Most times investing seems fairly complicated. So many different economic reports...so many data points...and so many experts with conflicting opinions.

And yet sometimes...it is amazingly simple.

In short, the market is bearish when the odds of recession are high. Conversely it is bullish when the odds of recession are low.

With that in mind let’s dig into this week’s Reitmeister Total Return commentary.

Market Commentary

In my Friday commentary I noted that indeed recent economic activity was coming in better than expected. Especially true for ISM Services given the strength of retail sales.

Sounds like great news, right?

Wrong.

Unfortunately, it had more investors worried about inflation staying too hot...which would lead the Fed to more rate hikes...which increases the possibility of a future recession forming. And thus, not surprisingly stocks headed lower once again.

This prompted me to clarify that the odds of recession are still very low. As proof I shared the Goldman Sachs outlook which only points to 25% odds of recession forming within the next year.

However, later on that same day found that was outdated information. They have actually revised that down to only 15% chance of recession given how most everything points to a soft landing.

Further, they believe the last rate hike has already taken place with the lowering of rates to start in the Spring of 2024. That is a touch later than most predictions...but close enough to mainstream assumptions that all point to a bull market ahead.

Do I agree with Goldman about no more rate hikes ahead?

I would say 50/50 versus getting one more quarter point hike in November. But even more important is the timing of them switching to lower rates.

I would be shocked if they made us wait til Q2 of 2024. I see that coming early to mid Q1 given that there are 6-12 months of lagged effects on Fed policy. (The longer they keep high rates in place...the more they risk recession).

Playing into all these prognostications of what the Fed will do, then we must also taking into account this week’s slate of inflation reports starting with CPI on Tuesday 9/13. Next up comes the lesser followed, yet still vital, PPI report on 9/14.

Once again, I recommend folks look past the year over year reading and dial into the month over month stats instead. The closer that reading gets to 2% annual run rate...the more likely the Fed is done with rate hikes.

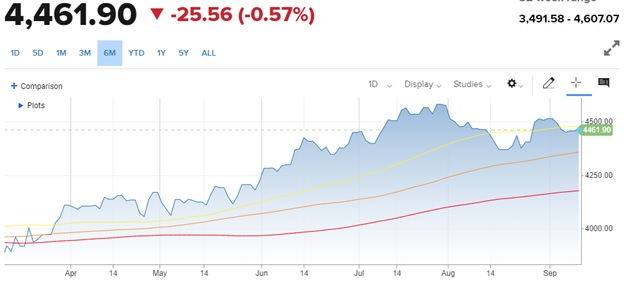

Price Action & Trading Plan

Moving Averages: 50 Day (yellow), 100 Day (orange), 200 Day (red)

The simplified version of the current price action is to say we are in a trading range awaiting the next catalyst to jump higher. And indeed, that catalyst may be the LACK of bearish catalysts allowing stocks to move higher.

Plain and simple, when you are above the 200 day moving average for the S&P 500 (SPY), it pays to be bullish.

As shared in the intro, sometimes investing is simple. If the odds of recession in the future are incredibly low...then that fundamentally says it is wise to be bullish.

However, much of the easy money bouncing from bear market bottom has already been banked. At this stage we are likely back to a more pedestrian 10-15% return for the S&P 500 in the coming year.

Not so bad versus the 8% average annual return. But not going to excite the average investor either.

Gladly there is a path to vastly superior results by overweighting the groups with the most upside potential such as:

Small & Mid Caps: Too much of the gains this past year, not to mention the past 3-5 years, has accrued to large caps. And yet over the long haul these smaller stocks typically outperform by a nice spread. Under the heading “reversion to the mean” small and mid caps are due for much more impressive results in the year ahead.

Tech Played Out: So, look to other groups with earnings power and undervalued shares. Industrials, basic materials and financials jump to the head of that list.

Investments that benefit from the lowering of interest rates: Auto, housing, banks, income stocks and bonds.

If you want more specific picks to get you on the right side of the market action then read on to the next section...

What To Do Next?

Discover my current portfolio of 7 stocks packed to the brim with the outperforming benefits found in our POWR Ratings model.

Plus I have added 4 ETFs that are all in sectors well positioned to outpace the market in the weeks and months ahead.

This is all based on my 43 years of investing experience seeing bull markets...bear markets...and everything between.

If you are curious to learn more, and want to see these 11 hand selected trades, then please click the link below to get started now.

Steve Reitmeister’s Trading Plan & Top Picks >

Wishing you a world of investment success!

Steve Reitmeister…but everyone calls me Reity (pronounced “Righty”)

CEO, StockNews.com and Editor, Reitmeister Total Return

SPY shares fell $0.17 (-0.04%) in after-hours trading Tuesday. Year-to-date, SPY has gained 17.50%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Steve Reitmeister

Steve is better known to the StockNews audience as “Reity”. Not only is he the CEO of the firm, but he also shares his 40 years of investment experience in the Reitmeister Total Return portfolio. Learn more about Reity’s background, along with links to his most recent articles and stock picks.

The post KISS for the Stock Market appeared first on StockNews.com