Moderna, Inc. (MRNA) is gaining investors’ attention after unveiling promising data from its latest flu vaccine trial. The biotech firm’s reformulated version of its messenger-RNA-based flu shot met its primary goals in a final-stage trial, paving the way to seek regulatory approval for the influenza vaccine.

Amid declining sales of its COVID-19 vaccines due to pandemic fatigue, MRNA is strategizing to expand its product portfolio and identify new revenue streams.

The second-quarter revenue of the company stood at $344 million, a significant plunge from the $4.75 billion recorded during the same period a year ago when Covid-19 cases were higher across the U.S. This huge dip was primarily attributed to a 94% sales drop of its Covid-19 shot. Consequently, MRNA reported a net loss tallying up to $1.38 billion or $3.62 per share for the quarter.

As the company gears up to reverse this slump with its updated Covid vaccine targeted at the omicron subvariant XBB.1.5., the success hinges on the turnout of Americans for vaccination and whether this could potentially boost revenues.

Given these factors, it may be prudent to await significant improvement before investing in the stock. Let’s delve into an analysis of some of its critical financial metric trends.

Analysis of MRNA’s Financial Performance: Fluctuations and Trends from 2020 to 2023

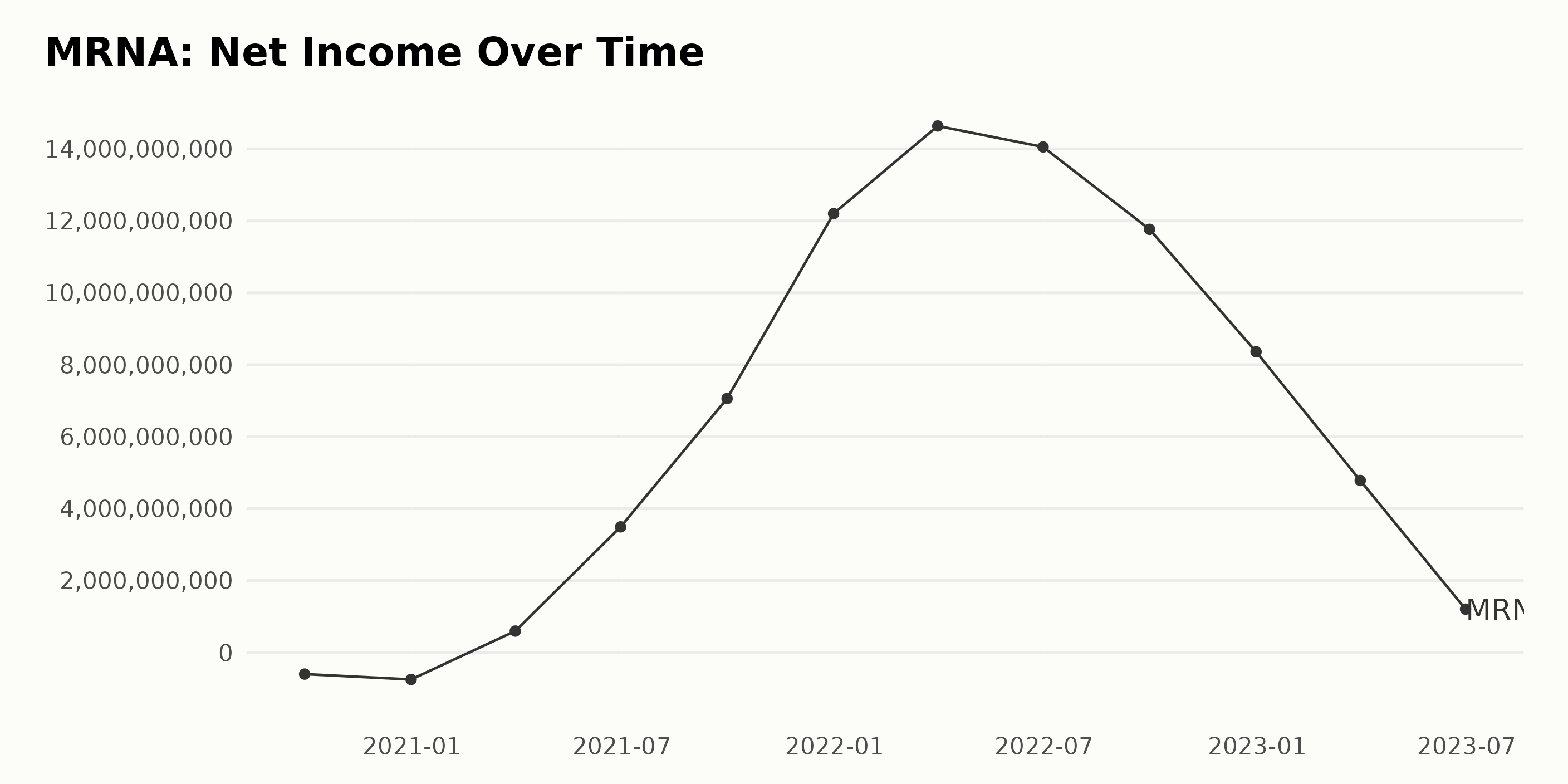

The trailing-12-month net income of MRNA has shown remarkable fluctuations over the reported period from September 2020 to June 2023.

- At the beginning of reporting in September 2020, MRNA started with a net income of -$598 million.

- The net income further decreased to -$747 million in December 2020.

- However, starting from March 2021, an uptrend was observed in MRNA’s net income as it grew to $598 million.

- This upward trend continued until June 2022, with significant jumps witnessed in June 2021 ($3.5 billion), September 2021 ($7.06 billion), and December 2021 ($12.2 billion), respectively.

- The highest reported net income was in March 2022 at $14.64 billion.

- After reaching this peak, MRNA’s net income dipped to $14.05 billion in June 2022, which further decreased to $11.7 billion in September 2022 and $8.4 billion in December 2022.

- From this point, MRNA’s net income started declining more rapidly, with values of $4.78 billion in March 2023 and $1.21 billion in June 2023, which is the last available data.

In terms of growth rate from September 2020 to June 2023, there is a substantial increase in MRNA’s net income despite a few downturns during the period. The net income rose from -$598M in September 2020 to $1.21B in June 2023. However, focusing more on recent data, MRNA has been experiencing a significant downward trend in net income since its peak in March 2022.

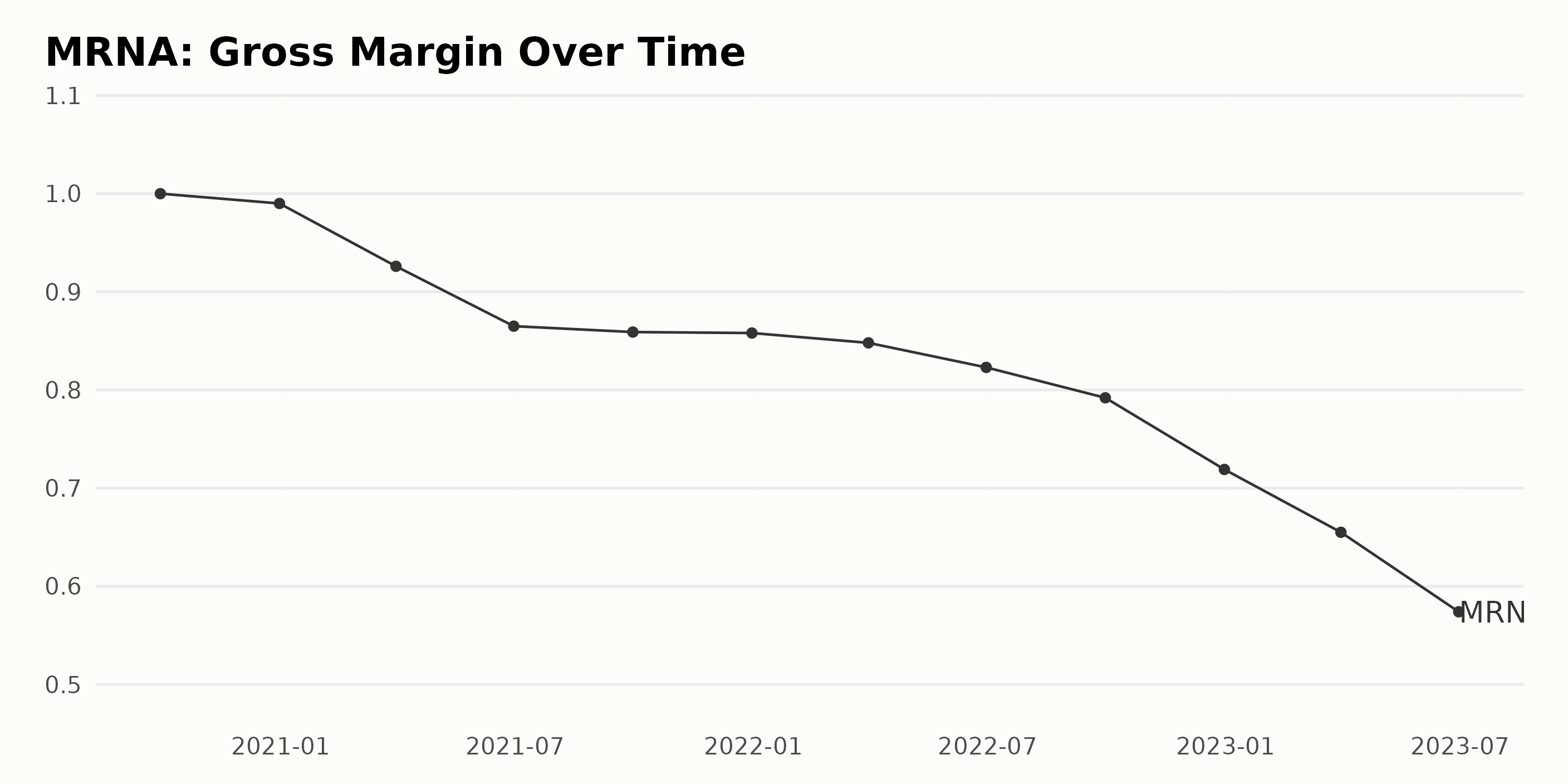

Starting from September 30, 2020, the gross margin has exhibited a consistent downward trend with fluctuations over the years. The gross margin began at 100% in September 2020 before concluding at 57.4% by June 2023, signifying an overall decline. Detailed observations of the gross margin are as follows:

- In 2020, the gross margin dipped slightly from 100% in September to 99% in December.

- Throughout 2021, the gross margin saw a relatively consistent decline, starting at 92.6% in March, 86.5% in June, 85.9% in September, and finally, closing the year at 85.8% in December.

- The decrease continued in 2022. The gross margin stood at 84.8% in March, 82.3% in June, 79.2% in September, and ended the year at a notably lower 71.9% in December.

- The decline gained pace in 2023, dropping sharply to 65.5% in March and closing at 57.4% in June 2023.

The gross margin of MRNA has seen a sizeable reduction from September 2020 to June 2023, decreasing by approximately 42.6%. This drop indicates financial shrinkage or escalating operational costs of the entity. The noticeable acceleration in the rates of decline, particularly in the period of 2023, is an area that needs further scrutiny.

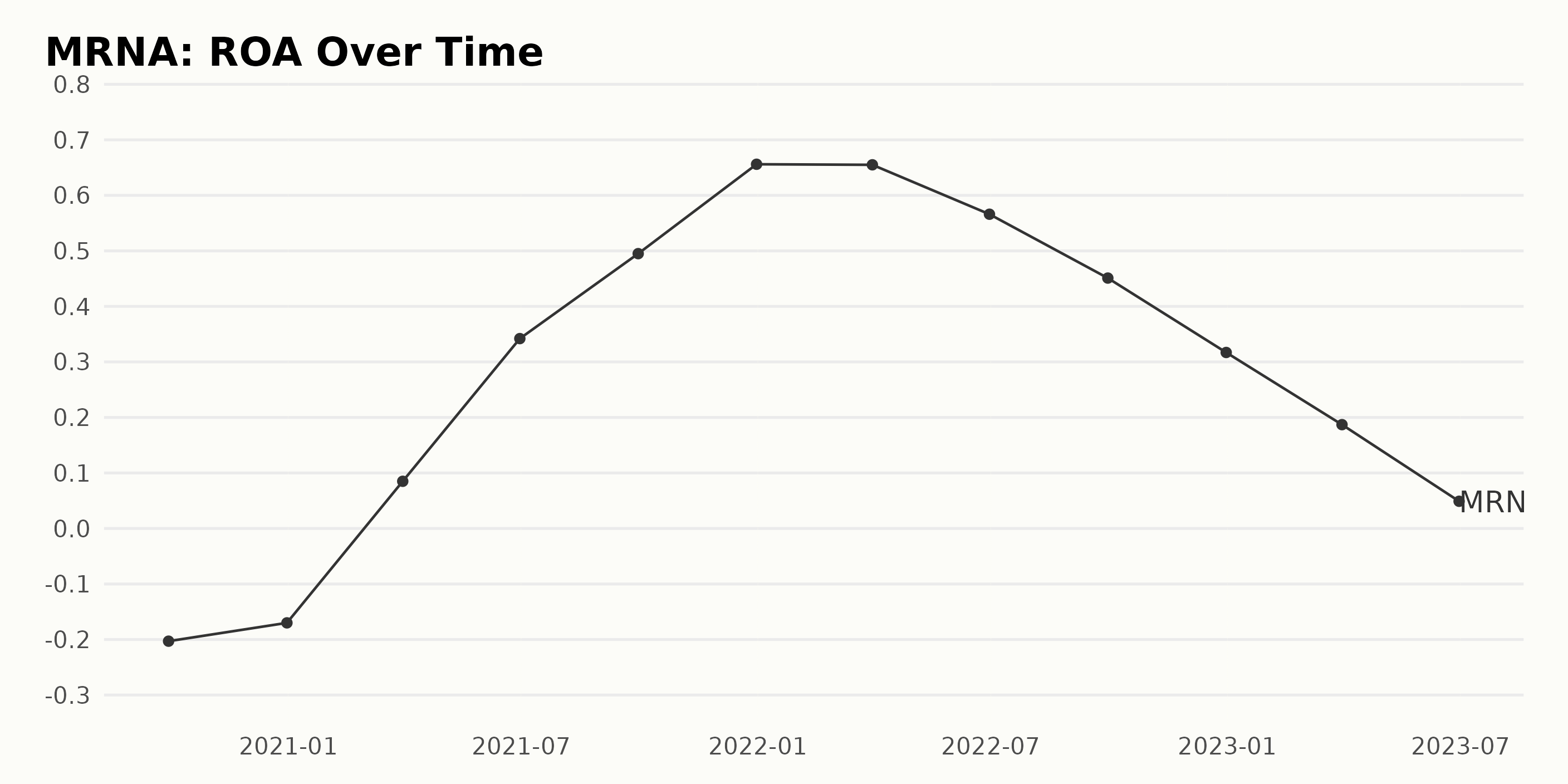

The reported ROA (return on assets) of MRNA has shown significant fluctuations over the series of data from September 2020 through June 2023.

- The ROA showed an increasing trend from a negative value of -20.3% in September 2020 to a peak of 65.6% in December 2021, indicating an improvement in asset performance.

- Following this peak, the ROA tended to decline till June 2023. By December 2022, the ROA was reduced to 31.7% and further down to 4.9% by June 2023.

It thus demonstrates an oscillating trend, with an overall growth rate of 54.2%, measuring from the first value of -20.3% to the last value of 4.9%. More recent data, particularly operations from 2022 onwards, emphasize a downward trend, which may require due attention.

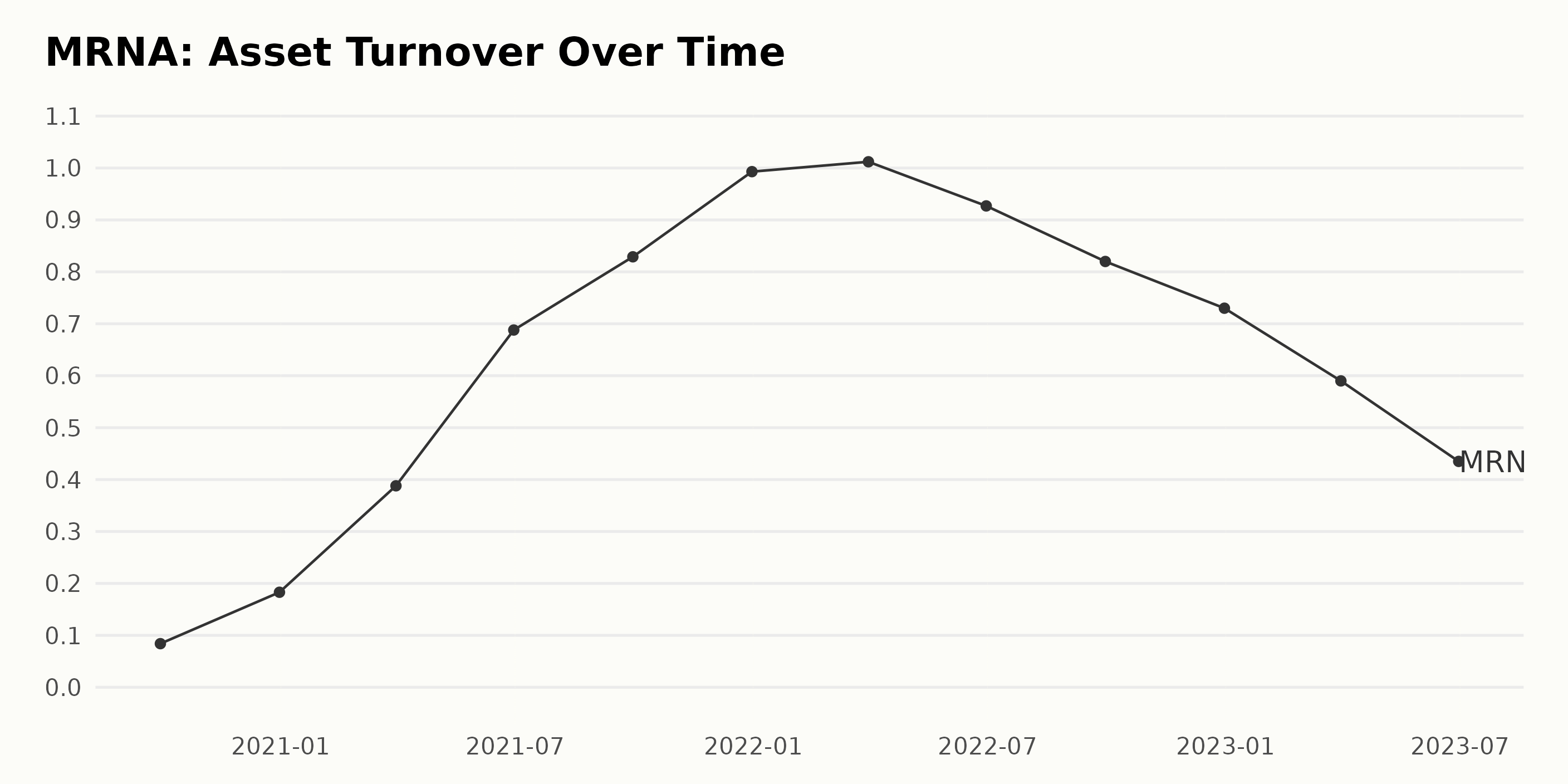

The Asset Turnover for MRNA has experienced a significant fluctuation across the 2020 - 2023 time period. Here is a summarized breakdown:

- From September 30, 2020, to March 31, 2022, there have been notable increases in the Asset Turnover figure. The growth began at 0.084 in September 2020 and peaked at 1.012 by the end of the first quarter 2022. This indicates an improving operational efficiency within MRNA during this period.

- From June 30, 2022, to December 31, 2022, there was a consistent decrease in asset turnover, with values sliding from 0.927 down to 0.73. This indicates a slowdown in the sales generation for every unit of asset.

- The declining trend continued into the first half of 2023, as the Asset Turnover shrank further to 0.435 by June 30, 2023.

It’s essential to note that the most recent data points highlight an ongoing downward trajectory leading into mid-2023. While the overall growth rate between the start and end points is significant, the second half of the evaluated period shows moderate declines. The underlying reasons for these fluctuations would need further investigation to provide a comprehensive analysis of MRNA’s operational efficiency.

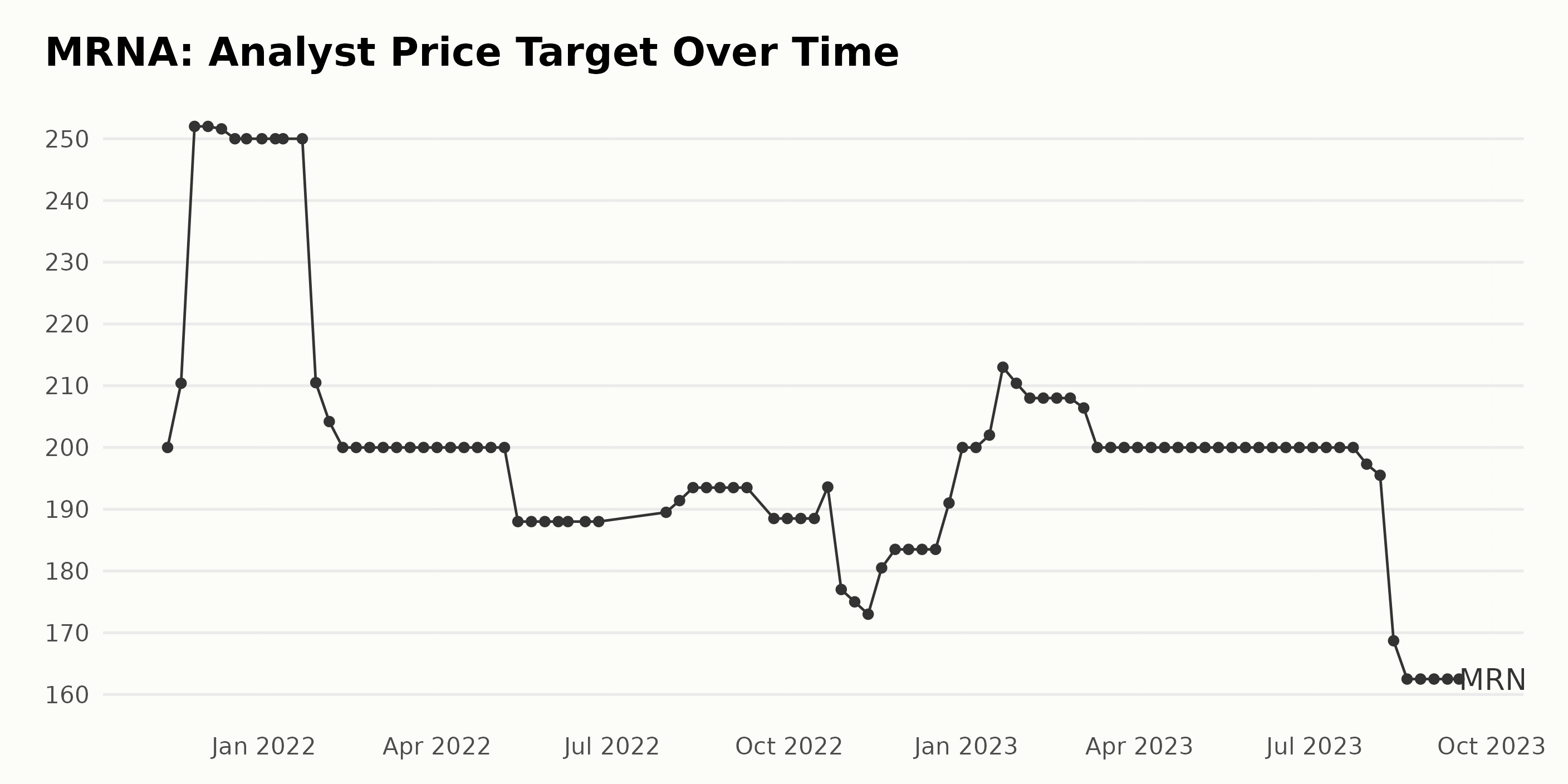

Through the analysis of the data series from November 2021 to September 2023, the fluctuations and trends in the Analyst Price Target of MRNA can be summarized as follows:

- Starting on November 12, 2021, with a target price of $200, the target steadily increased to reach a peak of $252 late in November 2021. The peak was maintained until early December 2021.

- After the peak, there was a gradual decrease until mid-January 2022, when it stabilized at $250 for about a month before dropping to roughly $200, where it stood until about mid-May 2022.

- By early June 2022, the Price Target had again declined subtly to $188, which sustained until late July 2022.

- There were mild fluctuations till October 2022 before dropping significantly to $177 late in October and continued to lower targets in November, reaching a low of $173.

- There was a recovery later in November to $183.5 in December, which was maintained until a week before year-end when it progressed to $200.

- In January 2023, the target price got a boost, reaching $213, before undergoing another slight decline, stabilizing at about $200 by Mid-March 2023.

- The steady $200 target lasted till late July 2023 when it started experiencing a downtrend, hitting a new low of $162.5 in mid-August, which was maintained till the last entry in September 2023.

Overall, the Analyst Price Target for MRNA experienced significant volatility over the period. A significant increase during the early months was followed by periods of stability and subsequent decreases. In terms of growth rate, it decreased from the initial $200 to $162.5 in September 2023, indicating a negative growth rate of about -19%. It must be noted that recent data from mid-2023 onward indicates a decline in the Analyst Price Target for MRNA.

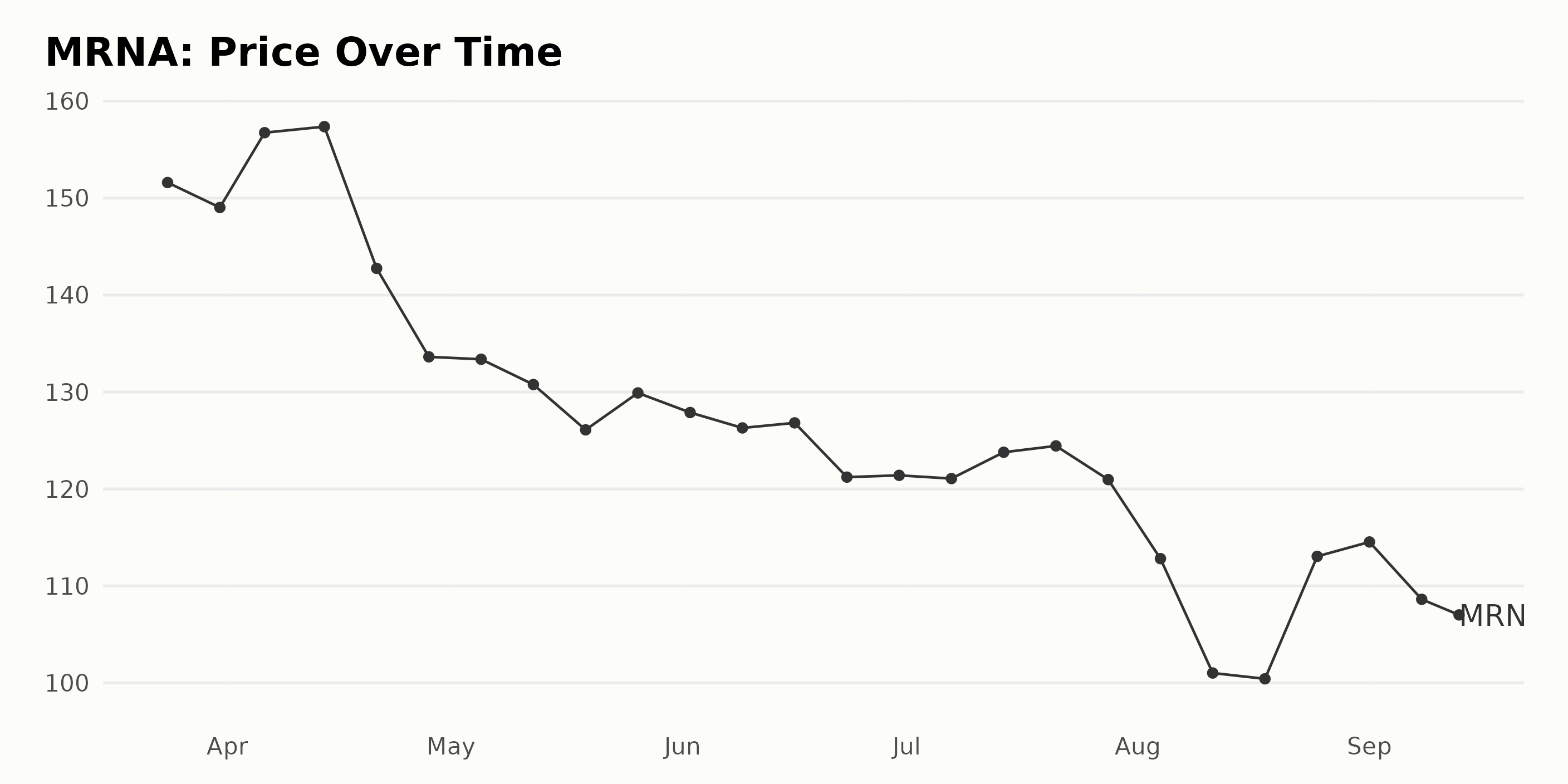

Analyzing MRNA’s Share Price Downtrend From March to September 2023

The general trend in the MRNA share price from March to September 2023 shows a progressive decline with intermittent periods of minor rebounds. Below are the monthly details:

- In March 2023, the MRNA share opened at $151.60 on March 24 and closed slightly lower at $149.03 on March 31.

- In April 2023, the MRNA share gained momentum, and the price rose to its peak of $157.37 on April 14 but ended the month at a significantly lower point of $133.63 on April 28, indicating a considerable drop.

- In May 2023, the MRNA share price continued to fall throughout the month, opening at $133.38 on May 5 and closing at $129.91 on May 26.

- In June 2023, MRNA shares remained stable and experienced a minor gain by mid-month, closing at $126.30 on June 9 and at $126.82 on June 16. However, it dipped at the end of the month to close at $121.41 on June 30.

- July 2023 saw a modest recovery in the price to $124.44 on July 21, but the month ended at a lower value of $120.97 on July 28.

- In August 2023, the MRNA share price experienced the steepest decline, falling from $112.82 on August 4 to bottom out at $100.42 on August 18 before rebounding to $113.05 on August 25.

- In September 2023, MRNA’s share price fluctuated, opening at $114.54 on September 1, dropping to $108.62 on September 8, and slightly falling again to $107.01 on September 13.

The data suggests a clear decelerating trend (decreasing growth rate) of the MRNA shares. Even though there are a few short periods of price increases, the overall trajectory of the share price is downward from March to September 2023. Here is a chart of MRNA’s price over the past 180 days.

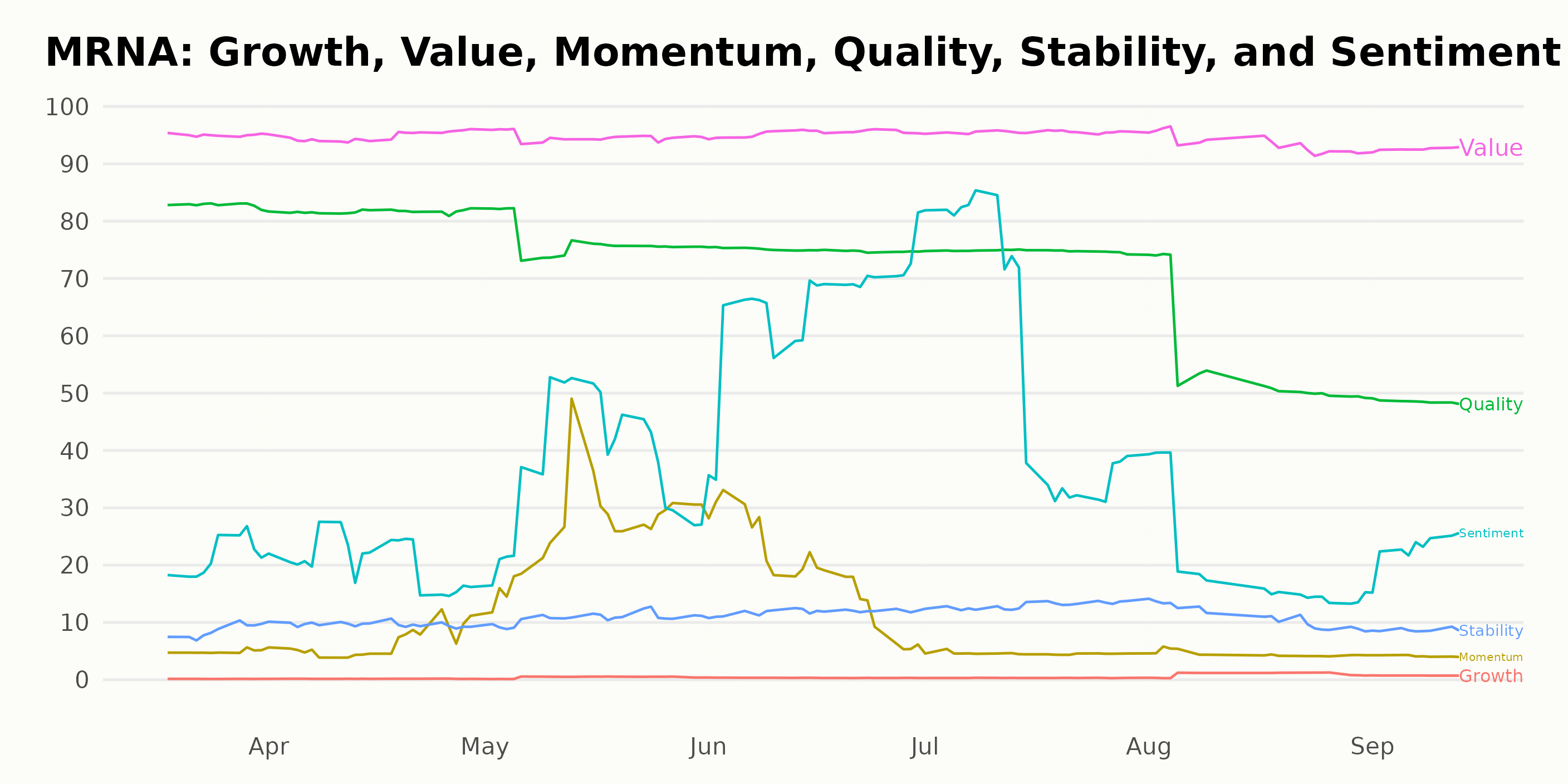

Tracking Key Trends in MRNA’s Value, Quality, and Sentiment Ratings

MRNA has an overall C rating, translating to a Neutral in our POWR Ratings system. It is ranked #144 out of the 370 stocks in the Biotech category.

When considering the POWR Ratings, three dimensions stand out for MRNA with significant values and evident trends.

Value: Value consistently ranks as the highest dimension for MRNA across the monitored period. Starting at 95 in March 2023, hovering at this level until July 2023, it experiences a slight uptick to 96 before gradually declining to reach 93 in September 2023. Despite the decline, the value remains robust. Key highlights:

- In March 2023, Value stood at 95

- It peaked at 96 in July 2023

- By September 2023, it slightly decreased to 93

Quality: Although it did not reach the highs of the Value dimension, Quality also demonstrated substantial scores that made it noteworthy. We see a clear downward trend: Quality starts at 83 in March 2023 but steadily drops to 49 by September 2023. Main points:

- Quality began at a high of 83 in March 2023

- This score continuously declined, bottoming out at 49 in September 2023

Sentiment: The Sentiment addressed the third noteworthy trend, showing a rise followed by a fall. Starting from 21 in March 2023, the sentiment increased, peaking at 65 in June 2023 before falling back to 23 in September 2023. Crucial observations:

- Initial Sentiment rating was 21 in March 2023

- The score spiked highest at 65 in June 2023

- It dropped back later to 23 in September 2023

These trends imply several significant underlying institutional perceptions or major market changes affecting MRNA over this period.

Stocks to Consider Instead of Moderna, Inc. (MRNA)

Other stocks in the Biotech sector that may be worth considering are Jazz Pharmaceuticals plc (JAZZ), Otsuka Holdings Co Ltd (OTSKY), and Amgen Inc. (AMGN) -- they have better POWR Ratings.

What To Do Next?

Discover 10 widely held stocks that our proprietary model shows have tremendous downside potential. Please make sure none of these “death trap” stocks are lurking in your portfolio:

MRNA shares were trading at $112.67 per share on Thursday afternoon, up $4.08 (+3.76%). Year-to-date, MRNA has declined -37.27%, versus a 18.60% rise in the benchmark S&P 500 index during the same period.

About the Author: Subhasree Kar

Subhasree’s keen interest in financial instruments led her to pursue a career as an investment analyst. After earning a Master’s degree in Economics, she gained knowledge of equity research and portfolio management at Finlatics.

The post Moderna (MRNA) Stock Analysis: Is the Biotech Stock a Buy at This Time? appeared first on StockNews.com