Amazon.com, Inc. (AMZN) is thriving in a world increasingly steered by digital technology and connectivity, which has catalyzed e-commerce growth rates. The company’s unrivaled logistics and distribution network have bolstered its position as a retail juggernaut. Furthermore, Amazon Web Services (AWS), riding on the wave of popularity in web hosting and other services, has emerged as a pivotal component of the company’s growth trajectory.

Notably, Amazon is proactively pursuing ambitions in the competitive AI industry. It aims to harness the immense possibilities of generative artificial intelligence with its latest offerings, such as the Q chatbot and the upgraded AI chip, Trainium2, while also strengthening its collaboration with chip-making behemoth Nvidia Corporation (NVDA).

Digital advertising remains another strong revenue stream for Amazon. As third-party sellers and major brands ramp up their ad expenditures to improve visibility in a keenly competitive market, Amazon’s ad revenue witnessed a 26% increase from the previous year in the most recent quarter.

The company is set for a steady revenue path and seems prepared for margin expansion across various verticals. Analysts from Jefferies remain bullish on AMZN, citing continuous margin enhancements, visible AWS acceleration, and long-term AI implications that will impact the business model over time.

In tandem with the ongoing holiday season, which typically ushers in booming activity in the e-commerce sector, Amazon has enjoyed considerable benefits. The company reported “record-breaking” sales during the holiday shopping season kickoff, with consumer spending being resilient regardless of persisting inflation and augmented borrowing costs.

Undeniably, Amazon appears well-positioned for substantial growth, presenting a compelling investment proposition. This outlook is underpinned by several key performance indicators that underscore our optimistic stance.

Amazon’s Financial Performance: An Examination of Net Income, Revenue, and Key Metrics (2020-2023)

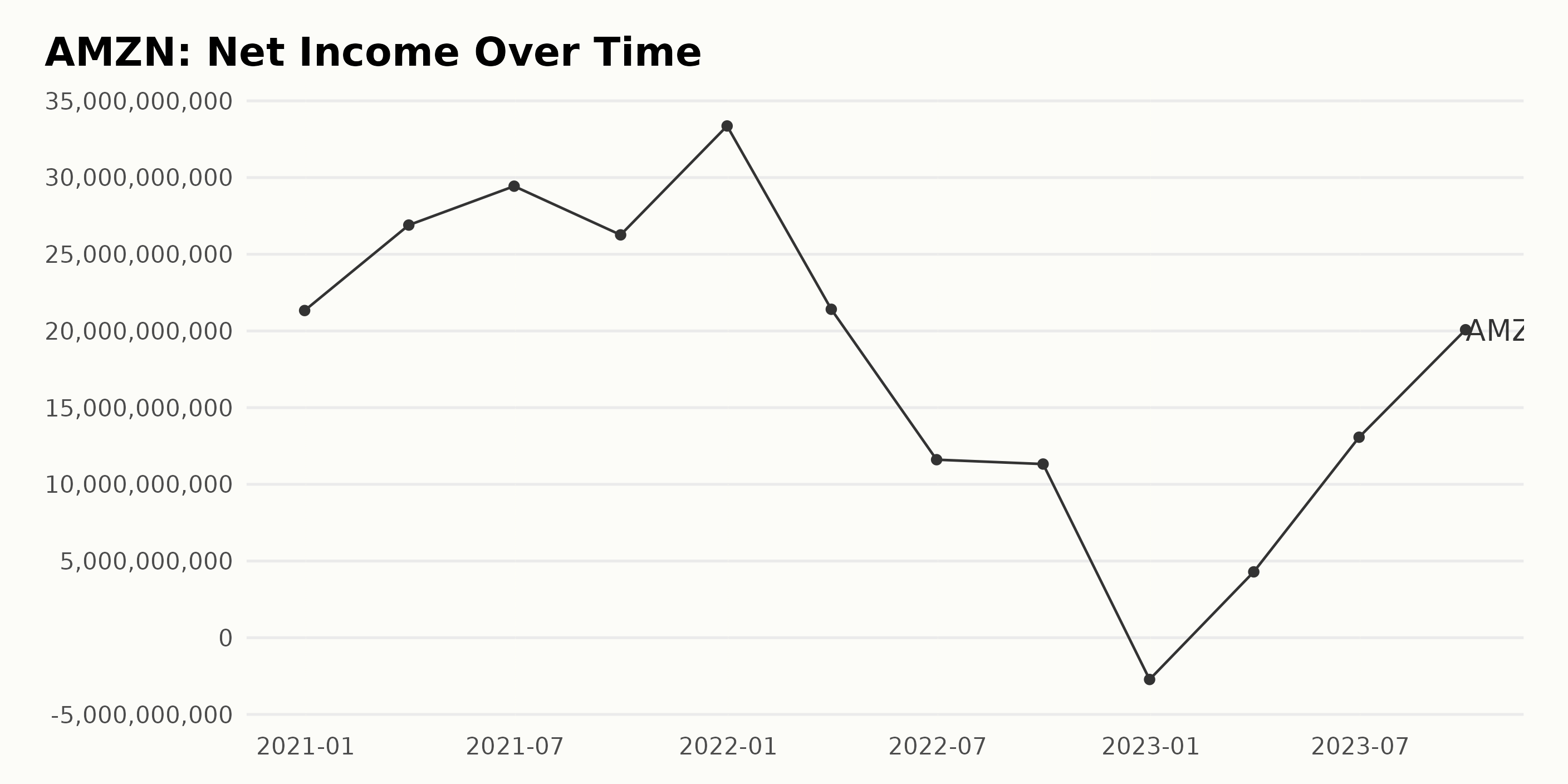

The trailing-12-month Net Income of AMZN experienced a series of varying trends and fluctuations over the period of observation from December 2020 to September 2023.

- Starting with a Net Income of $21.33 billion in December 2020, Amazon.com Inc. posted a progressive increase reaching a high point of $33.36 billion by end of December 2021.

- However, in the first quarter of 2022, there was a sharp decline down to $21.41 billion, followed by a consecutive drop throughout the second ($11.61 billion) and third ($11.32 billion) quarters of the year.

- Significantly, by the end of 2022, AMZN reported a negative Net Income of -$2.72 billion, marking its lowest point across the observed period.

- The company bounced back in the first quarter of 2023, going up to $4.29 billion. This recovery trend continued through the second ($13.07 billion) and third ($20.08 billion) quarters of 2023.

When calculating growth by measuring the last value from the first, Amazon.com Inc.’s Net Income registered a decline by around 6%, from $21.33 billion in December 2020 to $20.08 billion in September 2023. Emphasis should be placed on the drastic fall in Net Income in the fourth quarter of 2022 which led to a negative figure, a deviation from the rest of the series. On the bright side, notable recovery came into play in 2023, guided by consecutive growth in all three quarters, amounting to a rise from -$2.72 billion to $20.08 billion within just three quarters.

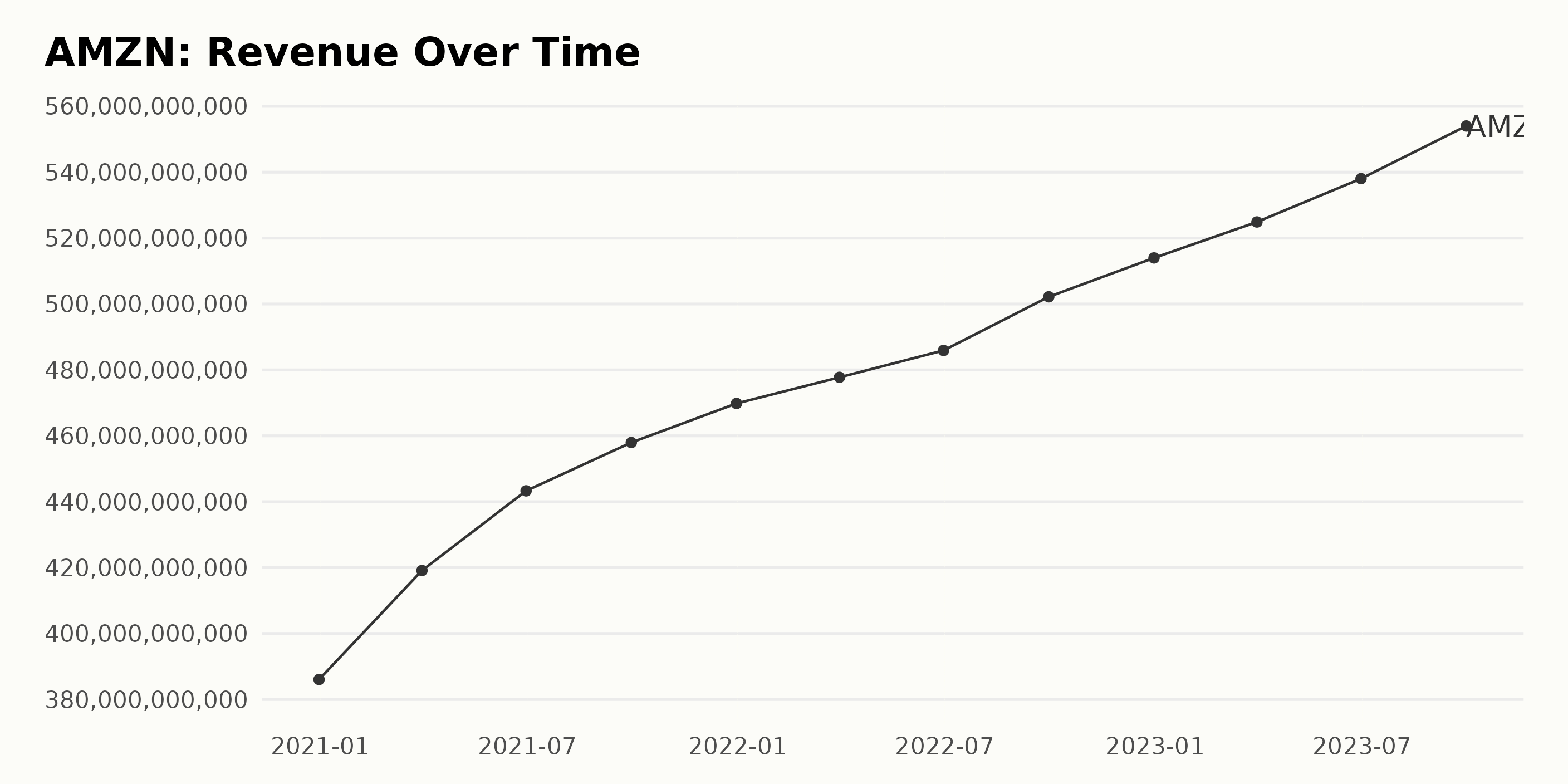

The trailing-12-month revenue data from AMZN indicates a steady upward trend over the reviewed time period, beginning on December 31, 2020 and concluding on September 30, 2023.

- On December 31, 2020, AMZN posted a Revenue of $386.06 billion.

- The following year, on December 31, 2021, the Revenue saw an increase to $469.82 billion.

- This upward trend continued into the next year, with AMZN recording a Revenue of $513.98 billion as of December 31, 2022.

- The latest data point, posted on September 30, 2023, shows a continued rise to $554.03 billion.

When calculating the growth rate, we see an increase of approximately 43.53%. This reflects a substantial and continuous growth in revenue for AMZN over the span of the reported period. It’s worth noting that while a consistent upward trajectory exists, fluctuations between different quarters remain within a manageable range, suggesting relatively stable growth. Please note that all figures are represented in billions. This provides an easier context for understanding the remarkable scale of AMZN’s operations and ongoing financial success.

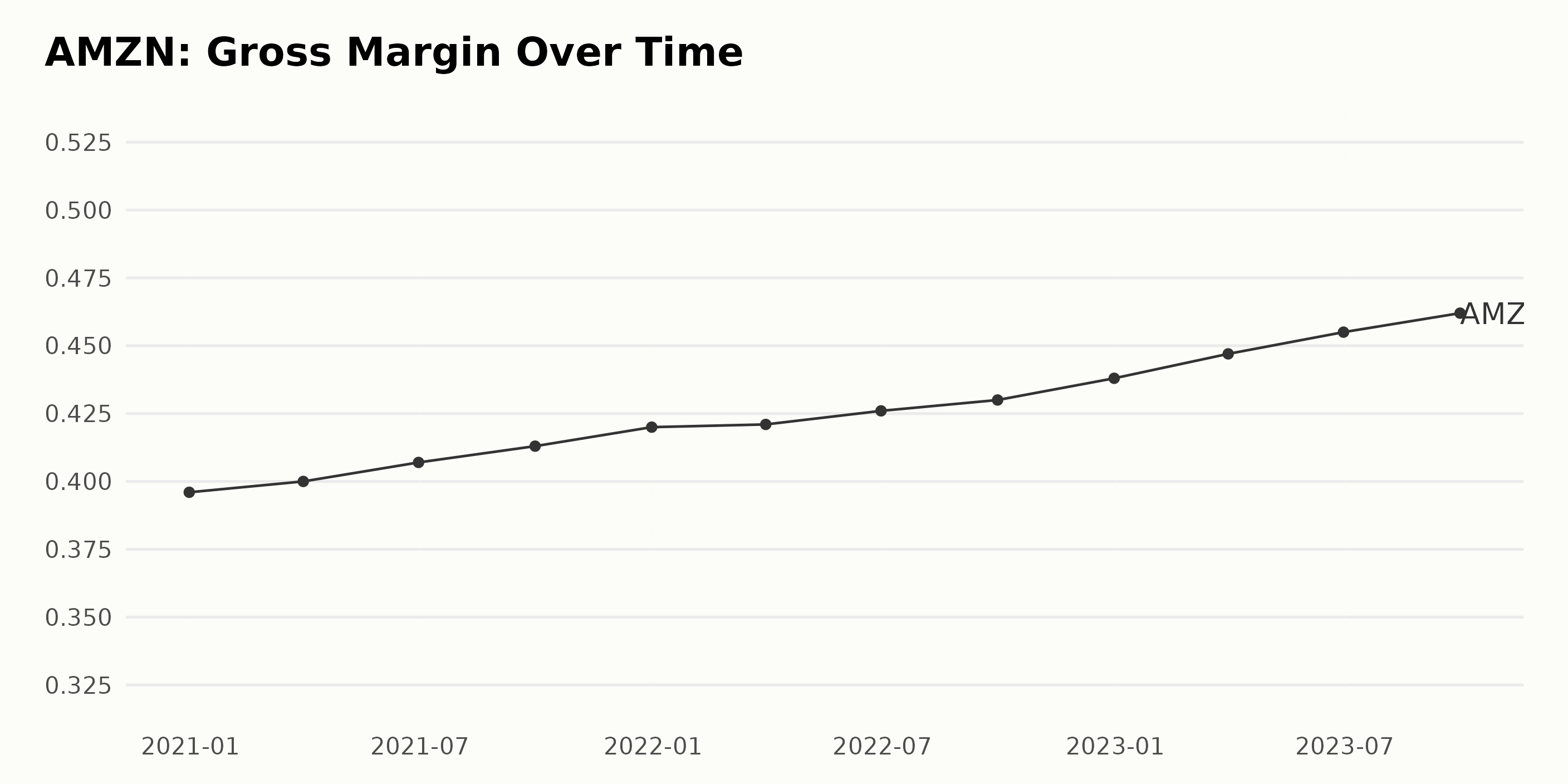

The historical trend from 2020 to 2023 suggests a steady increase in the gross margin percentage of AMZN. Here, we will summarize key fluctuations:

- On December 31, 2020, the Gross Margin was at 39.6%.

- By the end of the first quarter of 2021 (March 31), there was a slight bump up to 40%.

- On June 30, 2021, it increased a little further to 40.7%.

- The upward trend continued into September 2021, reaching 41.3% by the end of the third quarter.

- By the end of 2021 (December 31), the Gross Margin had increased to 42%.

More recent data indicate that over the course of 2022, the Gross Margin consistently climbed, reaching 43.8% by the end of the year. And this upward trajectory persisted into 2023:

- The Gross Margin hit 44.7% by March 31, 2023.

- Jumped to 45.5% by the end of the second quarter on June 30, 2023.

- And most recently, on September 30, 2023, the Gross Margin came in at 46.2%.

Hence, over the examined period, AMZN has witnessed a growth rate of approximately 6.6% in its Gross Margin, increasing from the initial value of 39.6% in late 2020 to 46.2% as of the last reported value in September 2023.

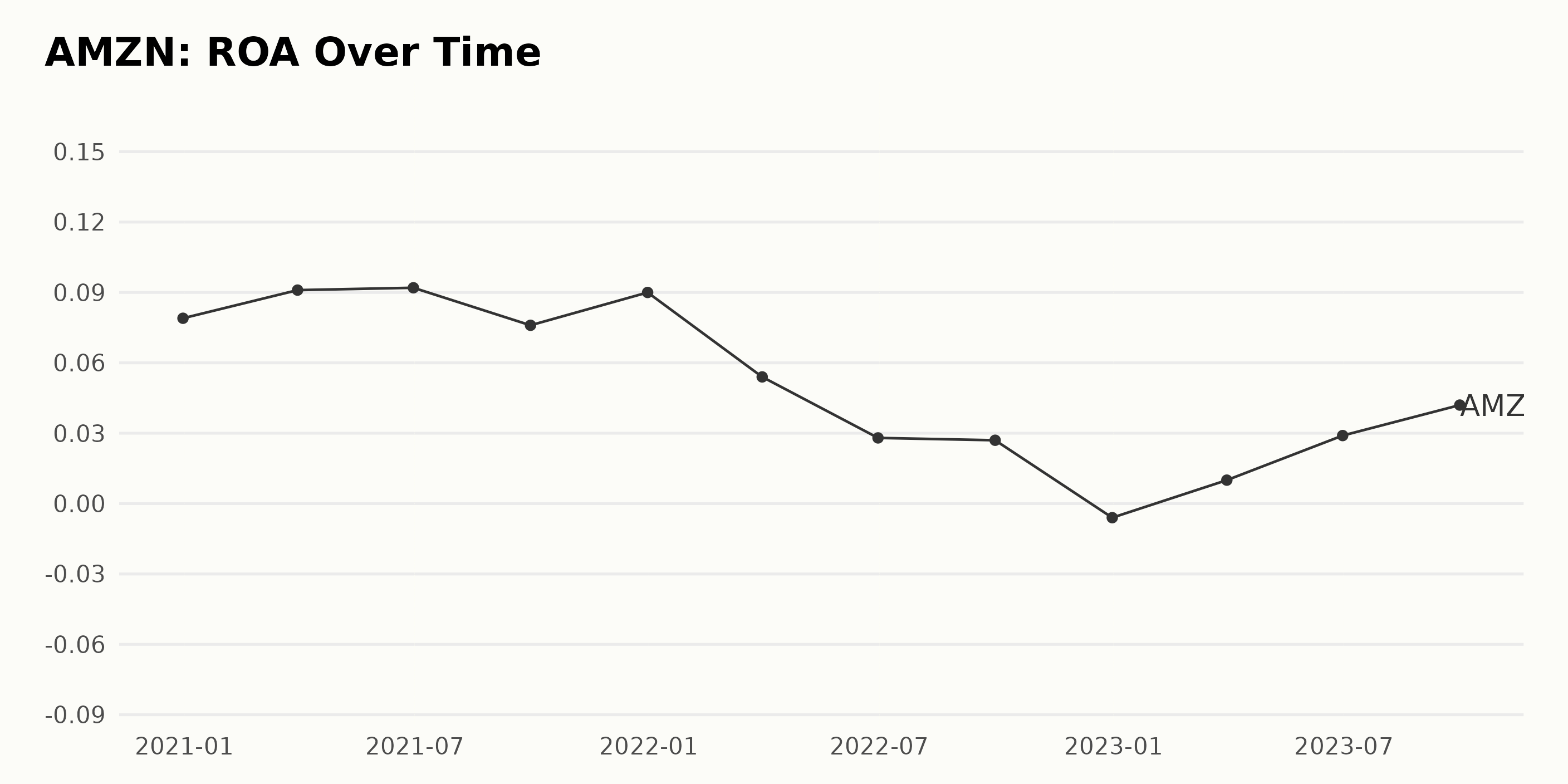

- As of December 31, 2020, Amazon.com Inc. (AMZN) reported an ROA of 0.079.

- There was a general increasing trend in the first half of 2021, peaking at an ROA of 0.092 in June. However, by September 2021, ROA had a slight decrease to 0.076 before rising again to 0.09 in December.

- The year 2022 showed a significant fluctuation. AMZN’s ROA dropped steeply in the first half of the year from 0.054 in March to 0.028 in June and remained relatively unchanged at 0.027 in September.

- By the end of 2022, there was a notable dip when the company reported a negative ROA of -0.006. This marks the first time in the series that the ROA became negative.

- Starting the year 2023 on a positive note, there was a rebound with the ROA standing at 0.01 in March. Subsequently, the ROA rose steadily over the next months. As of the end of the quarter ended September 2023, the ROA was recorded at 0.042.

In conclusion, the ROA of AMZN displays marked fluctuations over the reported period, encompassing noticeable growths, declines, and a recovery towards the end. This depicts a dynamic operational performance. Nonetheless, the latest trend indicates a resurging increase in profitability.

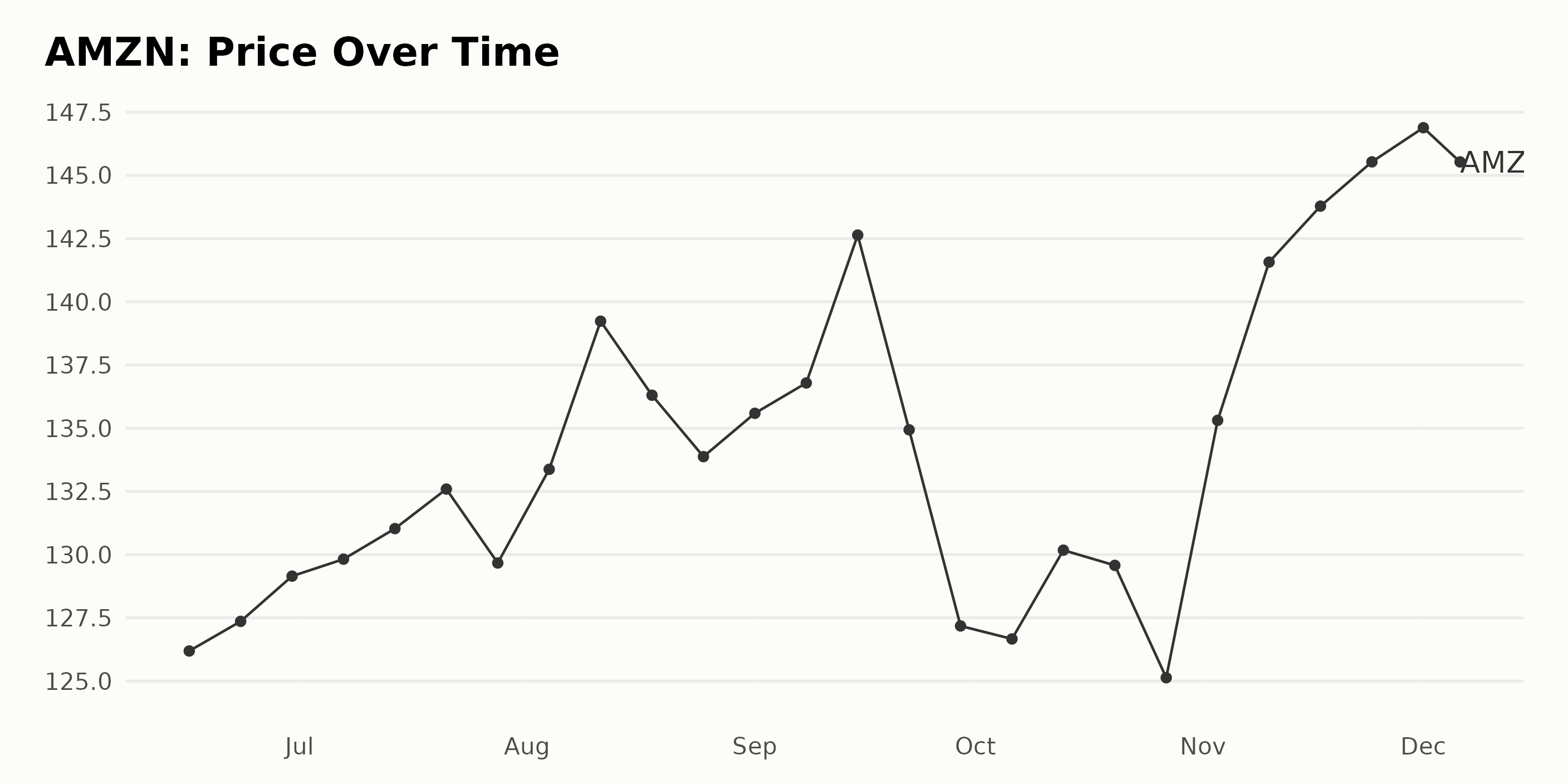

Analyzing Amazon’s Share Price Fluctuations and Growth: June-December 2023 Overview

Analyzing the provided data from June to December 2023, Amazon.com Inc. (AMZN) share prices have shown fluctuations, but with a general trend of growth.

- On June 16, 2023, the price was $126.19.

- The price experienced an increment each week until July 21, 2023, where it reached $132.59.

- In late July and August, there were some fluctuations with values ranging from $129.67 to a high of $139.23 on August 11, 2023.

- Prices declined to $133.88 by August 25 and picked up slightly in early September.

- After a peak at $142.64 on September 15, significant declines were observed, reaching as low as $125.13 by October 27.

- However, November witnessed a strong recovery with the price jumping back up to reach a peak at $146.89 by December 1, 2023.

- As of the last provided data on December 6, 2023, the price was at $145.53.

The overall trend over the period was growth, although there were periods of price decline, notably in late September and October. The lowest price during this period was $125.13 while the highest was $146.89, so the span represents an increase of approximately 17.4%. Please note: These trends signify past performance and should not be solely relied upon for future investment decisions, as market situations are subject to change. Here is a chart of AMZN’s price over the past 180 days.

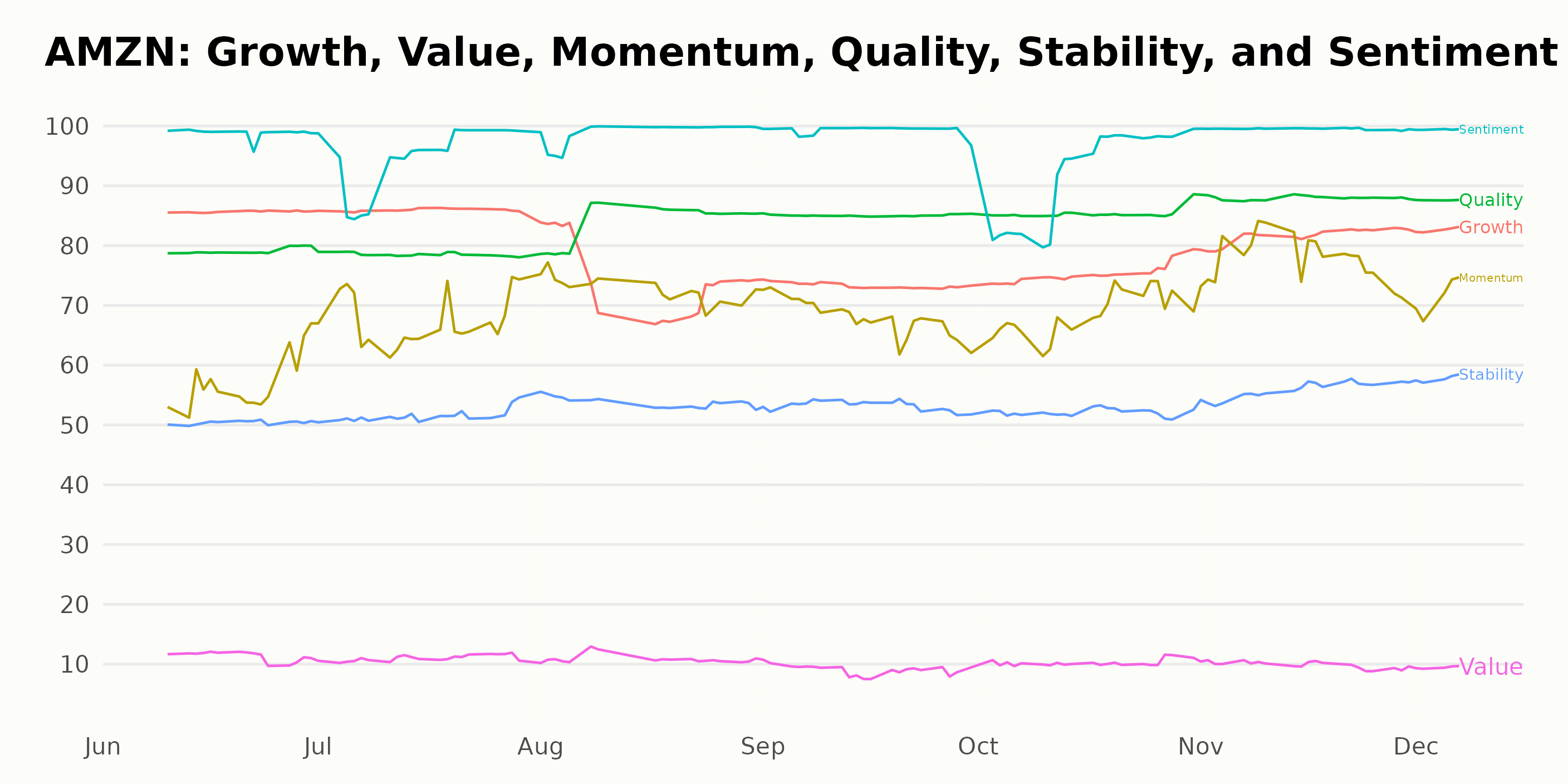

Analyzing Amazon’s Noteworthy POWR Ratings: Sentiment, Quality, and Growth

AMZN has an overall B rating, translating to a Buy in our POWR Ratings system. It is ranked #15 out of the 57 stocks in the Internet category.

In looking at the POWR Ratings for AMZN, the three most noteworthy dimensions to highlight are Sentiment, Quality, and Growth. Here’s a more detailed look into each of these dimensions:

Sentiment

The dimension of Sentiment consistently exhibits the highest ratings across the analyzed time frame. A peak value is observed in November 2023 with a perfect rating of 100, underlining extremely positive market sentiment towards AMZN. The lowest score in this dimension throughout the period is 92 in October 2023, which still depicts a strong positive sentiment.

Quality

The Quality dimension presents an interesting trend. Starting at 79 in June 2023, it sees a steady increase over the months reaching a value of 88 by November 2023. This suggests a significant improvement in AMZN’s fundamentals, such as profitability, management effectiveness, earnings consistency, among others.

Growth

While the Growth dimension starts off strong at 86 in June 2023, it shows some variability in the subsequent months. A slight drop to 75 is recorded in August and holds steady in October 2023. However, it rebounds to 83 by December 2023, indicating that despite some fluctuations, the growth potential remains robust in general. In conclusion, according to POWR ratings, Amazon.com Inc. is experiencing notable momentum in terms of market sentiment, quality of performance, and growth potential, with a considerable degree of fluctuation in the growth aspect.

How does Amazon.com Inc. (AMZN) Stack Up Against its Peers?

Other stocks in the Internet sector that may be worth considering are Yelp Inc. (YELP), Meta Platforms Inc. (META), and Alphabet Inc. (GOOGL) -- they have better POWR Ratings.

What To Do Next?

Discover 10 widely held stocks that our proprietary model shows have tremendous downside potential. Please make sure none of these “death trap” stocks are lurking in your portfolio:

AMZN shares were trading at $147.19 per share on Thursday afternoon, up $2.67 (+1.85%). Year-to-date, AMZN has gained 75.23%, versus a 21.18% rise in the benchmark S&P 500 index during the same period.

About the Author: Subhasree Kar

Subhasree’s keen interest in financial instruments led her to pursue a career as an investment analyst. After earning a Master’s degree in Economics, she gained knowledge of equity research and portfolio management at Finlatics.

The post Is Amazon.com (AMZN) Poised for MASSIVE Gains in December? appeared first on StockNews.com