Networking powerhouse Cisco Systems, Inc. (CSCO) is eyeing Artificial Intelligence opportunities. The company announced its decision to acquire Splunk Inc. (SPLK) in a $28 billion cash deal, with the aim of addressing cybersecurity needs.

CSCO, set to report its fiscal 2024 first-quarter results tomorrow, reported a three percentage point market share gain in the last reported quarter. For the to-be-reported quarter, the company expects revenue between $14.5 billion and $14.7 billion, while non-GAAP EPS is projected to be between $1.02 and $1.04.

Given this backdrop, let’s look at the trends of CSCO’s key financial metrics to understand why it could be wise to invest in the stock now.

Analyzing Cisco Systems, Inc.'s Financial Performance from 2021 to 2023

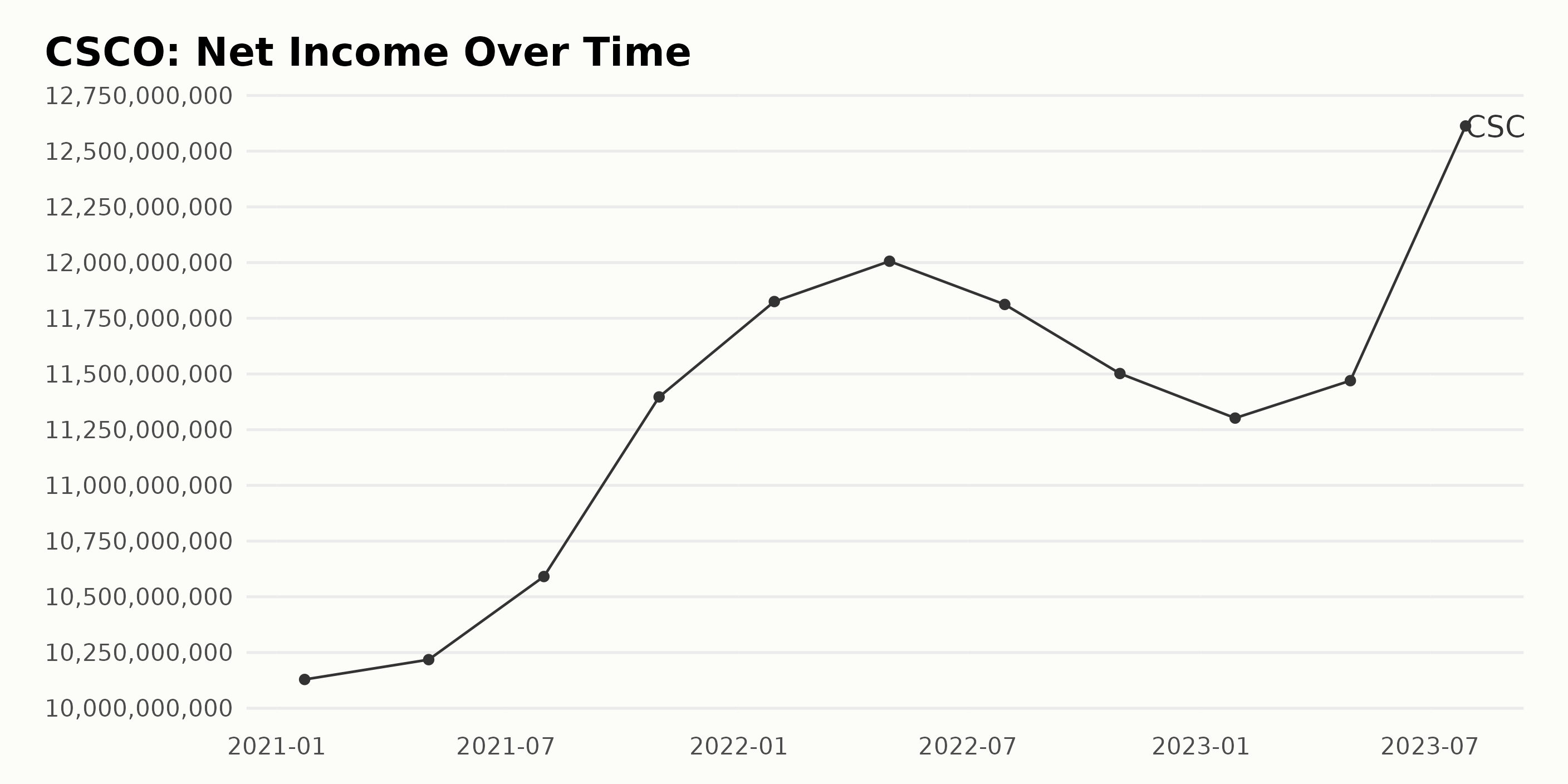

The fluctuating trend of trailing-12-month net income reported by CSCO from early 2021 to mid-2023 can be summarized as follows:

- On January 23, 2021, the net income was $10.13 billion

- A slight increase was witnessed on May 1, 2021, accounting for a net income of $10.22 billion.

- There was a minor surge by July 31, 2021, with the net income reaching $10.59 billion.

- Significant growth became apparent by October 30, 2021, as the net income rose to $11.4 billion.

- This growth continued into the new year, with the net income being $11.83 billion as of January 29, 2022.

- By April 30, 2022, the figures escalated slightly to peak at $12.01 billion.

- A downward curve set in from July 30, 2022, as the net income dropped to $11.81 billion.

- The net income further slid down to $11.5 billion by October 29, 2022.

- January 28, 2023, came with reduced net returns, specifically accounting for $11.3 billion.

- However, there was a subtle resurgence by April 29, 2023, as the net income jumped back to $11.47 billion.

- As of the last entry, dated July 29, 2023, the net income skyrocketed to $12.61 billion, which is its highest level during this period.

In summary, the net income of CSCO demonstrated a generally increasing trend despite some fluctuations. By comparing the first value to the last, the growth rate from January 2021 to July 2023 is approximately 24.5%, indicating favorable financial performance over this period.

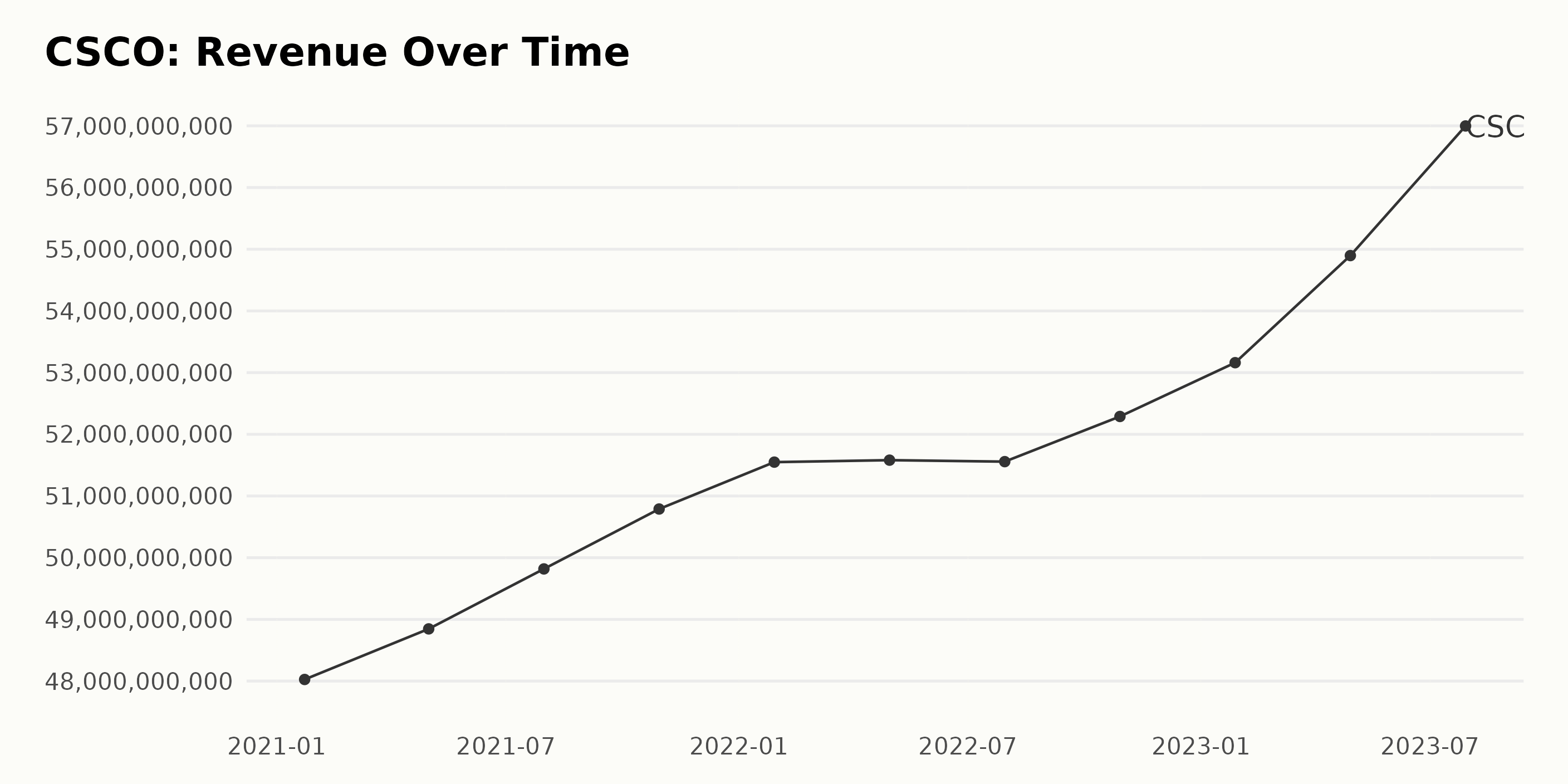

The following is the trend and fluctuations for the trailing-12-month revenue of CSCO:

- On January 23, 2021, the revenue was $48.03 billion.

- By May 1, 2021, it had increased slightly to $48.85 billion.

- Further growth was observed by July 31, 2021, when the revenue reached $49.82 billion.

- Then, by October 30, 2021, it showed another rise to $50.79 billion.

- The revenue recorded a value of $51.55 billion by January 29, 2022.

- A marginal increase was observed by April 30, 2022, taking the revenue to $51.58 billion.

- However, a slight dip occurred by July 30, 2022, with the revenue being $51.56 billion.

- It jumped back to $52.29 billion on October 29, 2022.

- January 28, 2023, saw a significant rise in revenue to $53.16 billion.

- Then, the revenue experienced the most considerable spikes so far, hitting successively larger amounts of $54.90 billion on April 29, 2023, and $57.00 billion on July 29, 2023

Most recently, CSCO's revenue records its highest value in the series at $57.00 billion as of July 29, 2023. Overall, compared to the first value taken on January 23, 2021, this represents a remarkable growth rate.

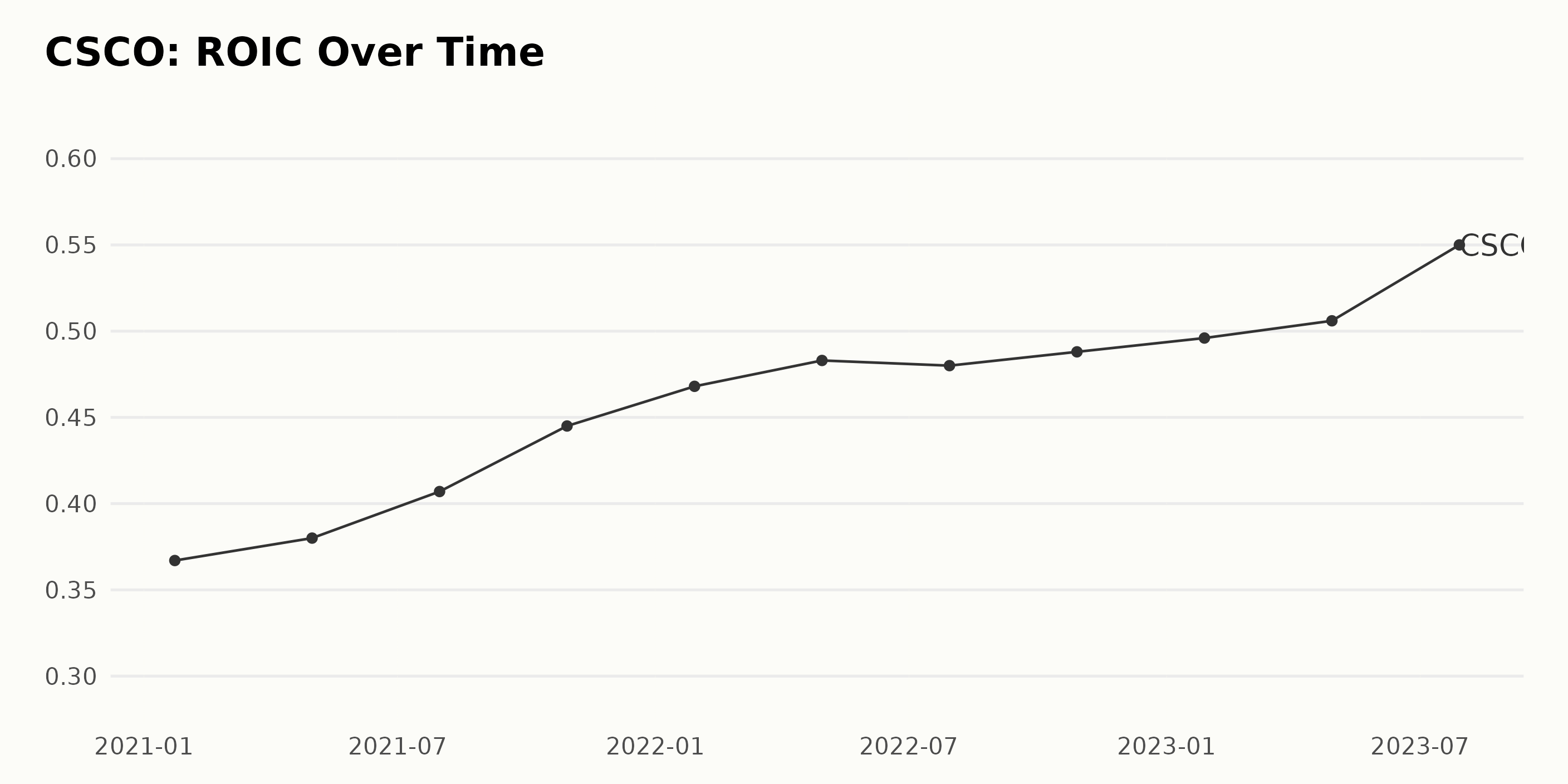

The Return On Invested Capital (ROIC) of CSCO exhibits a gradual upward trend over the span of two years, from January 2021 to July 2023.

- Starting with a ROIC of 0.367 in January 2021, by July 2023, the ROIC had achieved a value of 0.55, signifying an overall growth rate of nearly 50% during this timeframe.

- Within this timeframe, however, there are some observed minute fluctuations. For example, from April 2022 to July 2022, the ROIC dropped slightly from 0.483 to 0.48.

- Overall, though, the trend of the ROIC remains positive, consistent with the data showing an increase of 0.378 from the first value to the last.

- Most recently, from January 2023 to July 2023, the ROIC grew from 0.496 to 0.55, a relative increase of over 10% within just six months.

Therefore, despite brief instances of variation, CSCO's ROIC demonstrates a principally positive trajectory, indicative of potential robust operational efficiency and effective use of capital.

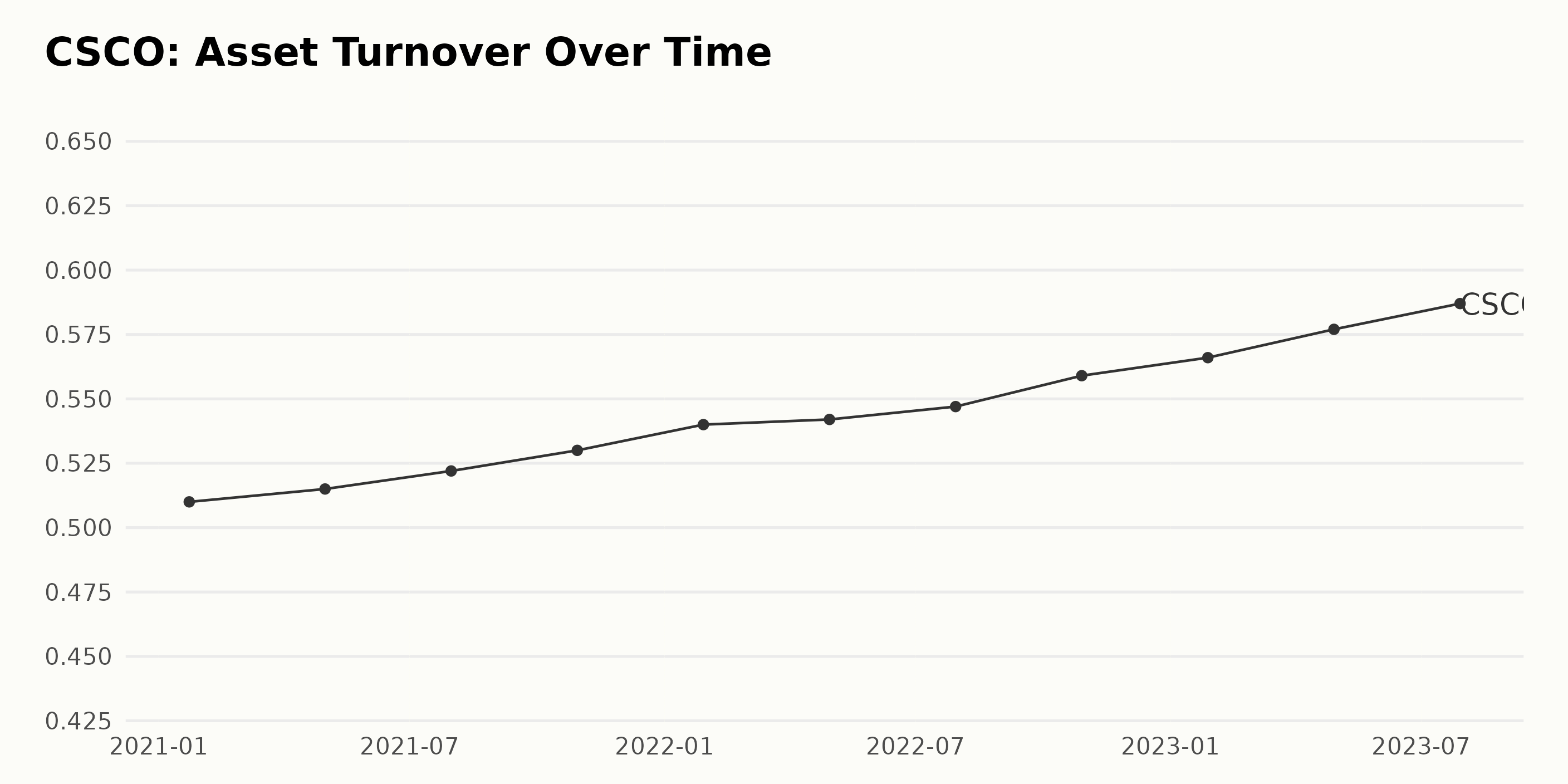

The reported asset turnover of CSCO exhibits a consistent upward trend over the specified period from January 2021 to July 2023. To provide a summary:

- On January 23, 2021, the company recorded an asset turnover value of 0.51.

- Over the course of two years and a few months, there has been a gradual increase in the asset turnover.

- Notably, as of July 29, 2023, the asset turnover reached its peak at 0.587, showing promising growth.

While fluctuations are observed throughout the series, they do not deviate from the overall trend towards growth. Significant points include:

- There was slight growth between May 1, 2021, and July 31, 2021, from 0.515 to 0.522.

- A notable increase occurred from October 30, 2021, with an asset turnover of 0.53, to January 29, 2022, when it rose to 0.54.

- By April 29, 2023, the asset turnover had further risen to 0.577, maintaining the general upward trend.

Considering the values from January 2021 (0.51) and July 2023 (0.587), we can calculate that the asset turnover experienced an approximate growth rate of 15.1% over this period. This suggests a positive trend in CSCO's ability to generate sales from its assets.

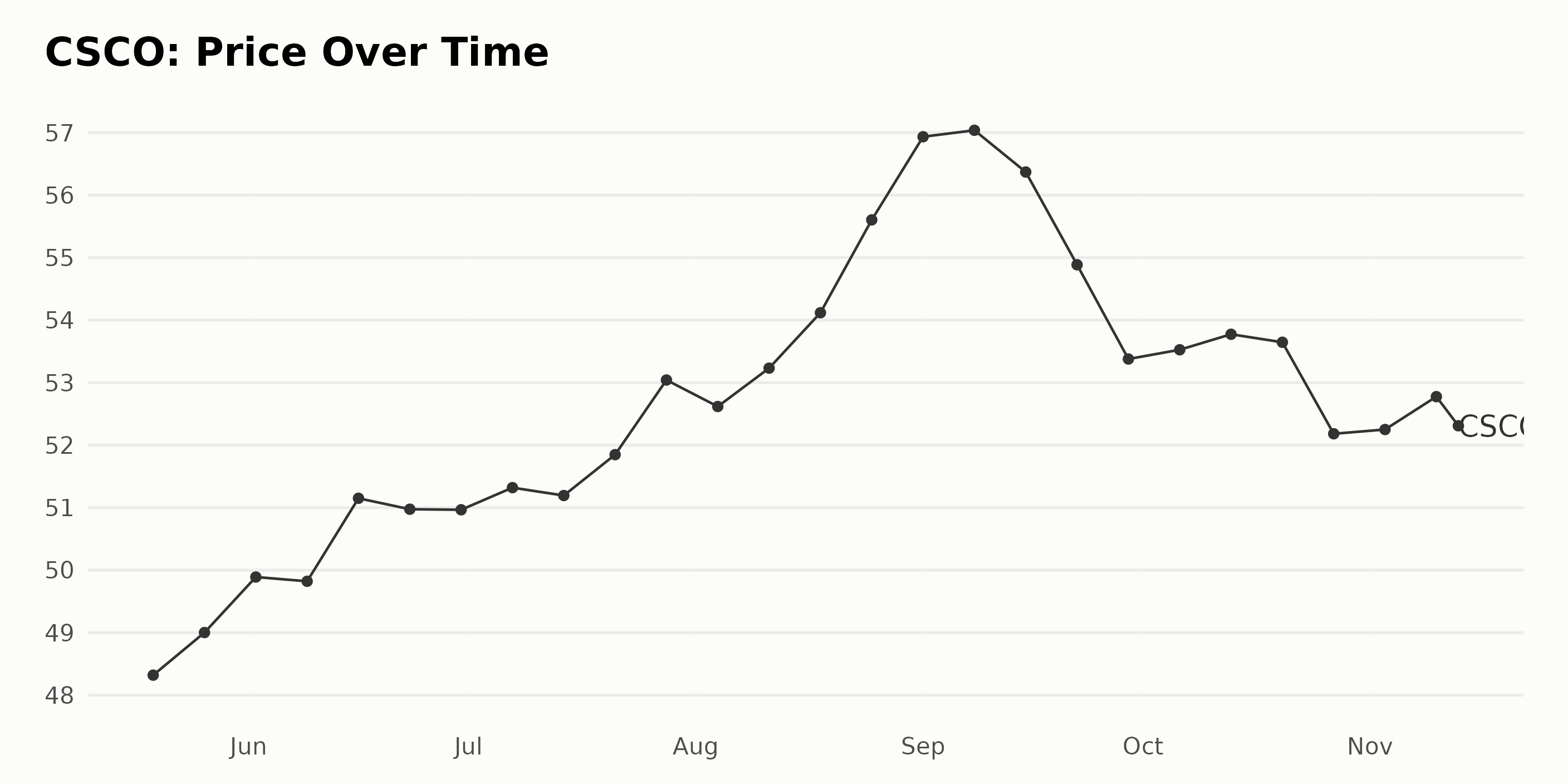

Analyzing Cisco Systems, Inc.'s Six-Month Stock Performance: Upward Trend, Downfall, and Stabilization

Analyzing the share price data of CSCO provided:

- Beginning on May 19, 2023, at a price of $48.32, there was an upward trend until September 8, 2023, when it peaked at $57.04.

- This rise over four months indicates a consistent positive growth rate for CSCO between May and early September 2023.

- The highest increase in price within a week happened between August 18, 2023 ($54.12) and August 25, 2023 ($55.60).

- Following the peak, there was a notable decrease in price, hitting a low point at $52.18 on October 27, 2023. This transition from the peak to this low point represents a decelerating trend in the share price.

- Though there were minimal fluctuations after the decline, the price remained relatively stable around the lower $50s onwards into November.

- The final recorded price was $52.23 on November 13, 2023, which is slightly higher than when the deceleration halted.

To summarize, CSCO experienced a steady upward trend from May 19, 2023, to September 8, 2023, followed by a less consistent downward trend until late October. Afterward, the price stabilized in the lower $50 range. Here is a chart of CSCO's price over the past 180 days.

Analyzing Cisco Systems, Inc.'s POWR Ratings: Quality, Stability, and Declining Momentum

The POWR Ratings Grade for CSCO, which is in the Technology - Communication/Networking category, has been fluctuating moderately between May 2023 and November 2023. The grade ranged from A (Strong Buy), denoting high performance, to B (Buy), signaling above-average performance. At a glance, here are some key details:

- The POWR Grade started at B (Buy) in May 2023 and rose to an A (Strong Buy) on May 27, 2023.

- It maintained this grade of A (Strong Buy) till June 10, 2023, before decreasing to B (Buy) again on June 17, 2023.

- Throughout this period, the rank in its category varied, with its highest rank being #2 (June 3 and June 10) and the lowest being #7 (July 8).

- From July 22, 2023, to September 2, 2023, CSCO's rank in its category bounced between #5 and #4.

- Starting from September 2, 2023, and continuing until the latest date given in November 2023, CSCO consistently held a POWR grade of B (Buy).

- In this same period of September to November, its rank in the category improved and steadied, holding steady at #3 from September 16, 2023, onwards.

As of the latest data available from November 14, 2023, CSCO maintains a POWR Grade of B (Buy). Its rank in the Technology - Communication/Networking category is #3 out of 45.

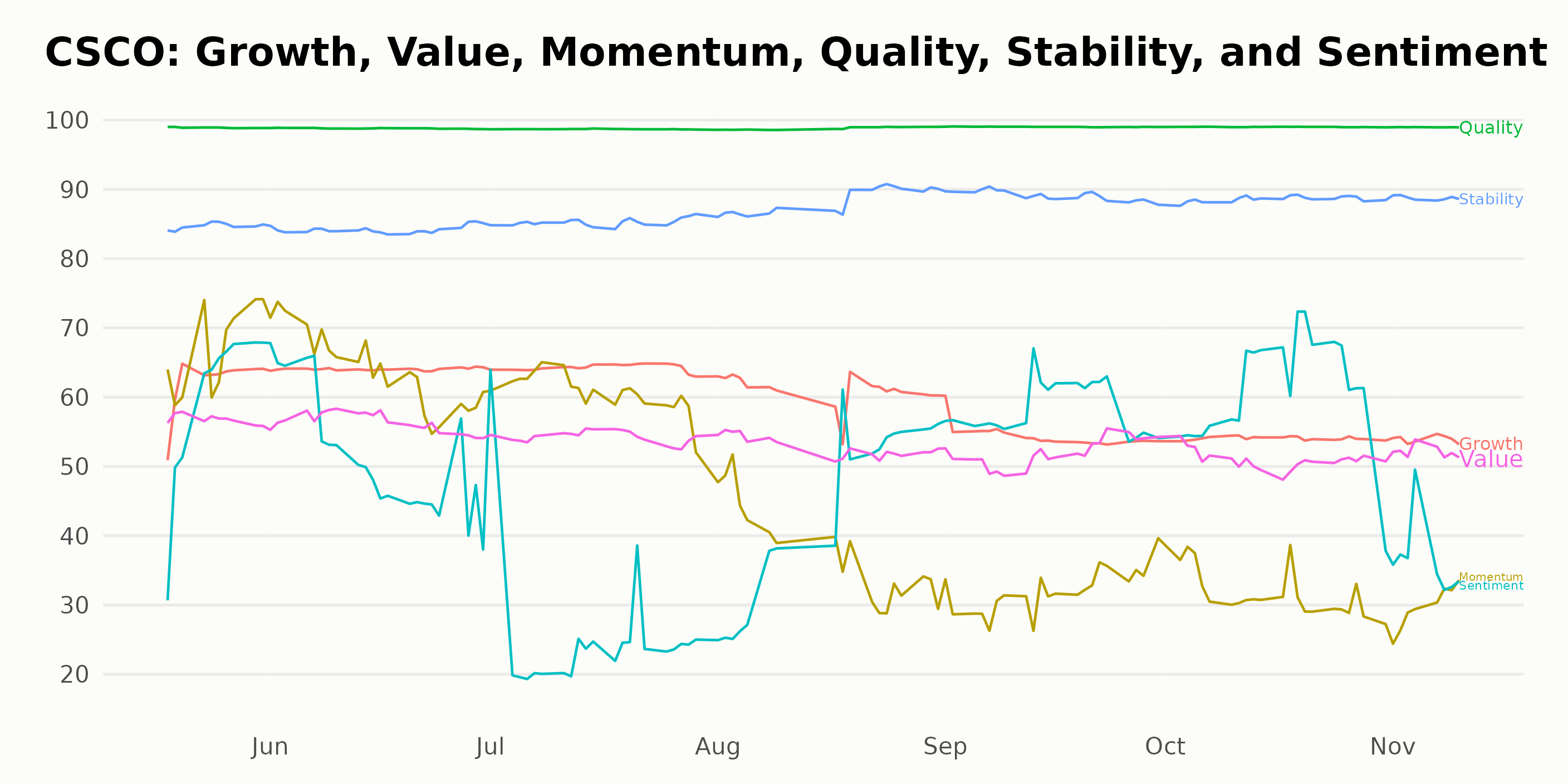

Based on POWR Ratings for CSCO, the three most noteworthy dimensions are Quality, Stability, and Momentum.

Quality

- In May 2023, the Quality rating was at its highest with a score of 99.

- This high rating remained consistent, maintaining a score of 99 from June to November 2023.

Stability

- The Stability rating has shown a steady upward trend. Starting at 85 in May 2023, the score incrementally increased month by month, reaching 89 by September 2023.

- This trend continued, maintaining a score of 89 through November 2023.

Momentum

- In May 2023, Momentum started at a stable value of 67.

- It experienced a clear decreasing trend over subsequent months, falling to 64 in June, 61 in July, 38 in August, 32 in September and continuing at the same level in October.

- By November 2023, the Momentum rating further decreased to a value of 30.

These ratings provide insight into CSCO's Quality and Stability while signaling a decrease in Momentum. Future decisions should take these ratings into consideration.

How does Cisco Systems, Inc. (CSCO) Stack Up Against its Peers?

Other stocks in the Technology - Communication/Networking sector that may be worth considering are Ceragon Networks Ltd. (CRNT), Gilat Satellite Networks Ltd. (GILT), and Eutelsat Group (ETCMY) - they are also rated A (Strong Buy) or B (Buy) in our proprietary rating system. Click here to explore more Technology - Communication/Networking stocks.

What To Do Next?

Get your hands on this special report with 3 low priced companies with tremendous upside potential even in today’s volatile markets:

3 Stocks to DOUBLE This Year >

CSCO shares were trading at $52.98 per share on Tuesday afternoon, up $0.75 (+1.44%). Year-to-date, CSCO has gained 14.62%, versus a 18.48% rise in the benchmark S&P 500 index during the same period.

About the Author: Anushka Dutta

Anushka is an analyst whose interest in understanding the impact of broader economic changes on financial markets motivated her to pursue a career in investment research.

The post Cisco Systems (CSCO) Earnings Spotlight: Tech Stock Buy or Sell? appeared first on StockNews.com