these did not sustain, and by August, a solid decelerating trend became more prominent. This indicates volatility and uncertainty in WISH's performance over this period.

Here is a chart of WISH's price over the past 180 days.

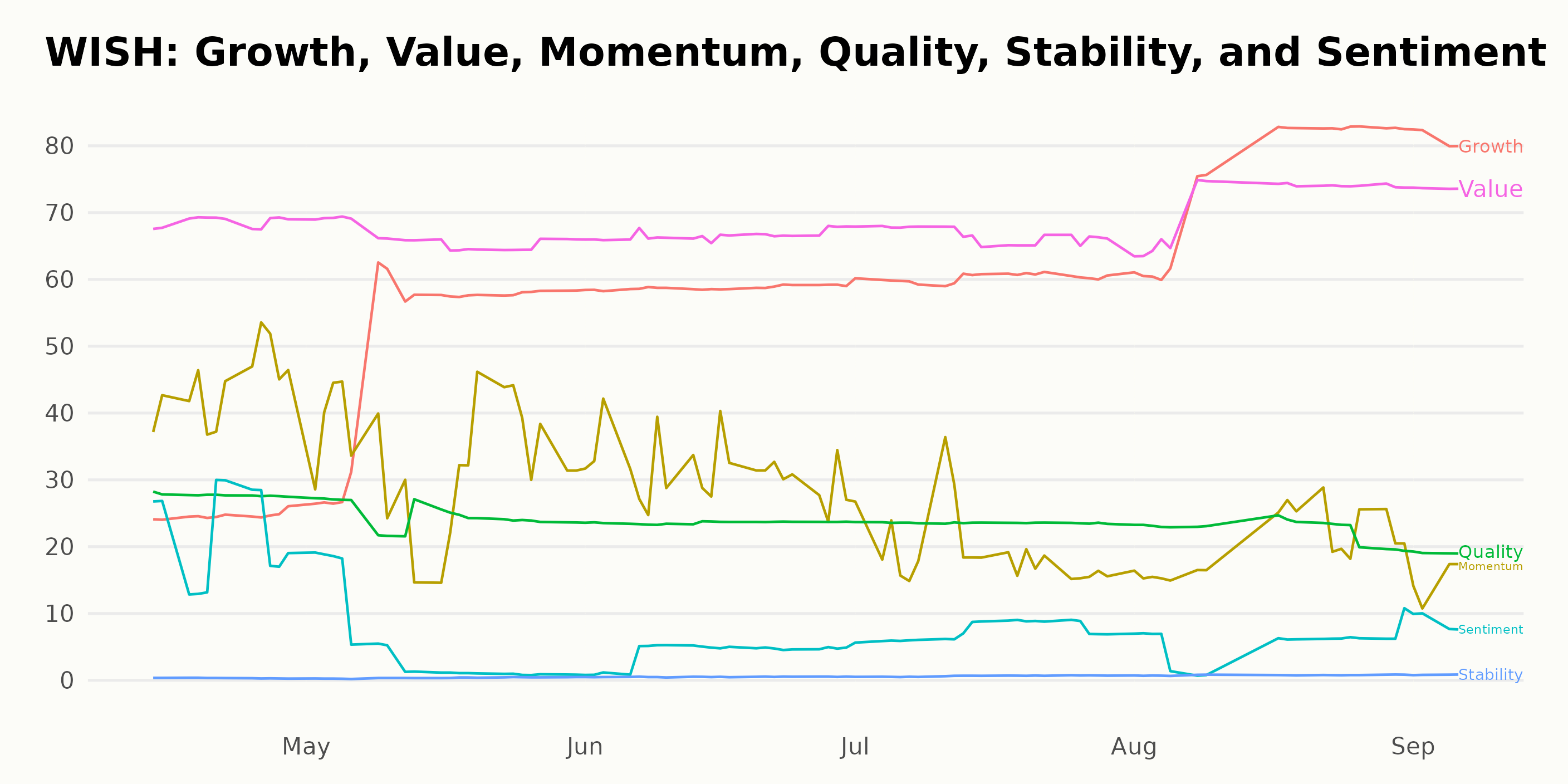

Analyzing POWR Ratings: Value, Growth, and Momentum Trends for WISH Stock (April - September 2023)

The POWR Ratings grade for the Internet category stock, WISH, has consistently held the rating D (Sell) during the given period, representing a comparatively weak performance. In terms of rank within its category, WISH showed a fluctuating pattern but generally maintained a position in the lower spectrum. Here's a snapshot of key data points on a monthly basis:

- In April 2023, WISH held the POWR Grade of D (Sell) and ranked #50 out of 60 in the Internet category by the end of the month.

- By the end of May 2023, it slipped further to rank #54 with still a D (Sell) POWR Grade.

- In June 2023, there was little change as the POWR Grade remained D (Sell), and it climbed to a rank of #52.

- Through July 2023, the POWR Grade of D (Sell) continued with a further slip in rank to #54.

- In August 2023, WISH maintained its D (Sell) POWR Grade but improved its rank slightly to #50.

- As of early September 2023, the POWR grade is still D (Sell), and the rank in category is #51.

This suggests that compared to others in its category, WISH has not exhibited signs of significantly improved performance in the given period.

The three most noteworthy dimensions of the POWR Ratings for WISH are Value, Growth, and Momentum. Here's a deeper look into these ratings from April to September 2023.

- Value:

The Value dimension has consistently received the highest ratings among all other measurements. In April 2023, it sat at 69 and increased progressively each month, reaching 74 by September 2023. This denotes a positive trend indicating the perceived value of WISH.

- Growth:

Another noteworthy dimension is Growth. Starting in April 2023 with a rating of 25, it witnessed considerable leaps over the subsequent months; reaching 81 by September 2023. This strong upward trend suggests an accelerating growth rate for WISH.

- Momentum:

The Momentum dimension showed a varied trend. It started at 44 in April 2023 but dropped each inter-succeeding month until reaching a low of 15 in September 2023. This depicts a clear downward trend in momentum over this period.

How does ContextLogic Inc. (WISH) Stack Up Against its Peers?

Other stocks in the Internet sector that may be worth considering are Yelp Inc. (YELP), Travelzoo (TZOO), and Despegar.com, Corp. (DESP) - they have better POWR Ratings. Click here to explore more Internet stocks.

What To Do Next?

Get your hands on this special report with 3 low priced companies with tremendous upside potential even in today’s volatile markets:

3 Stocks to DOUBLE This Year >

WISH shares were trading at $5.18 per share on Thursday afternoon, down $0.15 (-2.81%). Year-to-date, WISH has declined -64.60%, versus a 17.18% rise in the benchmark S&P 500 index during the same period.

About the Author: Anushka Dutta

Anushka is an analyst whose interest in understanding the impact of broader economic changes on financial markets motivated her to pursue a career in investment research.

The post Is ContextLogic (WISH) an Internet Stock Buy, Hold, or Sell This Week? appeared first on StockNews.com